MetLife 2004 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2004 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

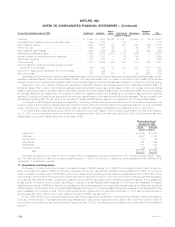

the accounting for gains (losses) from intercompany sales, which are eliminated in consolidation. The Company allocates capital to each segment based

upon an internal capital allocation system that allows the Company to more effectively manage its capital. The Company evaluates the performance of

each operating segment based upon net income excluding certain net investment gains (losses), net of income taxes, and the impact from the

cumulative effect of changes in accounting, net of income taxes. Scheduled periodic settlement payments on derivative instruments not qualifying for

hedge accounting are included in net investment gains (losses). The Company allocates certain non-recurring items, such as expenses associated with

certain legal proceedings, to Corporate & Other.

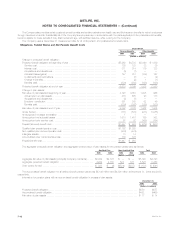

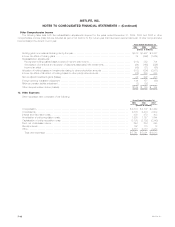

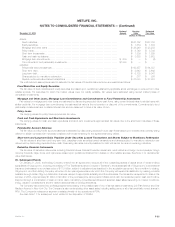

Auto & Corporate

As of or for the Year Ended December 31, 2004 Institutional Individual Home International Reinsurance & Other Total

(Dollars in millions)

Premiums*********************************************** $ 10,103 $ 4,172 $2,948 $ 1,735 $ 3,367 $ (9) $ 22,316

Universal life and investment-type product policy fees ********** 717 1,831 — 350 — 2 2,900

Net investment income************************************ 4,472 6,130 171 585 588 472 12,418

Other revenues ****************************************** 632 444 35 23 57 7 1,198

Net investment gains (losses) ****************************** 186 74 (9) 23 60 (152) 182

Policyholder benefits and claims **************************** 11,134 5,102 2,079 1,614 2,725 8 22,662

Interest credited to policyholder account balances ************* 960 1,674 — 152 212 — 2,998

Policyholder dividends ************************************ 107 1,638 2 47 20 — 1,814

Other expenses****************************************** 1,907 2,939 795 624 964 532 7,761

Income (loss) from continuing operations before provision

(benefit) for income taxes ******************************** 2,002 1,298 269 279 151 (220) 3,779

Income from discontinued operations, net of income taxes****** 10 3 — — — 123 136

Cumulative effect of a change in accounting, net of income taxes (60) — — (30) 5 (1) (86)

Net income ********************************************* 1,271 870 208 163 105 141 2,758

Total assets ********************************************* 126,058 176,384 5,233 11,293 14,503 23,337 356,808

Deferred policy acquisition costs**************************** 965 9,279 185 1,287 2,620 — 14,336

Goodwill, net ******************************************** 61 203 157 92 99 21 633

Separate account assets ********************************** 36,913 48,933 — 923 14 (14) 86,769

Policyholder liabilities************************************** 70,083 103,091 3,180 8,025 10,973 (1,325) 194,027

Separate account liabilities********************************* 36,913 48,933 — 923 14 (14) 86,769

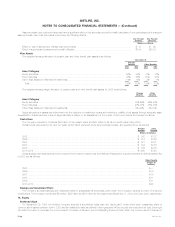

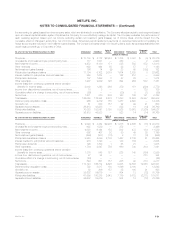

Auto & Corporate

As of or for the Year Ended December 31, 2003 Institutional Individual Home International Reinsurance & Other Total

(Dollars in millions)

Premiums*********************************************** $ 9,093 $ 4,344 $2,908 $ 1,678 $ 2,668 $ (18) $ 20,673

Universal life and investment-type product policy fees ********** 635 1,589 — 272 — — 2,496

Net investment income************************************ 4,028 6,194 158 502 473 184 11,539

Other revenues ****************************************** 592 407 32 80 49 39 1,199

Net investment gains (losses) ****************************** (293) (307) (15) 8 31 (6) (582)

Policyholder benefits and claims **************************** 9,843 5,039 2,139 1,457 2,136 51 20,665

Interest credited to policyholder account balances ************* 915 1,793 — 143 184 — 3,035

Policyholder dividends ************************************ 198 1,700 1 55 21 — 1,975

Other expenses****************************************** 1,784 2,847 756 660 740 304 7,091

Income (loss) from continuing operations before provision

(benefit) for income taxes ******************************** 1,315 848 187 225 140 (156) 2,559

Income from discontinued operations, net of income taxes****** 37 34 — — — 273 344

Cumulative effect of a change in accounting, net of income taxes (26) — — — — — (26)

Net income ********************************************* 849 601 157 208 92 310 2,217

Total assets ********************************************* 113,743 165,774 4,698 9,935 12,833 19,858 326,841

Deferred policy acquisition costs**************************** 739 8,817 180 1,046 2,160 1 12,943

Goodwill, net ******************************************** 59 206 157 85 100 21 628

Separate account assets ********************************** 35,632 39,619 — 504 13 (12) 75,756

Policyholder liabilities************************************** 61,599 100,278 2,943 7,179 9,783 (2,211) 179,571

Separate account liabilities********************************* 35,632 39,619 — 504 13 (12) 75,756

MetLife, Inc. F-51