Lenovo 2013 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2013 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2012/13 Annual Report Lenovo Group Limited 125

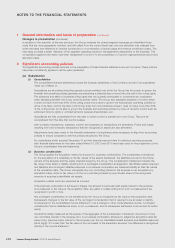

2 Significant accounting policies (continued)

(g) Intangible assets (continued)

(v) Patents, technology and marketing rights

Expenditure on acquired patents, technology and marketing rights is capitalized at historical cost upon acquisition

and amortized using the straight-line method over their estimated useful lives of not more than 5 years.

(h) Impairment of non-financial assets

Assets that have an indefinite useful life or are not yet available for use are not subject to depreciation or amortization

and are tested annually for impairment. Assets that are subject to depreciation or amortization are reviewed for

impairment whenever events or changes in circumstances indicate that the carrying amount may not be recoverable.

An impairment loss is recognized for the amount by which the asset’s carrying amount exceeds its recoverable amount.

The recoverable amount is the higher of an asset’s fair value less costs to sell and value in use. For the purposes of

assessing impairment, assets are grouped at the lowest level for which there are separately identifiable cash flows

(cash-generating units). Non-financial assets other than goodwill that suffered impairment are reviewed for possible

reversal of the impairment at each reporting date.

(i) Financial assets

Classification

The Group classifies its financial assets into: (i) at fair value through profit or loss, (ii) loans and receivables; and (iii)

available-for-sale. The classification depends on the purpose for which the financial assets were acquired. Management

determines the classification of its financial assets at initial recognition.

(i) Financial assets at fair value through profit or loss

Financial assets at fair value through profit or loss are financial assets held for trading, and those designated at

fair value through profit or loss at inception. A financial asset is classified in this category if acquired principally for

the purpose of selling in the short term or if so designated by management. Derivatives are also categorized as

held for trading unless they are designated as hedges (Note 2(k)). Assets in this category are classified as current

assets if expected to be settled within 12 months; otherwise, they are classified as non-current.

(ii) Loans and receivables

Loans and receivables are non-derivative financial assets with fixed or determinable payments that are not quoted

in an active market. They are included in current assets, except for maturities greater than 12 months after the

balance sheet date which are classified as non-current assets. Loans and receivables comprise trade, notes and

other receivables, deposits, bank deposits and cash and cash equivalents in the balance sheet (Note 2(n) and

2(o)).

(iii) Available-for-sale financial assets

Available-for-sale financial assets are non-derivatives that are either designated in this category or not classified

in any of the other categories. They are included in non-current assets unless mature or management intends to

dispose of them within 12 months of the balance sheet date.

Recognition and measurement

Regular way purchases and sales of financial assets are recognized on the trade-date, the date on which the Group

commits to purchase or sell the asset. Financial assets not carried at fair value through profit or loss are initially

recognized at fair value plus transaction costs. Financial assets carried at fair value through profit or loss are initially

recognized at fair value, and transaction costs are expensed in the income statement. Financial assets are derecognized

when the rights to receive cash flows from the investments have expired or have been transferred and the Group has

transferred substantially all risks and rewards of ownership. Available-for-sale financial assets and financial assets at fair

value through profit or loss are subsequently carried at fair value. Loans and receivables are subsequently carried at

amortized cost using the effective interest method.

Gains and losses arising from changes in the fair value of the “Financial assets at fair value through profit or loss”

category are presented in the income statement in the period in which they arise. Dividend income from financial assets

at fair value through profit or loss is recognized in the income statement as part of other income when the Group’s right

to receive payments is established.

Changes in the fair value of monetary and non-monetary securities classified as available-for-sale are recognized as

other comprehensive income/expense.