MetLife 2004 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2004 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

Series A Junior Participating Preferred Stock will have economic and voting terms equivalent to one share of common stock. Until it is exercised, the right

itself will not entitle the holder thereof to any rights as a stockholder, including the right to receive dividends or to vote at stockholder meetings.

Stockholder rights are not exercisable until the distribution date, and will expire at the close of business on April 4, 2010, unless earlier redeemed or

exchanged by the Holding Company. The rights plan is designed to protect stockholders in the event of unsolicited offers to acquire the Holding

Company and other coercive takeover tactics.

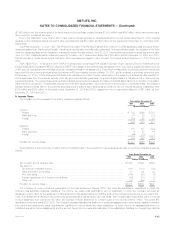

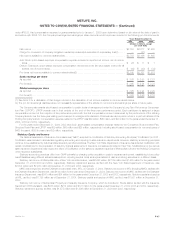

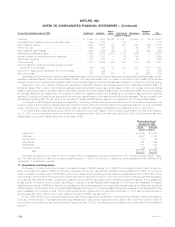

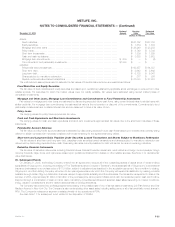

Common Stock

On October 26, 2004, the Holding Company’s Board of Directors authorized a $1 billion common stock repurchase program. This program began

after the completion of the February 19, 2002 and March 28, 2001 repurchase programs, each of which authorized the repurchase of $1 billion of

common stock. Under these authorizations, the Holding Company may purchase common stock from the MetLife Policyholder Trust, in the open market

and in privately negotiated transactions. As of January 31, 2005, the Holding Company has suspended its share repurchases during 2005 and

repurchases after 2005 will be dependent upon several factors, including the Company’s capital position, its financial strength and credit ratings, general

market conditions and the price of the Company’s common stock.

On December 16, 2004, the Holding Company repurchased 7,281,553 shares of its outstanding common stock at an aggregate cost of

approximately $300 million under an accelerated share repurchase agreement with a major bank. The Holding Company will either pay or receive an

amount based on the actual amount paid by the bank to purchase the shares. The final purchase price will be settled in either cash or Holding Company

stock at the Holding Company’s option. The Holding Company recorded the initial repurchase of shares as treasury stock and will record any amount

paid or received as an adjustment to the cost of the treasury stock.

The Company acquired 26,373,952, 2,997,200 and 15,244,492 shares of the Holding Company’s common stock for $1,000 million, $97 million

and $471 million during the years ended December 31, 2004, 2003 and 2002, respectively. During the year ended 2004, 1,675,814 shares of common

stock were issued from treasury stock for $50 million. During the year ended 2003, 59,904,925 shares of treasury common stock with a cost of

$1,667 million were issued of which 59,771,221 shares were issued in connection with the settlement of common stock purchase contracts (see

Note 8) for $1,006 million cash and 133,704 shares were issued in connection with activities such as share-based compensation for $5 million in cash.

During the year ended 2002, 16,379 shares of common stock were issued from treasury stock for $438 thousand. At December 31, 2004, the

Company had $710 million remaining on its existing share repurchase authorization.

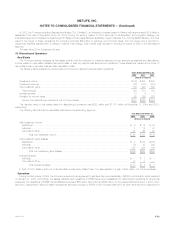

Dividend Restrictions

Under New York State Insurance Law, Metropolitan Life is permitted, without prior insurance regulatory clearance, to pay a dividend to the Holding

Company as long as the aggregate amount of all such dividends in any calendar year does not exceed the lesser of (i) 10% of its surplus to policyholders

as of the immediately preceding calendar year, and (ii) its statutory net gain from operations for the immediately preceding calendar year (excluding

realized capital gains). Metropolitan Life will be permitted to pay a dividend to the Holding Company in excess of the lesser of such two amounts only if it

files notice of its intention to declare such a dividend and the amount thereof with the New York Superintendent of Insurance ( the ‘‘Superintendent’’) and

the Superintendent does not disapprove the distribution. Under New York State Insurance Law, the Superintendent has broad discretion in determining

whether the financial condition of a stock life insurance company would support the payment of such dividends to its stockholders. The New York State

Department of Insurance has established informal guidelines for such determinations. The guidelines, among other things, focus on the insurer’s overall

financial condition and profitability under statutory accounting practices. For the years ended December 31, 2004, 2003 and 2002, Metropolitan Life paid

to MetLife, Inc. $797 million, $698 million and $535 million, respectively, in dividends for which prior insurance regulatory clearance was not required and

$0 million, $750 million and $369 million, respectively, in special dividends, as approved by the Superintendent. At December 31, 2004, the maximum

amount of the dividend which may be paid to the Holding Company from Metropolitan Life in 2005, without prior regulatory approval is $880 million.

Under Delaware Insurance Law, Metropolitan Tower Life Insurance Company (‘‘MTL’’) is permitted, without prior insurance regulatory clearance, to

pay a dividend to the Holding Company as long as the aggregate amount of all such dividends in any calendar year does not exceed the greater of

(i) 10% of its surplus to policyholders as of the next preceding calendar year, and (ii) its statutory net gain from operations for the next preceding calendar

year (excluding realized capital gains). MTL will be permitted to pay a cash dividend to the Holding Company in excess of the greater of such two

amounts only if it files notice of its intention to declare such a dividend and the amount thereof with the Delaware Commissioner of Insurance (the

‘‘Delaware Commissioner’’) and the Delaware Commissioner does not disapprove the distribution. Under Delaware Insurance Law, the Delaware

Commissioner has broad discretion in determining whether the financial condition of a stock life insurance company would support the payment of such

dividends to its stockholders. The Delaware Insurance Department has established informal guidelines for such determinations. The guidelines, among

other things, focus on the insurer’s overall financial condition and profitability under statutory accounting practices. On October 8, 2004, Metropolitan

Insurance and Annuity Company (‘‘MIAC’’) was merged into MTL. Prior to the merger, MIAC paid to MetLife, Inc. $65 million in dividends for which prior

insurance regulatory clearance was not required and no special dividends for the year ended December 31, 2004. For the year ended December 31,

2003, MIAC paid to MetLife, Inc, $104 million in dividends for which prior insurance regulatory clearance was not required and $94 million in special

dividends. For the year ended December 31, 2002, MIAC paid to MetLife, Inc. $25 million in dividends for which prior insurance regulatory clearance was

not required and paid no special dividends. MTL, exclusive of MIAC, paid no dividends during the years ended December 31, 2004, 2003 and 2002,

respectively. As of December 31, 2004, the maximum amount of the dividend which may be paid to the Holding Company from MTL in 2005, without

prior regulatory approval, is $119 million.

Under Rhode Island Insurance Law, Metropolitan Property and Casualty Insurance Company is permitted without prior insurance regulatory

clearance to pay a dividend to the Holding Company as long as the aggregate amount of all such dividends in any calendar year does not exceed the

lesser of (i) 10% of its surplus to policyholders as of the immediately preceding calendar year, and (ii) the next preceding two year earnings reduced by

capital gains and dividends paid to stockholders. Metropolitan Property and Casualty Insurance Company will be permitted to pay a stockholder dividend

to the Holding Company in excess of the lesser of such two amounts (an ‘‘extraordinary dividend’’) only if it files notice of its intention to declare such a

dividend and the amount thereof with the Rhode Island Commissioner of Insurance (‘‘Rhode Island Commissioner’’) and the Rhode Island Commissioner

does not disapprove the distribution. Under Rhode Island Insurance Law, the Rhode Island Commissioner has broad discretion in determining whether

the financial condition of stock property and casualty insurance company would support the payment of such dividends to its stockholders. For the year

ended December 31, 2004, Metropolitan Property and Casualty Insurance Company paid to MetLife, Inc. $300 million in extraordinary dividends.

MetLife, Inc. F-45