Lenovo 2013 Annual Report Download - page 147

Download and view the complete annual report

Please find page 147 of the 2013 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

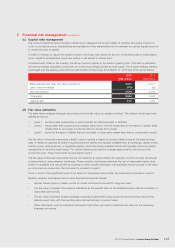

2012/13 Annual Report Lenovo Group Limited 145

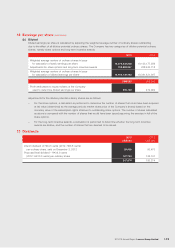

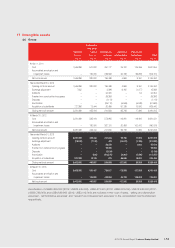

9 Taxation

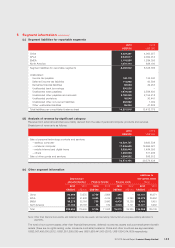

The amount of taxation in the consolidated income statement represents:

2013 2012

US$’000 US$’000

Current tax

– Hong Kong profits tax 1,328 236

– Taxation outside Hong Kong 181,267 174,548

Deferred tax (Note 21) (12,888) (67,757)

169,707 107,027

Hong Kong profits tax has been provided at the rate of 16.5% (2012: 16.5%) on the estimated assessable profit for the year.

Taxation outside Hong Kong represents income and irrecoverable withholding taxes of subsidiaries operating in the Chinese

Mainland and overseas, calculated at rates applicable in the respective jurisdictions.

The Group has been granted certain tax concessions by tax authorities in the Chinese Mainland and overseas whereby the

subsidiaries operating in the respective jurisdictions are entitled to tax concessions.

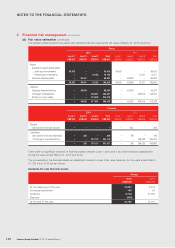

The differences between the Group’s expected tax charge, calculated at the domestic rates applicable to the countries

concerned, and the Group’s tax charge for the year are as follows:

2013 2012

US$’000 US$’000

Profit before taxation 801,299 582,443

Tax calculated at domestic rates applicable in countries concerned 137,345 180,375

Income not subject to taxation (137,918) (123,533)

Expenses not deductible for taxation purposes 133,750 108,375

Utilization of previously unrecognized tax losses (69,347) (87,565)

Effect on opening deferred income tax assets due to change in tax rates (844) (7,660)

Deferred income tax assets not recognized 76,772 32,812

Under-provision in prior years 29,949 4,223

169,707 107,027

The weighted average applicable tax rate for the year was 17.1% (2012: 31%). The decrease is caused by changes in tax

concessions and profitability of the group’s subsidiaries in respective countries they are operating.

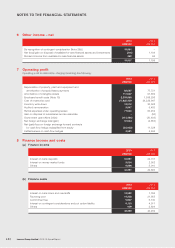

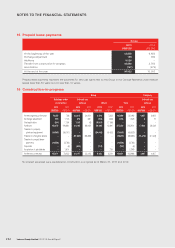

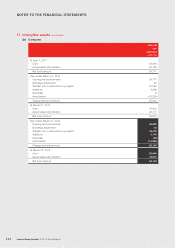

The tax (charge)/credit relating to components of other comprehensive income is as follows:

2013 2012

Before Tax After Before Tax After

tax charge tax tax credit tax

US$’000 US$’000 US$’000 US$’000 US$’000 US$’000

Fair value change on

available-for-sale financial assets (4,057) – (4,057) (36,337) – (36,337)

Fair value change on cash flow hedges 19,798 (26) 19,772 33,797 61 33,858

Actuarial loss from defined benefit pension plans (17,174) (1,632) (18,806) (37,537) 2,834 (34,703)

Currency translation differences (118,602) – (118,602) (51,055) – (51,055)

Other comprehensive income (120,035) (1,658) (121,693) (91,132) 2,895 (88,237)

Current tax ––

Deferred tax (Note 21) (1,658) 2,895

(1,658) 2,895