Lenovo 2013 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2013 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2012/13 Annual Report Lenovo Group Limited 25

PIO

NE

ER

PIO

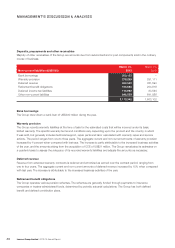

Further analyses of income and expense by function for the year ended March 31, 2013 are set out below:

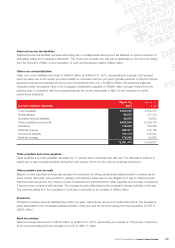

Other income – net

This mainly represents the gain arising from the de-recognition of contingent consideration during the year. In October

2012, the Group completed the transfer of ownership interest under the business combination agreement with Medion.

Details are set out in Note 29(i) to the financial statements.

Selling and distribution expenses

Selling and distribution expenses for the year increased by 12 percent as compared to last year. This is principally

attributable to a US$39 million increase in promotional, branding and marketing activities and the increase in employee

benefit costs.

Administrative expenses

Administrative expenses for the year increased by 16 percent as compared to last year. This is mainly attributable to the

increase in employee benefit costs and a US$23 million increase in depreciation and amortization expenses.

Research and development expenses

Research and development spending for the year increased by 38 percent as compared to last year. The major part of the

increase is attributable to the increase in employee benefit costs, and an increase in R&D supplies & laboratory expenses

of US$32 million.

Other operating income – net

The net other operating income for the year comprises incentives and grants received of US$115 million, netted with

US$38 million net exchange loss; and other miscellaneous expenses.

The net other operating income in last year comprises incentives and grants received of US$30 million, net exchange gain

of US$5 million and other miscellaneous income, and is offset by a one-off license fee of US$35 million.

2013 2012

For the year ended March 31 US$’000 US$’000

Depreciation of property, plant and equipment and

amortization of prepaid lease payments 92,097 77,721

Amortization of intangible assets 117,507 97,684

Employee benefit costs, including 2,359,593 1,938,256

– long-term incentive awards 77,724 66,418

Rental expenses under operating leases 77,530 63,252