Lenovo 2013 Annual Report Download - page 160

Download and view the complete annual report

Please find page 160 of the 2013 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO THE FINANCIAL STATEMENTS

Lenovo Group Limited 2012/13 Annual Report

158

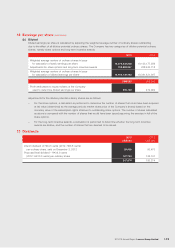

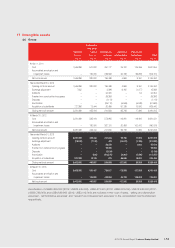

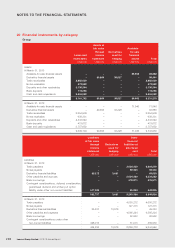

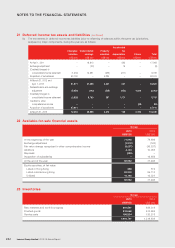

20 Financial instruments by category

Group

Loans and

receivables

Assets at

fair value

through

income

statement

Derivatives

used for

hedging

Available-

for-sale

financial

assets Total

US$’000 US$’000 US$’000 US$’000 US$’000

Assets

At March 31, 2013

Available-for-sale financial assets – – – 69,962 69,962

Derivative financial assets – 60,864 38,627 – 99,491

Trade receivables 2,885,039 – – – 2,885,039

Notes receivable 572,992 – – – 572,992

Deposits and other receivables 2,130,594 – – – 2,130,594

Bank deposits 119,055 – – – 119,055

Cash and cash equivalents 3,454,082 – – – 3,454,082

9,161,762 60,864 38,627 69,962 9,331,215

At March 31, 2012

Available-for-sale financial assets – – – 71,946 71,946

Derivative financial assets – 29,655 33,228 – 62,883

Trade receivables 2,354,909 – – – 2,354,909

Notes receivable 639,331 – – – 639,331

Deposits and other receivables 2,443,540 – – – 2,443,540

Bank deposits 413,672 – – – 413,672

Cash and cash equivalents 3,757,652 – – – 3,757,652

9,609,104 29,655 33,228 71,946 9,743,933

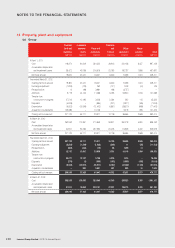

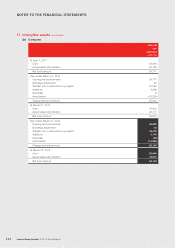

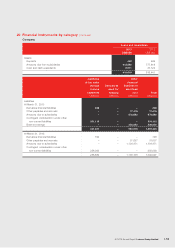

Liabilities

at fair value

through

income

statement

Derivatives

used for

hedging

Other

financial

liabilities at

amortized

cost Total

US$’000 US$’000 US$’000 US$’000

Liabilities

At March 31, 2013

Trade payables – – 3,624,500 3,624,500

Notes payable – – 99,503 99,503

Derivative financial liabilities 65,372 3,681 – 69,053

Other payables and accruals – – 5,034,562 5,034,562

Bank borrowings – – 478,971 478,971

Contingent considerations, deferred consideration,

guaranteed dividend and written put option

liability under other non-current liabilities 517,385 – 25,850 543,235

582,757 3,681 9,263,386 9,849,824

At March 31, 2012

Trade payables – – 4,050,272 4,050,272

Notes payable – – 127,315 127,315

Derivative financial liabilities 35,337 13,916 – 49,253

Other payables and payables – – 4,595,224 4,595,224

Bank borrowings – – 62,952 62,952

Contingent considerations under other

non-current liabilities 428,915 – 31,015 459,930

464,252 13,916 8,866,778 9,344,946