Lenovo 2013 Annual Report Download - page 166

Download and view the complete annual report

Please find page 166 of the 2013 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO THE FINANCIAL STATEMENTS

Lenovo Group Limited 2012/13 Annual Report

164

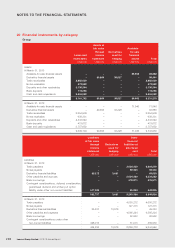

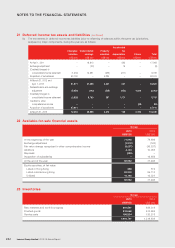

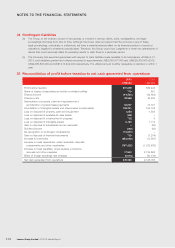

24 Receivables (continued)

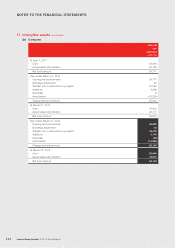

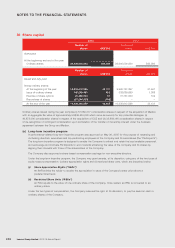

(c) Details of deposits, prepayments and other receivables are as follows:

Group Company

2013 2012 2013 2012

US$’000 US$’000 US$’000 US$’000

Deposits 2,923 884 448 499

Other receivables (i) 2,127,671 2,442,656 555 513

Prepayments (ii) 1,104,871 859,513 719 4,916

3,235,465 3,303,053 1,722 5,928

Notes:

(i) Majority of other receivables of the Group are amounts due from subcontractors for part components sold in the ordinary course of

business.

(ii) The Group defers the cost of shipped products awaiting revenue recognition until the goods are delivered and revenue is

recognized. In-transit product shipments to customers of US$180 million as at March 31, 2013 (2012: US$392 million) are included

in prepayments.

(d) The carrying amounts of trade, notes and other receivables and deposits approximate their fair values. The maximum

exposure to credit risk at the balance sheet date is the fair value of each class of receivable mentioned above. The

Group does not hold any collateral as security.

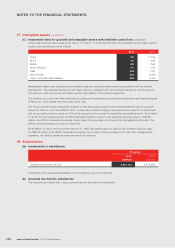

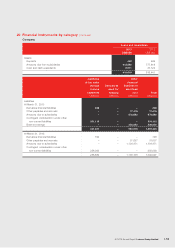

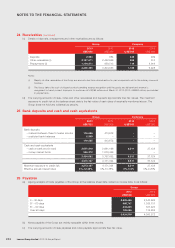

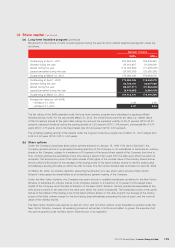

25 Bank deposits and cash and cash equivalents

Group Company

2013 2012 2013 2012

US$’000 US$’000 US$’000 US$’000

Bank deposits

– matured between three to twelve months 116,696 413,672 ––

– restricted bank balances 2,359 –––

119,055 413,672 ––

Cash and cash equivalents

– cash at bank and in hand 2,607,810 2,681,196 6,511 37,124

– money market funds 846,272 1,076,456 ––

3,454,082 3,757,652 6,511 37,124

3,573,137 4,171,324 6,511 37,124

Maximum exposure to credit risk 3,573,137 4,171,324 6,511 37,124

Effective annual interest rates 0%-12.42% 0%-10.78% 0%-0.6% 0%-0.25%

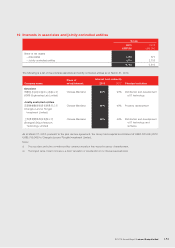

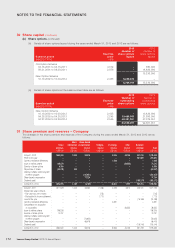

26 Payables

(a) Ageing analysis of trade payables of the Group at the balance sheet date, based on invoice date, is as follows:

Group

2013 2012

US$’000 US$’000

0 – 30 days 2,526,465 2,543,626

31 – 60 days 566,747 1,025,131

61 – 90 days 332,223 307,223

Over 90 days 199,065 174,292

3,624,500 4,050,272

(b) Notes payable of the Group are mainly repayable within three months.

(c) The carrying amounts of trade payables and notes payable approximate their fair value.