Lenovo 2013 Annual Report Download - page 146

Download and view the complete annual report

Please find page 146 of the 2013 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188

|

|

NOTES TO THE FINANCIAL STATEMENTS

Lenovo Group Limited 2012/13 Annual Report

144

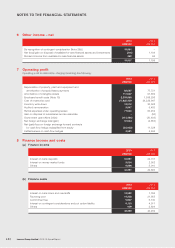

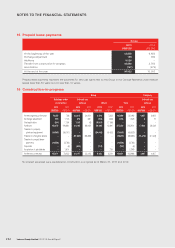

6 Other income – net

2013 2012

US$’000 US$’000

De-recognition of contingent consideration (Note 29(i)) 19,861 –

Net (loss)/gain on disposal of available-for-sale financial assets and investments (316) 1,104

Dividend income from available-for-sale financial assets 362 95

19,907 1,199

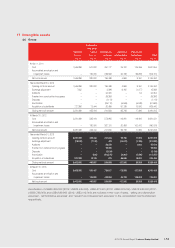

7 Operating profit

Operating profit is stated after charging/(crediting) the following:

2013 2012

US$’000 US$’000

Depreciation of property, plant and equipment and

amortization of prepaid lease payments 92,097 77,721

Amortization of intangible assets 117,507 97,684

Employee benefit costs (Note 10) 2,359,593 1,938,256

Cost of inventories sold 27,825,429 24,229,947

Inventory write-down 13,012 30,588

Auditor’s remuneration 5,567 5,483

Rental expenses under operating leases 77,530 63,252

Gain on disposal of subsidiaries and an associate –(50)

Government grant (Note 29(iv)) (115,366) (30,493)

Net foreign exchange loss/(gain) 37,634 (4,653)

Net (gain)/loss on foreign exchange forward contracts

for cash flow hedge reclassified from equity (20,953) 11,338

Ineffectiveness on cash flow hedges 3,581 4,495

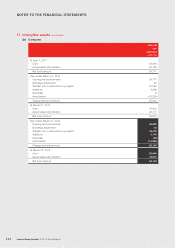

8 Finance income and costs

(a) Finance income

2013 2012

US$’000 US$’000

Interest on bank deposits 34,981 34,731

Interest on money market funds 3,004 2,952

Others 6,896 5,010

44,881 42,693

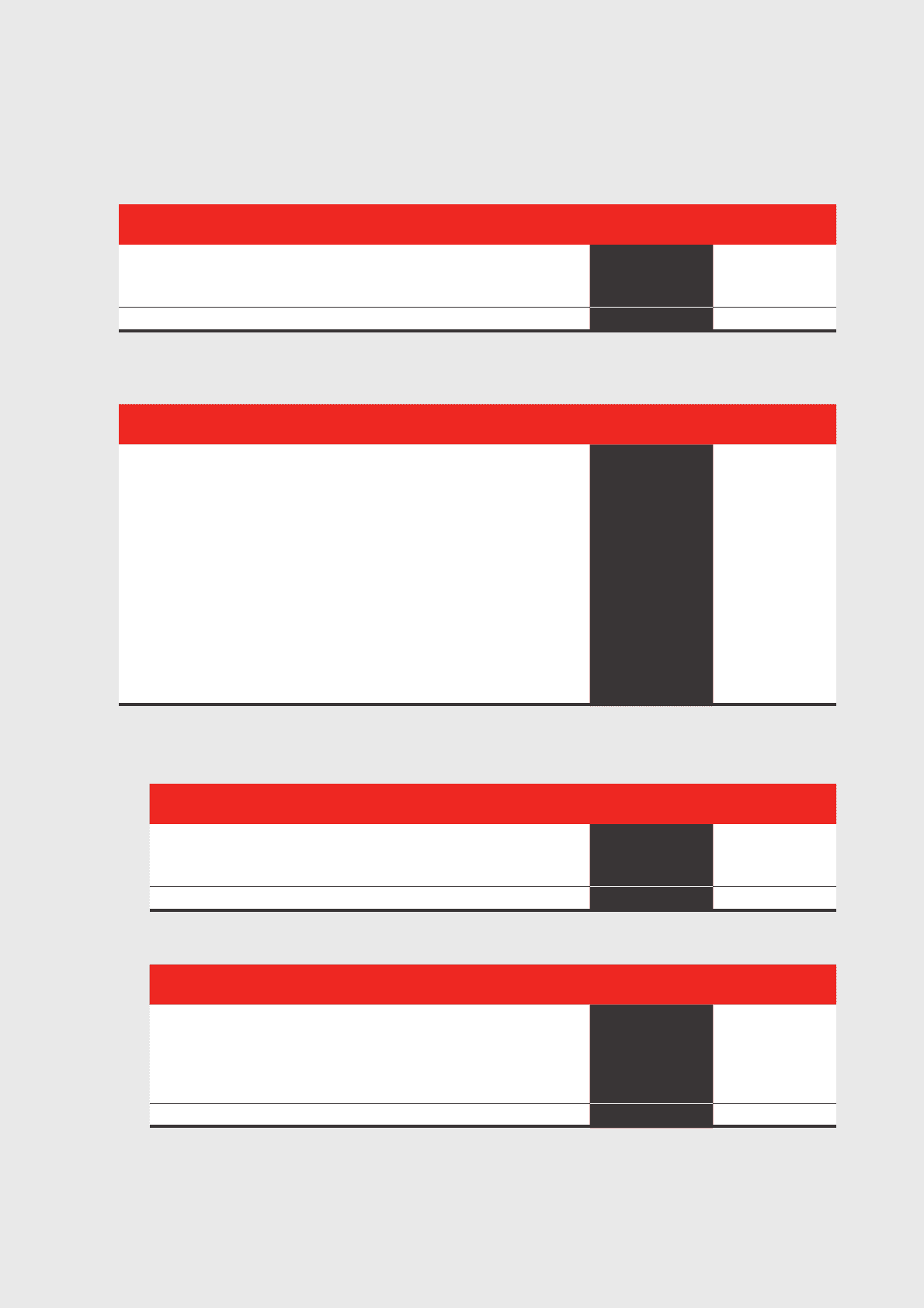

(b) Finance costs

2013 2012

US$’000 US$’000

Interest on bank loans and overdrafts 12,592 7,794

Factoring cost 14,358 21,955

Commitment fee 5,907 6,130

Interest on contingent considerations and put option liability 9,103 4,911

Others 909 2,694

42,869 43,484