MetLife 2004 Annual Report Download - page 40

Download and view the complete annual report

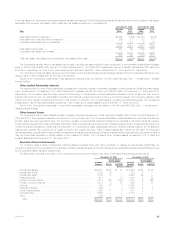

Please find page 40 of the 2004 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In the context of acquisition, disposition, investment and other transactions, the Company has provided indemnities and guarantees, including those

related to tax, environmental and other specific liabilities, and other indemnities and guarantees that are triggered by, among other things, breaches of

representations, warranties or covenants provided by the Company. In addition, in the normal course of business, the Company provides indemnifica-

tions to counterparties in contracts with triggers similar to the foregoing, as well as for certain other liabilities, such as third party lawsuits. These

obligations are often subject to time limitations that vary in duration, including contractual limitations and those that arise by operation of law, such as

applicable statutes of limitation. In some cases, the maximum potential obligation under the indemnities and guarantees is subject to a contractual

limitation ranging from less than $1 million to $800 million, while in other cases such limitations are not specified or applicable. Since certain of these

obligations are not subject to limitations, the Company does not believe that it is possible to determine the maximum potential amount due under these

guarantees in the future.

In addition, the Company indemnifies its directors and officers as provided in its charters and by-laws. Also, the Company indemnifies other of its

agents for liabilities incurred as a result of their representation of the Company’s interests. Since these indemnities are generally not subject to limitation

with respect to duration or amount, the Company does not believe that it is possible to determine the maximum potential amount due under these

indemnities in the future.

During the year ended December 31, 2004, the Company recorded liabilities of $10 million with respect to indemnities provided in certain

dispositions. The approximate term for these liabilities ranges from 12 to 18 months. The maximum potential amount of future payments that MetLife

could be required to pay is $73 million. Due to the uncertainty in assessing changes to the liabilities over the term, the liability on the balance sheet will

remain until either expiration or settlement of the guarantee unless evidence clearly indicates that the estimates should be revised. The fair value of the

remaining indemnities, guarantees and commitments entered into during 2004 was insignificant and thus, no liabilities were recorded. The Company’s

recorded liability at December 31, 2004 and 2003 for indemnities, guarantees and commitments, excluding amounts recorded during 2004 as

described in the preceding sentences, is insignificant.

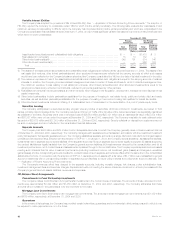

Accelerated Share Repurchase

On December 16, 2004, the Holding Company repurchased 7,281,553 shares of its outstanding common stock at an aggregate cost of

approximately $300 million under an accelerated share repurchase agreement with a major bank. The bank borrowed the stock sold to the Holding

Company from third parties and is purchasing the shares in the open market over the next few months to return to the lenders. The Holding Company will

either pay or receive an amount based on the actual amount paid by the bank to purchase the shares. The final purchase price is expected to be

determined in April 2005, and will be settled in either cash or Holding Company stock at the Holding Company’s option. The Holding Company recorded

the initial repurchase of shares as treasury stock and will record any amount paid or received as an adjustment to the cost of the treasury stock.

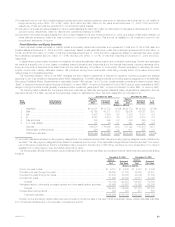

Quantitative and Qualitative Disclosures About Market Risk

The Company must effectively manage, measure and monitor the market risk associated with its invested assets and interest rate sensitive

insurance contracts. It has developed an integrated process for managing risk, which it conducts through its Corporate Risk Management Department,

Asset/Liability Management Committees (‘‘A/LM Committees’’) and additional specialists at the business segment level. The Company has established

and implemented comprehensive policies and procedures at both the corporate and business segment level to minimize the effects of potential market

volatility.

Market Risk Exposures

The Company has exposure to market risk through its insurance operations and investment activities. For purposes of this disclosure, ‘‘market risk’’

is defined as the risk of loss resulting from changes in interest rates, equity prices and foreign currency exchange rates.

Interest rates. The Company’s exposure to interest rate changes results from its significant holdings of fixed maturities, as well as its interest rate

sensitive liabilities. The fixed maturities include U.S. and foreign government bonds, securities issued by government agencies, corporate bonds and

mortgage-backed securities, all of which are mainly exposed to changes in medium- and long-term treasury rates. The interest rate sensitive liabilities for

purposes of this disclosure include guaranteed interest contracts and fixed annuities, which have the same type of interest rate exposure (medium- and

long-term treasury rates) as the fixed maturities. The Company employs product design, pricing and asset/liability management strategies to reduce the

adverse effects of interest rate volatility. Product design and pricing strategies include the use of surrender charges or restrictions on withdrawals in some

products. Asset/liability management strategies include the use of derivatives, the purchase of securities structured to protect against prepayments,

prepayment restrictions and related fees on mortgage loans and consistent monitoring of the pricing of the Company’s products in order to better match

the duration of the assets and the liabilities they support.

Equity prices. The Company’s investments in equity securities expose it to changes in equity prices, as do certain liabilities which involve long term

guarantees on equity performance. It manages this risk on an integrated basis with other risks through its asset/liability management strategies. The

Company also manages equity price risk through industry and issuer diversification, asset allocation techniques and the use of derivatives.

Foreign currency exchange rates. The Company’s exposure to fluctuations in foreign currency exchange rates against the U.S. dollar results from

its holdings in non-U.S. dollar denominated fixed maturity securities, equity securities and liabilities, as well as through its investments in foreign

subsidiaries. The principal currencies which create foreign currency exchange rate risk in the Company’s investment portfolios are the Euro, Canadian

dollars and British pounds. The Company mitigates the majority of its fixed maturities’ foreign currency exchange rate risk through the utilization of foreign

currency swaps and forward contracts. Through its investments in foreign subsidiaries, the Company is primarily exposed to the Mexican peso, South

Korean won, Chilean peso and Taiwanese dollar. The Company has matched substantially all of its foreign currency liabilities in its foreign subsidiaries

with their respective foreign currency assets, thereby reducing its risk to currency exchange rate fluctuation. In some countries, local surplus is held

entirely or in part in U.S. dollar assets which further minimizes exposure to exchange rate fluctuation risk. Selectively, the Company uses U.S. dollar

assets to support certain long duration foreign currency liabilities.

Risk Management

Corporate risk management. MetLife has established several financial and non-financial senior management committees as part of its risk

management process. These committees manage capital and risk positions, approve asset/liability management strategies and establish appropriate

corporate business standards.

MetLife, Inc. 37