Lenovo 2013 Annual Report Download - page 157

Download and view the complete annual report

Please find page 157 of the 2013 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2012/13 Annual Report Lenovo Group Limited 155

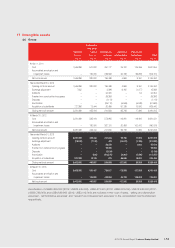

17 Intangible assets (continued)

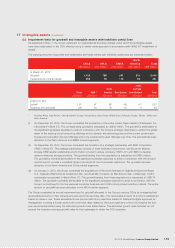

(c) Impairment tests for goodwill and intangible assets with indefinite useful lives

As explained in Note 1, the Group underwent an organizational structure change under which the intangible assets

have been reallocated to the CGU affected using a relative value approach in accordance with HKAS 36 “Impairment of

assets”.

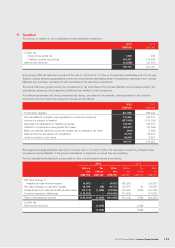

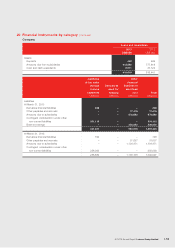

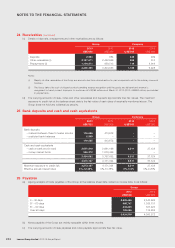

The carrying amounts of goodwill and trademarks and trade names with indefinite useful lives are presented below:

China APLA EMEA

North

America Total

US$ million US$ million US$ million US$ million US$ million

At March 31, 2013

Goodwill 1,123 789 261 231 2,404

Trademarks and trade names 209 79 113 60 461

China REM *

North

America West Europe

Japan,

Australia,

New Zealand Total

US$ million US$ million US$ million US$ million US$ million US$ million

At March 31, 2012

Goodwill 1,101 167 160 242 611 2,281

Trademarks and trade names 209 64 58 110 14 455

* Includes Africa, Asia Pacific, Central/Eastern Europe, Hong Kong, India, Korea, Middle East, Pakistan, Russia, Taiwan, Turkey and

Latin America.

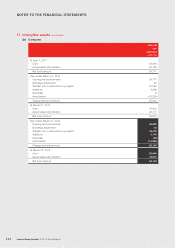

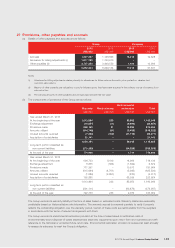

(i) On December 26, 2012, the Group completed the acquisition of the entire issued share capital of Stoneware, Inc.

(“Stoneware”) (Note 37). The corresponding goodwill is calculated at US$36 million. The goodwill is attributable to

the significant synergies expected to arise in connection with the Group’s strategic objectives to extend the global

reach of the existing cloud-computing offerings and to develop this technology beyond the current government-

focused and education-focused offerings into more consumer-focused offerings over time. The goodwill has been

allocated to the North America and EMEA market segments.

(ii) On December 29, 2012, the Group completed the formation of a strategic partnership with EMC Corporation

(“EMC”) (Note 37). The strategic partnership consists of three business components, namely server alliance,

storage OEM/reseller relationship and formation of a joint venture company (“EMC JV”) with EMC to develop

network-attached storage products. The goodwill arising from this acquisition is calculated at US$52 million.

The goodwill is primarily attributable to the significant synergies expected to arise in connection with the Group’s

commitment to provide a complete range of products for the commercial customers. The goodwill has been

allocated to the North America and China market segments.

(iii) On January 2, 2013, the Group completed the acquisitions of the entire interests in Digibrás Indústria do Brasil

S.A., Digiboard Eletrônica da Amazônia Ltda., and Dual Mix Comércio de Eletrônicos Ltda., (collectively “CCE”),

companies incorporated in Brazil (Note 37). The goodwill arising from these acquisitions is calculated at US$114

million. The goodwill is primarily attributable to the significant synergies expected to arise in connection with the

Group’s commitment to its core personal computer business and CCE’s strong market position in Brazil. The entire

amount of goodwill has been allocated to the APLA market segment.

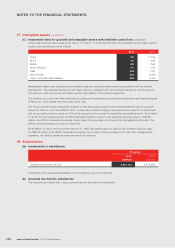

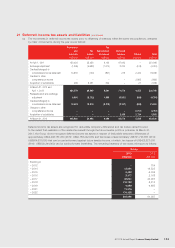

The Group completed its annual impairment test for goodwill allocated to the Group’s various CGUs by comparing their

recoverable amounts to their carrying amounts as at the reporting date. The recoverable amount of a CGU is determined

based on value in use. These assessments use pre-tax cash flow projections based on financial budgets approved by

management covering a 5-year period with a terminal value related to the future cash flow of the CGU beyond the five-

year period extrapolated using the estimated growth rates stated below. The estimated growth rates adopted do not

exceed the long-term average growth rates for the businesses in which the CGU operates.