MetLife 2004 Annual Report Download - page 23

Download and view the complete annual report

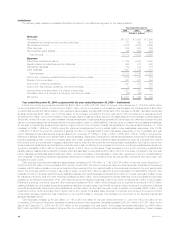

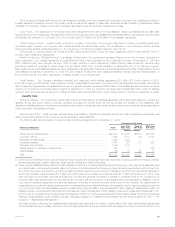

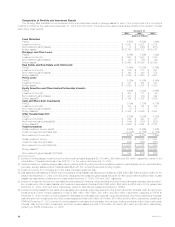

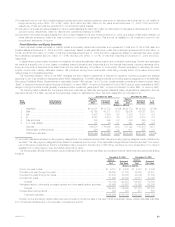

Please find page 23 of the 2004 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.more than five years column represents the sum of cash flows, also adjusted for the estimated timing of mortality, retirement and other appropriate

factors and undiscounted with respect to interest, extending for more than 100 years from the present date. As a result, the sum of the cash outflows

shown for all years in the table of $80.2 billion exceeds the corresponding liability amounts of $36.2 billion included in the consolidated financial

statements at December 31, 2004. The liability amount in the consolidated financial statements reflects the discounting for interest, as well as

adjustments for the timing of other factors as described above.

(3) Amounts differ from the balances presented on the consolidated balance sheets. The amounts above do not include related premiums and discounts

or capital leases which are presented separately.

(4) The Company anticipates that these amounts could be invested in these partnerships any time over the next five years, but are presented in the

current period, as the timing of the fulfillment of the obligation cannot be predicted.

(5) Excluded from operating leases in the above contractual obligations table is $117 million, $26 million, $38 million, and $53 million for total, less than

three years, three to five years, and more than five years, respectively, related to discontinued operations pertaining to SSRM.

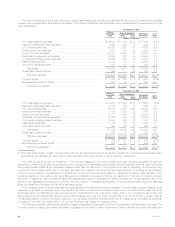

As of December 31, 2004, and relative to its liquidity program, the Company had no material (individually or in the aggregate) purchase obligations or

material (individually or in the aggregate) unfunded pension or other postretirement benefit obligations due within one year.

On April 11, 2003, an affiliate of the Company elected not to make future payments required by the terms of a non-recourse loan obligation. The

book value of this loan was approximately $17 million at December 31, 2004. The Company’s exposure under the terms of the applicable loan

agreement is limited solely to its investment in certain securities held by an affiliate. Subsequent to December 31, 2004, in connection with the sale of the

related equity investment, the loan was forgiven and the affiliate was discharged and released from its obligations thereunder.

Letters of Credit. At December 31, 2004 and 2003, the Company had outstanding $961 million and $828 million, respectively, in letters of credit

from various banks, all of which expire within one year. Since commitments associated with letters of credit and financing arrangements may expire

unused, these amounts do not necessarily reflect the actual future cash funding requirements.

Support Agreements. Metropolitan Life entered into a net worth maintenance agreement with New England Life Insurance Company (‘‘NELICO’’) at

the time Metropolitan Life merged with New England Mutual Life Insurance Company. Under the agreement, Metropolitan Life agreed, without limitation

as to the amount, to cause NELICO to have a minimum capital and surplus of $10 million, total adjusted capital at a level not less than the company

action level RBC, as defined by state insurance statutes, and liquidity necessary to enable it to meet its current obligations on a timely basis. At

December 31, 2004, the capital and surplus of NELICO was in excess of the minimum capital and surplus amount referenced above, and its total

adjusted capital was in excess of the most recent referenced RBC-based amount calculated at December 31, 2004.

In connection with the Company’s acquisition of GenAmerica Financial Corporation (‘‘GenAmerica’’), Metropolitan Life entered into a net worth

maintenance agreement with General American. Under the agreement, Metropolitan Life agreed, without limitation as to amount, to cause General

American to have a minimum capital and surplus of $10 million, total adjusted capital at a level not less than 180% of the company action level RBC, as

defined by state insurance statutes, and liquidity necessary to enable it to meet its current obligations on a timely basis. The agreement was subsequently

amended to provide that, for the five year period from 2003 through 2007, total adjusted capital must be maintained at a level not less than 200% of the

company action level RBC, as defined by state insurance statutes. At December 31, 2004, the capital and surplus of General American was in excess of

the minimum capital and surplus amount referenced above, and its total adjusted capital was in excess of the most recent referenced RBC-based

amount calculated at December 31, 2004.

Metropolitan Life has also entered into arrangements for the benefit of some of its other subsidiaries and affiliates to assist such subsidiaries and

affiliates in meeting various jurisdictions’ regulatory requirements regarding capital and surplus and security deposits. In addition, Metropolitan Life has

entered into a support arrangement with respect to a subsidiary under which Metropolitan Life may become responsible, in the event that the subsidiary

becomes the subject of insolvency proceedings, for the payment of certain reinsurance recoverables due from the subsidiary to one or more of its

cedents in accordance with the terms and conditions of the applicable reinsurance agreements.

General American has agreed to guarantee the contractual obligations of its subsidiary, Paragon Life Insurance Company, and certain contractual

obligations of its former subsidiaries, MetLife Investors Insurance Company (‘‘MetLife Investors’’), First MetLife Investors Insurance Company and MetLife

Investors Insurance Company of California. In addition, General American has entered into a contingent reinsurance agreement with MetLife Investors.

Under this agreement, in the event that MetLife Investors’ statutory capital and surplus is less than $10 million or total adjusted capital falls below 150% of

the company action level RBC, as defined by state insurance statutes, General American would assume as assumption reinsurance, subject to

regulatory approvals and required consents, all of MetLife Investors’ life insurance policies and annuity contract liabilities. At December 31, 2004, the

capital and surplus of MetLife Investors was in excess of the minimum capital and surplus amount referenced above, and its total adjusted capital was in

excess of the most recent referenced RBC-based amount calculated at December 31, 2004.

Management does not anticipate that these arrangements will place any significant demands upon the Company’s liquidity resources.

Litigation. Various litigation, claims and assessments against the Company in addition to those discussed elsewhere herein and those otherwise

provided for in the Company’s consolidated financial statements, have arisen in the course of the Company’s business, including, but not limited to, in

connection with its activities as an insurer, employer, investor, investment advisor and taxpayer. Further, state insurance regulatory authorities and other

federal and state authorities regularly make inquiries and conduct investigations concerning the Company’s compliance with applicable insurance and

other laws and regulations.

It is not feasible to predict or determine the ultimate outcome of all pending investigations and legal proceedings or provide reasonable ranges of

potential losses except as noted elsewhere herein in connection with specific matters. In some of the matters referred to herein, very large and/or

indeterminate amounts, including punitive and treble damages, are sought. Although in light of these considerations, it is possible that an adverse

outcome in certain cases could have a material adverse effect upon the Company’s consolidated financial position, based on information currently known

by the Company’s management, in its opinion, the outcomes of such pending investigations and legal proceedings are not likely to have such an effect.

However, given the large and/or indeterminate amounts sought in certain of these matters and the inherent unpredictability of litigation, it is possible that

an adverse outcome in certain matters could, from time to time, have a material adverse effect on the Company’s consolidated net income or cash flows

in particular quarterly or annual periods.

MetLife, Inc.

20