Lenovo 2013 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2013 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2012/13 Annual Report Lenovo Group Limited 95

Bank Borrowings

Particulars of bank borrowings as at March 31, 2013 are set out in note 28 to the financial statements.

Donations

Charitable and other donations made by the Group during the year amounted to US$1,108,000 (2012: US$714,000).

Property, Plant and Equipment

Details of the movements in the property, plant and equipment of the Group and of the Company during the year are set out in

note 14 to the financial statements.

Share Capital

Details of the movements in the share capital of the Company during the year are set out in note 30 to the financial statements.

Subsidiaries, Associates and Jointly Controlled Entities

Particulars of the Company’s principal subsidiaries, associates and jointly controlled entities as at March 31, 2013 are set out in

notes 39 and 19 to the financial statements respectively.

Management Contracts

No contracts concerning the management and administration of the whole or any substantial part of the business of the Company

were entered into or existed during the year.

Major Customers and Suppliers

During the year, the Group sold less than 15% of its goods and services to its five largest customers. The percentages of

purchases for the year attributable to the Group’s major suppliers are as follows:

The largest supplier 17%

Five largest suppliers combined 24%

None of the directors of the Company, their associates or any shareholder (which to the knowledge of the directors owns more

than 5% of the Company’s share capital) had an interest in the major suppliers noted above.

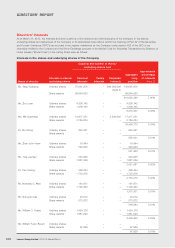

Purchase, Sale or Redemption of the Company’s Listed Securities

During the year, the Company repurchased a total of 57,246,000 ordinary shares of HK$0.025 each in the capital of the Company

at prices ranging from HK$5.54 to HK$6.49 per share on The Stock Exchange of Hong Kong Limited (the “Stock Exchange” or

“HKSE”). Details of the repurchases of such ordinary shares were as follows:

Month of the

repurchases

Number of ordinary

shares repurchased

Highest price

paid per share

Lowest price

paid per share

Aggregate

consideration paid

(excluding expenses)

HK$ HK$ HK$

June 2012 8,010,000 6.49 6.24 51,131,740

July 2012 49,236,000 6.48 5.54 291,171,260

57,246,000 342,303,000

All 57,246,000 ordinary shares repurchased were cancelled on delivery of the share certificates during the year and the issued

share capital of the Company was accordingly diminished by the nominal value of the repurchased ordinary shares so cancelled.

The premium paid on repurchase of such ordinary shares was charged against the share premium account of the Company.

During the year ended March 31, 2013, the trustee of the long-term incentive program of the Company purchased 106,968,000

ordinary shares from the market for award to employees upon vesting. Details of the program are set out under section headed

“Long-Term Incentive Program” in the Compensation Committee Report on page 72 of this annual report.

Save as disclosed above, neither the Company nor any of its subsidiaries had purchased, sold or redeemed any of the Company’s

securities during the year ended March 31, 2013.