Lenovo 2013 Annual Report Download - page 165

Download and view the complete annual report

Please find page 165 of the 2013 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188

|

|

2012/13 Annual Report Lenovo Group Limited 163

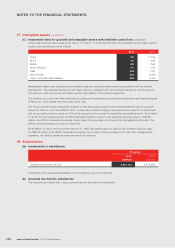

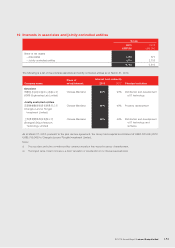

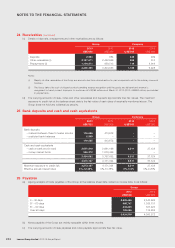

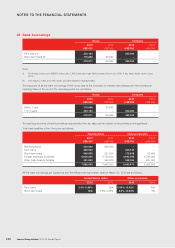

24 Receivables

(a) Customers are generally granted credit term ranging from 0 to 120 days. Ageing analysis of trade receivables of the

Group at the balance sheet date, based on invoice date, is as follows:

Group

2013 2012

US$’000 US$’000

0 – 30 days 1,967,312 1,504,488

31 – 60 days 560,180 642,754

61 – 90 days 136,543 112,871

Over 90 days 257,924 124,193

2,921,959 2,384,306

Less: provision for impairment (36,920) (29,397)

Trade receivables – net 2,885,039 2,354,909

Trade receivables that are not past due are fully performing and not considered impaired.

At March 31, 2013, trade receivables, net of impairment, of US$331,457,000 (2012: US$282,766,000) were past due.

The ageing of these receivables, based on due date, is as follows:

Group

2013 2012

US$’000 US$’000

Within 30 days 221,310 232,556

31 – 60 days 42,559 23,741

61 – 90 days 37,395 7,634

Over 90 days 30,193 18,835

331,457 282,766

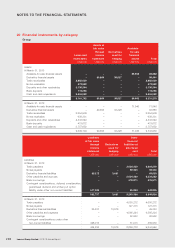

Movements on the provision for impairment of trade receivables are as follows:

Group

2013 2012

US$’000 US$’000

At beginning of the year 29,397 21,081

Exchange adjustment (649) (165)

Provisions made 23,527 24,163

Uncollectible receivables written off (9,261) (12,076)

Unused amounts reversed (13,653) (3,606)

Acquisition of subsidiaries 7,559 –

At the end of the year 36,920 29,397

(b) Notes receivable of the Group are bank accepted notes mainly with maturity dates of within six months.