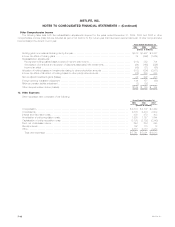

MetLife 2004 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2004 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

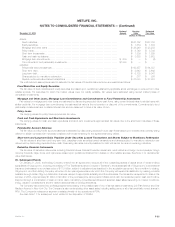

In 2002, the Company acquired Aseguradora Hidalgo S.A. (‘‘Hidalgo’’), an insurance company based in Mexico with approximately $2.5 billion in

assets as of the date of acquisition (June 20, 2002). During the second quarter of 2003, as a part of its acquisition and integration strategy, the

International segment completed the legal merger of Hidalgo into its original Mexican subsidiary, Seguro Genesis, S.A., forming MetLife Mexico, S.A. As a

result of the merger of these companies, the Company recorded $62 million of earnings, net of income taxes, from the merger and a reduction in

policyholder liabilities resulting from a change in reserve methodology. Such benefit was recorded in the second quarter of 2003 in the International

segment.

See also Note 20 for Subsequent Events.

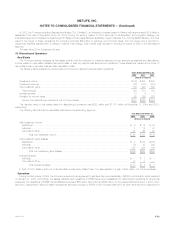

18. Discontinued Operations

Real Estate

The Company actively manages its real estate portfolio with the objective to maximize earnings through selective acquisitions and dispositions.

Income related to real estate classified as held-for-sale or sold is presented as discontinued operations. These assets are carried at the lower of

depreciated cost or fair value less expected disposition costs.

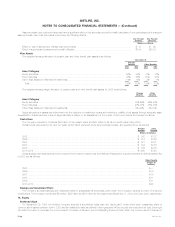

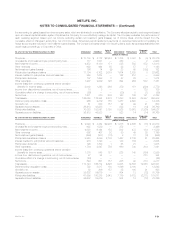

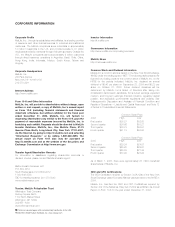

The following table presents the components of income from discontinued real estate operations:

Years Ended December 31,

2004 2003 2002

(Dollars in millions)

Investment income ******************************************************************************* $136 $ 231 $ 530

Investment expense ****************************************************************************** (82) (138) (351)

Net investment gains****************************************************************************** 139 420 582

Total revenues ********************************************************************************* 193 513 761

Interest expense ********************************************************************************* 13 4 1

Provision for income taxes ************************************************************************* 63 186 276

Income from discontinued operations, net of income taxes ******************************************** $117 $ 323 $ 484

The carrying value of real estate related to discontinued operations was $252 million and $1,170 million at December 31, 2004 and 2003,

respectively.

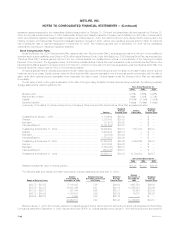

The following table shows the real estate discontinued operations by segment:

Year Ended December 31,

2004 2003 2002

(Dollars in millions)

Net investment income

Institutional *********************************************************************************** $6 $12 $42

Individual************************************************************************************* 71257

Corporate & Other***************************************************************************** 41 69 80

Total net investment income*************************************************************** $ 54 $ 93 $179

Net investment gains (losses)

Institutional *********************************************************************************** $ 9 $ 45 $156

Individual************************************************************************************* (3) 43 262

Corporate & Other***************************************************************************** 133 332 164

Total net investment gains (losses) ********************************************************* $139 $420 $582

Interest Expense

Individual************************************************************************************* $— $1 $1

Corporate & Other***************************************************************************** 13 3 —

Total interest expense ******************************************************************** $13 $ 4 $ 1

In April of 2004, MetLife sold one of its real estate investments, Sears Tower. The sale resulted in a gain of $85 million, net of income taxes.

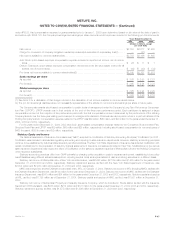

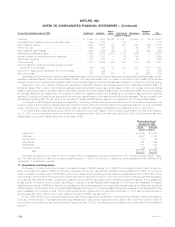

Operations

During the third quarter of 2004, the Company entered into an agreement to sell its wholly-owned subsidiary, SSRM, to a third party, which was sold

on January 31, 2005. Accordingly, the assets, liabilities and operations of SSRM have been reclassified into discontinued operations for all periods

presented. The operations of SSRM include affiliated revenues of $59 million, $54 million and $56 million, for the years ended December 31, 2004, 2003

and 2002, respectively, related to asset management services provided by SSRM to the Company that have not been eliminated from discontinued

MetLife, Inc. F-53