Lenovo 2013 Annual Report Download - page 181

Download and view the complete annual report

Please find page 181 of the 2013 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2012/13 Annual Report Lenovo Group Limited 179

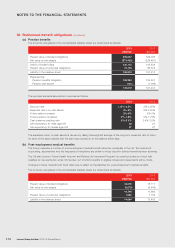

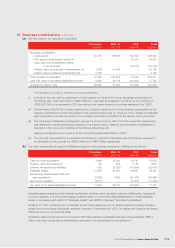

37 Business combinations (continued)

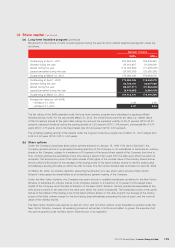

(a) Set forth below is the calculation of goodwill*:

Stoneware EMC JV CCE Total

US$’000 US$’000 US$’000 US$’000

Purchase consideration

– Cash paid (i) 43,756 58,813 102,493 205,062

– Fair value of consideration shares (ii) – – 43,331 43,331

– Less: cash and consideration shares

to be recovered – – (74,318) (74,318)

– Present value of contingent considerations (iii) 1,238 41,550 – 42,788

– Present value of deferred consideration (iii) 2,148 – – 2,148

Total purchase consideration 47,142 100,363 71,506 219,011

Less: Fair value of net assets/(liabilities) acquired 11,589 48,716 (42,563) 17,742

Goodwill (iv), (Note 17(c)) 35,553 51,647 114,069 201,269

* The calculations of goodwill for Stoneware and CCE are preliminary.

(i) Included in the cash paid is a settlement of notes payable on behalf of the former Stoneware shareholders on

the closing date, which amounted to US$13,886,000. Cash paid for acquisition of CCE is net of an amount of

US$30,987,000 to be recovered in 2013 according to the relevant sales and purchase agreement (the “SPA”).

(ii) The fair value of 46,875,000 ordinary shares of the Company issued as part of the purchase consideration for the

business combinations of CCE were based on the published share price on January 2, 2013. Shares consideration

paid is expected to be fully recovered by the Company according to the SPA and the relevant closing document.

(iii) The contingent consideration arrangement requires the Group to pay in cash to the then respective shareholders

with reference to certain performance indicators. The present value of deferred and contingent considerations is

included in other non-current liabilities in the balance sheet (Note 29).

Deferred consideration will be paid to certain former Stoneware shareholders in 2016.

(iv) The amounts of goodwill from the business combinations in respect of Stoneware and CCE that are expected to

be deductible for tax purpose are US$25 million and US$97 million respectively.

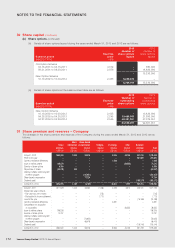

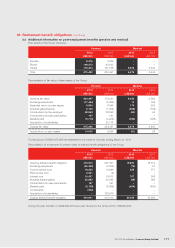

(b) The major components of assets and liabilities arising from the business combination activities are as follows:

Stoneware EMC JV CCE Total

US$’000 US$’000 US$’000 US$’000

Cash and cash equivalents 2,896 10,000 24,127 37,023

Property, plant and equipment 42 425 7,178 7,645

Deferred tax assets less liabilities 592 (6,022) (16,589) (22,019)

Intangible assets 13,000 36,500 49,667 99,167

Net working capital except cash and

cash equivalents (2,926) 7,813 (91,473) (86,586)

Non-current liabilities (2,015) – (15,473) (17,488)

Fair value of net assets/(liabilities) acquired 11,589 48,716 (42,563) 17,742

Intangible assets arising from the business combination activities mainly represent customer relationships, trademarks

and brand licenses. The Group has engaged external valuers to perform fair value assessments on these intangible

assets in accordance with HKAS 38 “Intangible Assets” and HKFRS 3 (Revised) “Business Combinations”.

At March 31, 2013, the Group has not finalized the fair value assessment for net assets acquired (including intangible

assets) from the business combination activities in respect of Stoneware and CCE. The relevant fair values of net assets

stated above are on a provisional basis.

Acquisition-related costs incurred in connection with these business combination activities of approximately US$5.7

million have been recognized as administrative expenses in the consolidated income statement.