MetLife 2004 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2004 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.METLIFE, INC.

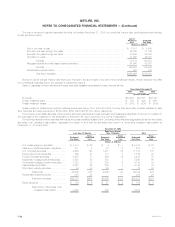

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

Significant Accounting Policies

Investments

The Company’s fixed maturity and equity securities are classified as available-for-sale and are reported at their estimated fair value. Unrealized

investment gains and losses on securities are recorded as a separate component of other comprehensive income or loss, net of policyholder related

amounts and deferred income taxes. The cost of fixed maturity and equity securities is adjusted for impairments in value deemed to be other-than-

temporary in the period that determination is made. These adjustments are recorded as investment losses. The assessment of whether such impairment

has occurred is based on management’s case-by-case evaluation of the underlying reasons for the decline in fair value. Management considers a wide

range of factors, as described in ‘‘Summary of Critical Accounting Estimates-Investments,’’ about the security issuer and uses its best judgment in

evaluating the cause of the decline in the estimated fair value of the security and in assessing the prospects for near-term recovery. Inherent in

management’s evaluation of the security are assumptions and estimates about the operations of the issuer and its future earnings potential.

The Company’s review of its fixed maturities and equity securities for impairments also includes an analysis of the total gross unrealized losses by

three categories of securities: (i) securities where the estimated fair value had declined and remained below cost or amortized cost by less than 20%; (ii)

securities where the estimated fair value had declined and remained below cost or amortized cost by 20% or more for less than six months; and

(iii) securities where the estimated fair value had declined and remained below cost or amortized cost by 20% or more for six months or greater.

Investment gains and losses on sales of securities are determined on a specific identification basis. All security transactions are recorded on a trade

date basis. Amortization of premium and accretion of discount on fixed maturity securities is recorded using the effective interest method.

Mortgage loans on real estate are stated at amortized cost, net of valuation allowances. Valuation allowances are recorded when it is probable that,

based upon current information and events, the Company will be unable to collect all amounts due under the contractual terms of the loan agreement.

Such valuation allowances are established for the excess carrying value of the mortgage loan over the present value of expected future cash flows

discounted at the loan’s original effective interest rate, the value of the loan’s collateral or the loan’s market value if the loan is being sold. The Company

also establishes allowances for loan loss when a loss contingency exists for pools of loans with similar characteristics based on property types and loan

to value risk factors. A loss contingency exists when the likelihood that a future event will occur is probable based on past events. Changes in valuation

allowances are included in net investment gains and losses. Interest income earned on impaired loans is accrued on the principal amount of the loan

based on the loan’s contractual interest rate. However, interest ceases to be accrued for loans on which interest is generally more than 60 days past due

and/or where the collection of interest is not considered probable. Cash receipts on impaired loans are recorded as a reduction of the recorded

investment.

Real estate held-for-investment, including related improvements, is stated at cost less accumulated depreciation. Depreciation is provided on a

straight-line basis over the estimated useful life of the asset (typically 20 to 55 years). Once the Company identifies a property that is expected to be sold

within one year and commences a firm plan for marketing the property, the Company, if applicable, classifies the property as held-for-sale and reports the

related net investment income and any resulting investment gains and losses as discontinued operations. Real estate held-for-sale is stated at the lower

of depreciated cost or fair value less expected disposition costs. Real estate is not depreciated while it is classified as held-for-sale. Cost of real estate

held-for-investment is adjusted for impairment whenever events or changes in circumstances indicate the carrying amount of the asset may not be

recoverable. Impaired real estate is written down to estimated fair value with the impairment loss being included in net investment gains and losses.

Impairment losses are based upon the estimated fair value of real estate, which is generally computed using the present value of expected future cash

flows from the real estate discounted at a rate commensurate with the underlying risks. Real estate acquired upon foreclosure of commercial and

agricultural mortgage loans is recorded at the lower of estimated fair value or the carrying value of the mortgage loan at the date of foreclosure.

Policy loans are stated at unpaid principal balances.

Short-term investments are stated at amortized cost, which approximates fair value.

Other invested assets consist principally of leveraged leases and funds withheld at interest. The leveraged leases are recorded net of non-recourse

debt. The Company participates in lease transactions which are diversified by industry, asset type and geographic area. The Company regularly reviews

residual values and impairs residuals to expected values as needed. Funds withheld represent amounts contractually withheld by ceding companies in

accordance with reinsurance agreements. For agreements written on a modified coinsurance basis and certain agreements written on a coinsurance

basis, assets supporting the reinsured policies and equal to the net statutory reserves are withheld and continue to be legally owned by the ceding

companies. Other invested assets also includes the fair value of embedded derivatives related to funds withheld and modified coinsurance contracts.

The Company recognizes interest on funds withheld in accordance with the treaty terms as investment income is earned on the assets supporting the

reinsured policies.

The Company participates in structured investment transactions, primarily asset securitizations and structured notes. These transactions enhance

the Company’s total return of the investment portfolio principally by generating management fee income on asset securitizations and by providing equity-

based returns on debt securities through structured notes and similar instruments.

The Company sponsors financial asset securitizations of high yield debt securities, investment grade bonds and structured finance securities and

also is the collateral manager and a beneficial interest holder in such transactions. As the collateral manager, the Company earns management fees on

the outstanding securitized asset balance, which are recorded in income as earned. When the Company transfers assets to a bankruptcy-remote special

purpose entity (‘‘SPE’’) and surrenders control over the transferred assets, the transaction is accounted for as a sale. Gains or losses on securitizations

are determined with reference to the carrying amount of the financial assets transferred, which is allocated to the assets sold and the beneficial interests

retained based on relative fair values at the date of transfer. Beneficial interests in securitizations are carried at fair value in fixed maturities. Income on

these beneficial interests is recognized using the prospective method. The SPEs used to securitize assets are not consolidated by the Company

because the Company has determined that it is not the primary beneficiary of these entities. Prior to the adoption of FIN 46(r), such SPEs were not

consolidated because they did not meet the criteria for consolidation under previous accounting guidance.

The Company purchases or receives beneficial interests in SPEs, which generally acquire financial assets, including corporate equities, debt

securities and purchased options. The Company has not guaranteed the performance, liquidity or obligations of the SPEs and the Company’s exposure

to loss is limited to its carrying value of the beneficial interests in the SPEs. The Company uses the beneficial interests as part of its risk management

strategy, including asset-liability management. These SPEs are not consolidated by the Company because the Company has determined that it is not the

MetLife, Inc. F-11