Lenovo 2013 Annual Report Download - page 180

Download and view the complete annual report

Please find page 180 of the 2013 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

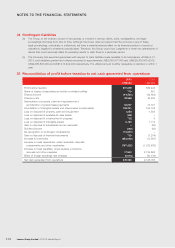

NOTES TO THE FINANCIAL STATEMENTS

Lenovo Group Limited 2012/13 Annual Report

178

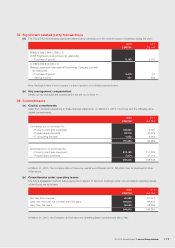

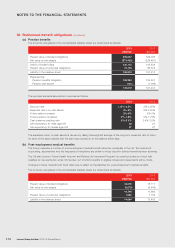

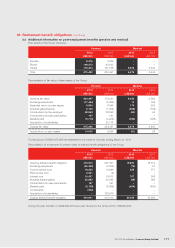

36 Retirement benefit obligations (continued)

(c) Additional information on post-employment benefits (pension and medical) (continued)

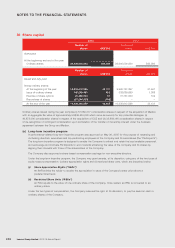

Summary of pensions and post-retirement medical benefits of the Group:

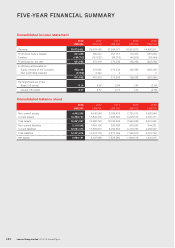

2013 2012 2011 2010 2009

US$’000 US$’000 US$’000 US$’000 US$’000

Present value of defined benefit obligations 445,183 435,760 255,673 239,566 210,613

Fair value of plan assets 281,300 230,942 180,803 158,699 142,613

Deficit 163,883 204,818 74,870 80,867 68,000

Actuarial (gains)/losses arising on plan assets (7,840) 1,786 3,642 (386) 6,023

Actuarial losses/(gains) arising on plan liabilities 25,014 35,751 3,548 11,226 (13,048)

17,174 37,537 7,190 10,840 (7,025)

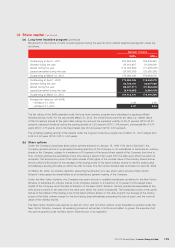

The amounts recognized in the consolidated income statement are as follows:

Pension Medical

2013 2012 2013 2012

US$’000 US$’000 US$’000 US$’000

Current service cost 16,233 14,296 522 577

Past service cost 2,031 (9) ––

Interest cost 10,407 10,611 707 958

Expected return on plan assets (5,904) (6,548) (174) (202)

Curtailment losses (166) –––

Total expense recognized in the

consolidated income statement 22,601 18,350 1,055 1,333

(d) The Company does not have any pension plan or post-employment medical benefits plan.

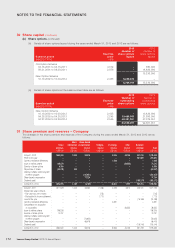

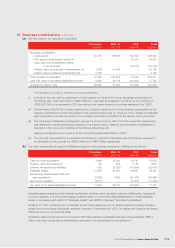

37 Business combinations

During the year, the Group completed three business combination activities aiming at expanding the Group’s existing scale of

operations and to enlarge the Group’s market share.

On December 26, 2012, the Group acquired 100% of the issued share capital of Stoneware, a company incorporated in the

United States. Stoneware is a company in the business of development and sale of cloud computing related software.

On December 29, 2012, the Group completed the formation of a strategic partnership with EMC which consists of three

business components, namely server alliance, storage OEM/reseller relationship and formation of joint venture company with

EMC to develop network-attached storage products. Immediately following completion, the Group and EMC respectively

owns 51% and 49% of the issued share capital of EMC JV.

On January 2, 2013, the Group acquired the entire equity interests in CCE, companies incorporated in Brazil. CCE is

principally engaged in the manufacturing and marketing of personal computers and consumer electronics.

The Group’s business combination activities involve post-acquisition performance-based contingent considerations. HKFRS

3 (Revised) “Business Combinations” requires the recognition of the fair value of those contingent considerations as of their

respective dates of business combination as part of the consideration transferred in exchange for the acquired subsidiaries/

businesses. These fair value measurements require, among other things, significant estimation of post-acquisition performance

of the acquired subsidiaries/businesses and significant judgment on time value of money. Contingent considerations shall be

re-measured at their fair value resulting from events or factors which emerge after the date of business combination, with any

resulting gain or loss recognized in the consolidated income statement in accordance with HKFRS 3 (Revised).

HKAS 27 “Consolidated and Separate Financial Statements” (as amended in 2008) requires that the proportions allocated

to the parent and non-controlling interests are determined on the basis of present ownership interests. The joint venture

agreement with EMC involves an arrangement on the transfer of ownership interest with EMC under call and put options

granted to the Company and EMC respectively, and has been accounted for in accordance with HKAS 27.

The estimated total consideration for the business combination activities completed during the year is approximately US$219

million, including cash and the Company’s shares as consideration shares.