Lenovo 2013 Annual Report Download - page 177

Download and view the complete annual report

Please find page 177 of the 2013 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2012/13 Annual Report Lenovo Group Limited 175

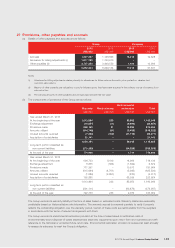

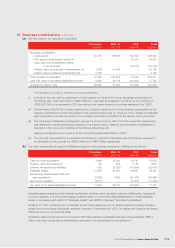

36 Retirement benefit obligations

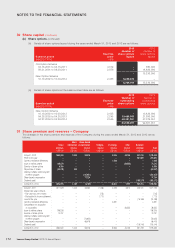

Group

2013 2012

US$’000 US$’000

Pension obligation included in non-current liabilities

Pension benefits 149,219 191,413

Post-employment medical benefits 14,664 13,405

163,883 204,818

Expensed in income statement

Pension benefits (Note 10) 22,601 18,350

Post-employment medical benefits 1,055 1,333

23,656 19,683

Net actuarial loss recognized as a component of

other comprehensive income for the year 17,174 37,537

Cumulative actuarial losses recognized as a component of

other comprehensive income 65,716 48,542

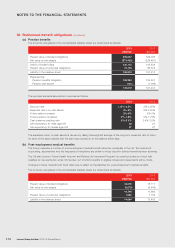

On the acquisition of the personal computer business of IBM, the Group assumed a cash balance pension liability for

substantially all former IBM employees in Japan, and final salary defined benefit obligations for selected employees in other

countries.

In the United States, the Group operates a final-salary pension plan that covers approximately 20% of all employees. These

were former participants in the IBM US pension plan. In addition, the Group operates a supplemental defined benefit plan that

covers certain executives transferred from IBM and is intended to provide benefits in excess of certain US tax and labor law

limits that apply to the pension plan. Both plans are frozen to new participation. However, benefits continue to accrue.

In Germany, the Group operates a sectionalized plan that has both defined contribution and defined benefit features, including

benefits based on a final pay formula. This plan is closed to new entrants.

On the business combinations of NEC personal computer division and Medion, the Group assumed the cash balance

pension liability and end-of-employment benefit obligation for all employees from the then NEC personal computer division

and pension commitment for the two Medion’s management board members. Each Medion’s management board member is

entitled to a lifelong pension upon leaving Medion after turning 60 or due to prolonged disability and consequently termination

of the employment relationship with Medion. The pension liability in Medion is unfunded.

The Group’s major plans are valued by qualified actuaries annually using the projected unit credit method.

Actuarial gains and losses arising from experience adjustments and changes in actuarial assumptions are charged or credited

to other comprehensive income in the period they arise.