Lenovo 2013 Annual Report Download - page 163

Download and view the complete annual report

Please find page 163 of the 2013 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2012/13 Annual Report Lenovo Group Limited 161

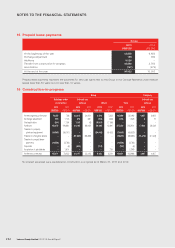

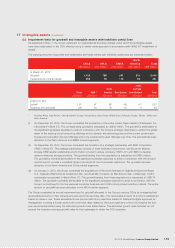

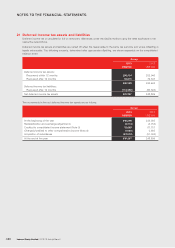

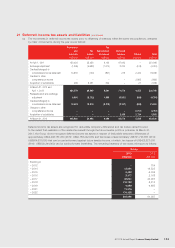

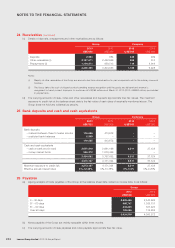

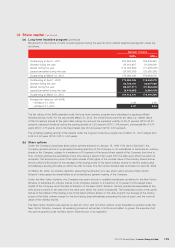

21 Deferred income tax assets and liabilities (continued)

(a) The movements in deferred income tax assets (prior to offsetting of balances within the same tax jurisdiction), analyzed

by major components, during the year are as follows:

Provisions

and

accruals

Tax

losses

Tax

depreciation

allowance

Deferred

revenue Others Total

US$’000 US$’000 US$’000 US$’000 US$’000 US$’000

At April 1, 2011 150,420 25,456 8,130 67,092 – 251,098

Exchange adjustment (1,245) (5,688) (1,014) 3,704 (518) (4,761)

Credited/(charged) to

consolidated income statement 74,935 (100) (897) 278 2,249 76,465

Credited to other

comprehensive income – – – – 2,895 2,895

Acquisition of subsidiaries 269 6,431 342 – 27 7,069

At March 31, 2012 and

April 1, 2013 224,379 26,099 6,561 71,074 4,653 332,766

Reclassification and exchange

adjustment 8,090 (8,732) 1,895 (5,551) (458) (4,756)

Credited/(charged) to

consolidated income statement 13,423 13,319 (2,370) (2,107) (584) 21,681

Charged to other

comprehensive income – – – – (1,757) (1,757)

Acquisition of subsidiaries – – – 2,158 3,734 5,892

At March 31, 2013 245,892 30,686 6,086 65,574 5,588 353,826

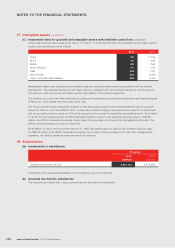

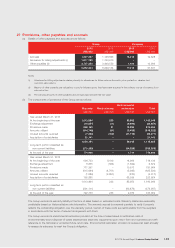

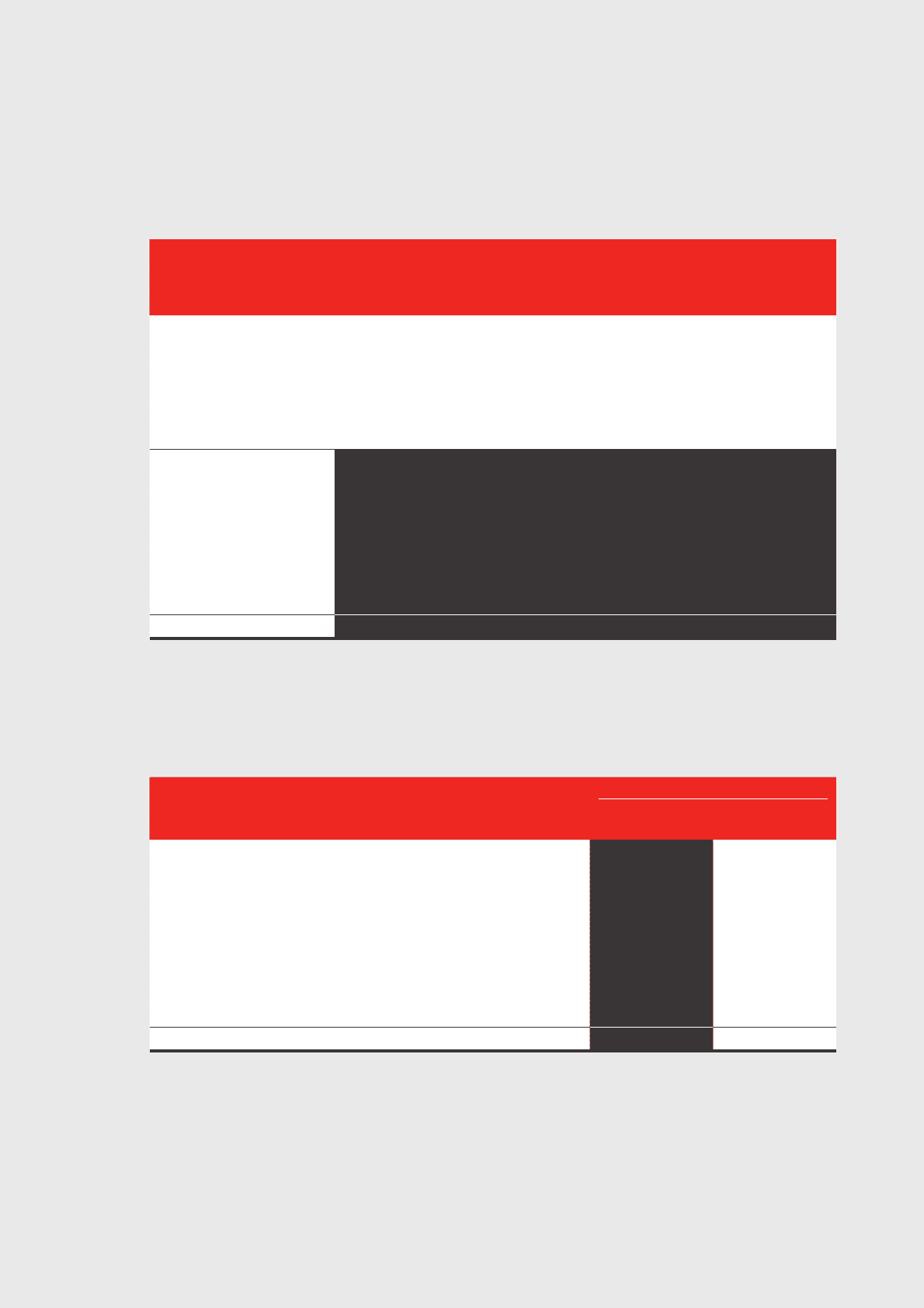

Deferred income tax assets are recognized for deductible temporary differences and tax losses carried forward

to the extent that realization of the related tax benefit through the future taxable profits is probable. At March 31,

2013, the Group did not recognize deferred income tax assets in respect of deductible temporary differences of

approximately US$2,406,161,000 (2012: US$2,166,242,000) and tax losses of approximately US$791,723,000 (2012:

US$584,631,000) that can be carried forward against future taxable income, of which, tax losses of US$428,827,000

(2012: US$503,244,000) can be carried forward indefinitely. The remaining balances of tax losses will expire as follows:

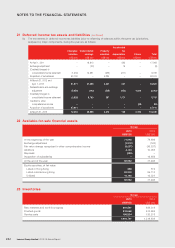

Group

2013 2012

US$’000 US$’000

Expiring in

– 2012 –754

– 2014 13,051 14,525

– 2015 6,423 6,795

– 2016 2,177 2,168

– 2017 35,631 44,067

– 2018 115,722 8,213

– 2019 4,489 4,865

– 2021 11,275 –

– 2022 174,128 –

362,896 81,387