Lenovo 2013 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2013 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2012/13 Annual Report Lenovo Group Limited 29

PIO

NE

ER

PIO

Deferred income tax liabilities

Deferred income tax liabilities comprise withholding tax on undistributed earnings and tax liabilities on upward valuation of

intangibles arising from business combination. The 36 percent increase over last year is attributable to the amounts arising

from the formation of EMC JV and acquisition of CCE and Stoneware totalling US$28 million.

Other non-current liabilities

Other non-current liabilities amounted to US$847 million as at March 31, 2013, representing an increase of 32 percent,

which is mainly due to the written put option liability in connection with the put option granted pursuant to the joint venture

agreement entered into between the Group and Compal Electronics, Inc. of US$215 million. The remaining balances

comprise mainly the present value of the contingent consideration payable of US$260 million brought forward from the

previous year in connection with the arrangements with the former shareholder of NEC JV with reference to certain

performance indicators.

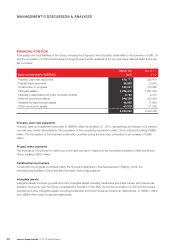

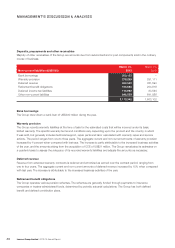

Current liabilities (US$’000)

March 31,

2013

March 31,

2012

Trade payables 3,624,500 4,050,272

Notes payable 99,503 127,315

Derivative financial liabilities 69,053 49,253

Other payables and accruals 6,852,344 6,349,134

Provisions 776,640 725,062

Deferred revenue 393,417 310,159

Income tax payable 100,179 135,530

Bank borrowings 175,838 62,952

12,091,474 11,809,677

Trade payables and notes payables

Trade payables and notes payables decreased by 11 percent when compared with last year. The decrease in balance is

mainly due to less purchase activities during the fourth quarter, which is in line with the business projections.

Other payables and accruals

Majority of other payables and accruals represent the allowance for billing adjustments relates primarily to allowances for

future volume discounts, price protection, rebates, and customer sales returns and obligations to pay for finished goods

that have been acquired in the ordinary course of business from subcontractors. Other payables and accruals increased by

8 percent when compared with last year. The increase is partly attributable to the increased business activities of the year.

The amounts arising from the acquisition of CCE also contributed to an increase of US$50 million.

Provisions

Provisions comprise warranty liabilities (due within one year), restructuring and environmental restorations. The increase is

partly attributable to the increased business activities of the year, and the amounts arising from the acquisition of CCE of

US$21 million.

Bank borrowings

Bank borrowings amounted to US$176 million as at March 31, 2013, representing an increase of 179 percent, mainly due

to the amounts arising from the acquisition of CCE of US$111 million.