MetLife 2004 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2004 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Excluding the impact of these items, income from continuing operations increased by $28 million in the year ended December 31, 2004 from the

comparable 2003 period. The increase in earnings in 2004 over the prior year period is primarily attributable to an increase in net investment income of

$183 million and a decrease in policyholder benefits and claims of $27 million, both of which are net of income taxes. This is partially offset by an increase

in net investment losses of $93 million and an increase in interest on bank holder deposits of $14 million, a charge related to unoccupied space of

$10 million, as well as expenses associated with the piloting of a new product of $7 million, all net of income taxes. In addition, the tax benefit increased

by $41 million as a result of a change in the Company’s allocation of tax expense among segments.

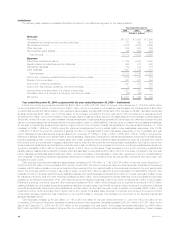

Total revenues, excluding net investment gains (losses), increased by $267 million, or 130%, to $472 million for the year ended December 31, 2004

from $205 million for the comparable 2003 period. The increase in revenue is primarily attributable to increases in income on fixed maturity securities,

corporate joint venture income, mortgage loans on real estate and equity securities due to increased invested assets and higher yields.

Total expenses increased by $185 million, or 52%, to $540 million for the year ended December 31, 2004 from $355 million for the comparable

2003 period. The year ended December 31, 2004 includes a $50 million contribution to the MetLife Foundation, partially offset by a $22 million reduction

of interest expense associated with the resolution of all issues relating to the Internal Revenue Service’s audit of Metropolitan Life’s and its subsidiaries’ tax

returns for the years 1997-1999. The year ended December 31, 2003 includes a $144 million benefit from a reduction of a previously established liability

associated with the Company’s race-conscious underwriting settlement. Excluding these items, other expenses increased by $13 million for the year

ended December 31, 2004. This increase is attributable to higher interest expense of $61 million as a result of the issuance of senior notes at the end of

2003 and during 2004, as well as higher interest credited to bank holder deposits of $22 million as a result of growth in MetLife Bank, N.A., (‘‘MetLife

Bank’’), a national bank’s, business. This increase is partially offset by a decrease of $54 million from lower interest expense on surplus notes, as well as

lower expenses from policyholder benefits and claims of $43 million, a charge related to unoccupied space of $15 million, as well as expenses

associated with the piloting of a new product of $11 million.

Year ended December 31, 2003 compared with the year ended December 31, 2002 — Corporate & Other

Income (Loss) from continuing operations increased by $478 million, or 108%, to $37 million for the year ended December 31, 2003 from

($441) million for the comparable 2002 period. The 2003 period includes a $92 million benefit, net of income taxes, from a reduction of a previously

established liability related to the Company’s race conscious underwriting settlement and a $36 million benefit from a revision of the estimate of income

tax for 2002. The 2002 period includes a $169 million charge, net of income taxes, to cover costs associated with asbestos-related claims, a $48 million

charge, net of income taxes, to cover costs associated with the resolution of a federal government investigation of General American Life Insurance

Company’s (‘‘General American’’) former Medicare business, and a $30 million reduction, net of income taxes, of a previously established liability related

to the Company’s sales practice class action settlement in 1999. Excluding the impact of these items, the increase in earnings year over year is mainly

due to higher investment income.

Total revenues, excluding net investment gains and losses, increased by $190 million, or 1,267%, to $205 million for the year ended December 31,

2003 from $15 million for the comparable 2002 period. This variance is mainly due to higher investment income resulting from the change in capital

allocation methodology, as well as increases in income from corporate joint ventures, equity-linked notes and securities lending.

Total expenses decreased by $374 million, or 51%, to $355 million for the year ended December 31, 2003 from $729 million for the comparable

2002 period. The 2003 period includes a $144 million reduction of a previously established liability related to the Company’s race-conscious underwriting

settlement. The 2002 period includes a $266 million charge to increase the Company’s asbestos-related liability and expenses to cover costs associated

with the resolution of federal government investigations of General American’s former Medicare business.

MetLife Capital Trust I

In connection with MetLife, Inc.’s, initial public offering in April 2000, the Holding Company and MetLife Capital Trust I (the ‘‘Trust’’) issued equity

security units (the ‘‘units’’). Each unit originally consisted of (i) a contract to purchase, for $50, shares of the Holding Company’s common stock (the

‘‘purchase contracts’’) on May 15, 2003; and (ii) a capital security of the Trust, with a stated liquidation amount of $50.

In accordance with the terms of the units, the Trust was dissolved on February 5, 2003, and $1,006 million aggregate principal amount of

8.00% debentures of the Holding Company (the ‘‘MetLife debentures’’), the sole assets of the Trust, were distributed to the owners of the Trust’s capital

securities in exchange for their capital securities. The MetLife debentures were remarketed on behalf of the debenture owners on February 12, 2003 and

the interest rate on the MetLife debentures was reset as of February 15, 2003 to 3.911% per annum for a yield to maturity of 2.876%. As a result of the

remarketing, the debenture owners received $21 million ($0.03 per diluted common share) in excess of the carrying value of the capital securities. This

excess was recorded by the Company as a charge to additional paid-in capital and, for the purpose of calculating earnings per share, is subtracted from

net income to arrive at net income available to common shareholders.

On May 15, 2003, the purchase contracts associated with the units were settled. In exchange for $1,006 million, the Company issued 2.97 shares

of MetLife, Inc. common stock per purchase contract, or 59.8 million shares of treasury stock. The excess of the Company’s cost of the treasury stock

($1,662 million) over the contract price of the stock issued to the purchase contract holders ($1,006 million) was $656 million, which was recorded as a

direct reduction to retained earnings.

Due to the dissolution of the Trust in 2003, there was no interest expense on capital securities for the year ended December 31, 2004. Interest

expense on the capital securities is included in other expenses and was $10 million and $81 million for the years ended December 31, 2003 and 2002,

respectively.

Subsequent Events

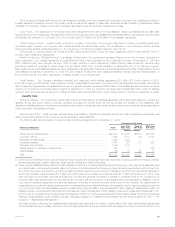

On January 31, 2005, the Holding Company entered into an agreement to acquire all of the outstanding shares of capital stock of certain indirect

subsidiaries of Citigroup Inc., including the majority of The Travelers Insurance Company (‘‘Travelers’’), and substantially all of Citigroup Inc.’s international

insurance businesses for a purchase price of $11.5 billion, subject to adjustment as described in the acquisition agreement. As a condition to closing,

Citigroup Inc. and the Holding Company will enter into ten-year agreements under which the Company will expand its distribution by making products

available through certain Citigroup distribution channels, subject to appropriate suitability and other standards. The transaction is expected to close in the

summer of 2005. Approximately $1 billion to $3 billion of the purchase price will be paid in MetLife stock with the remainder paid in cash which will be

financed through a combination of cash on hand, debt, mandatorily convertible securities and selected asset sales depending on market conditions,

timing, valuation considerations and the relative attractiveness of funding alternatives.

The Company has entered into brokerage agreements relating to the possible sale of two of its real estate investments, 200 Park Avenue and One

Madison Avenue in New York City. The Company is also contemplating other asset sales, including selling some or all of its beneficially owned shares in

RGA.

MetLife, Inc. 17