Lenovo 2013 Annual Report Download - page 170

Download and view the complete annual report

Please find page 170 of the 2013 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO THE FINANCIAL STATEMENTS

Lenovo Group Limited 2012/13 Annual Report

168

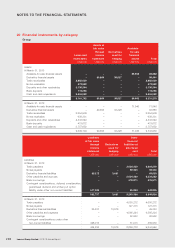

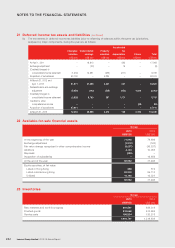

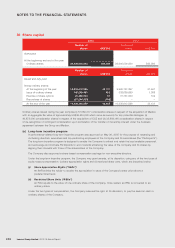

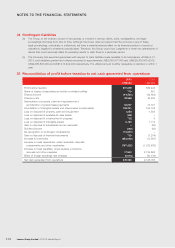

30 Share capital

2013 2012

Number of

shares HK$’000

Number of

shares HK$’000

Authorized:

At the beginning and end of the year

Ordinary shares 20,000,000,000 500,000 20,000,000,000 500,000

Number of

shares US$’000

Number of

shares US$’000

Issued and fully paid:

Voting ordinary shares:

At the beginning of the year 10,335,612,596 33,131 9,965,161,897 31,941

Issue of ordinary shares 140,299,463 452 338,689,699 1,088

Exercise of share options 20,486,000 67 31,761,000 102

Repurchase of shares (57,246,000) (185) ––

At the end of the year 10,439,152,059 33,465 10,335,612,596 33,131

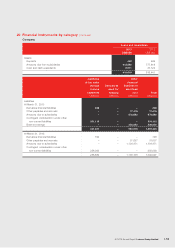

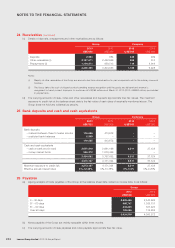

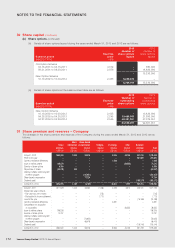

Ordinary shares issued during the year comprise (i) 57,560,317 consideration shares in respect of the acquisition of Medion

with an aggregate fair value of approximately US$36,555,000 which serve as security for any potential damages; (ii)

46,875,000 consideration shares in respect of the acquisition of CCE and (iii) 35,864,146 consideration shares in respect

of de-recognition of contingent consideration upon completion of the transfer of ownership interest under the business

agreement between the Group and Medion.

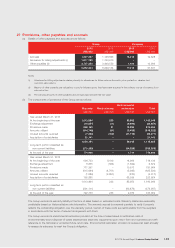

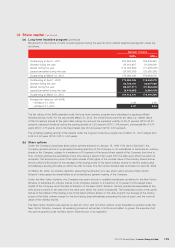

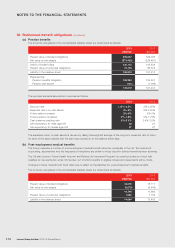

(a) Long-term incentive program

A performance-related long-term incentive program was approved on May 26, 2005 for the purpose of rewarding and

motivating directors, executives and top-performing employees of the Company and its subsidiaries (the “Participants”).

The long-term incentive program is designed to enable the Company to attract and retain the best available personnel,

and encourage and motivate Participants to work towards enhancing the value of the Company and its shares by

aligning their interests with those of the shareholders of the Company.

The Company also approved a share-based compensation package for non-executive directors.

Under the long-term incentive program, the Company may grant awards, at its discretion, using any of the two types of

equity-based compensation: (i) share appreciation rights and (ii) restricted share units, which are described below:

(i) Share Appreciation Rights (“SARs”)

An SAR entitles the holder to receive the appreciation in value of the Company’s share price above a

predetermined level.

(ii) Restricted Share Units (“RSUs”)

An RSU equals to the value of one ordinary share of the Company. Once vested, an RSU is converted to an

ordinary share.

Under the two types of compensation, the Company reserves the right, at its discretion, to pay the award in cash or

ordinary shares of the Company.