Lenovo 2010 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2010 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2009/10 Annual Report Lenovo Group Limited

97

2009/10 Annual Report Lenovo Group Limited

97

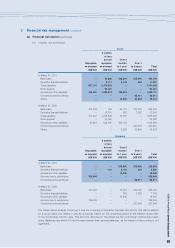

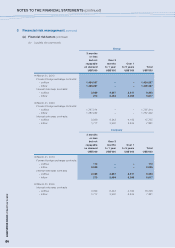

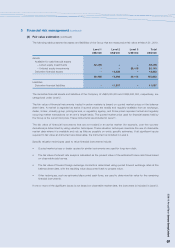

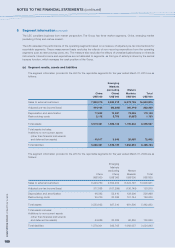

3 Financial risk management (continued)

(d) Fair value estimation (continued)

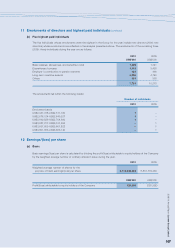

The following table presents the assets and liabilities of the Group that are measured at fair value at March 31, 2010.

Level 1 Level 2 Level 3 Total

US$’000 US$’000 US$’000 US$’000

Assets

Available-for-sale financial assets

– Listed equity investments 92,405 – – 92,405

– Unlisted equity investments – – 20,115 20,115

Derivative financial assets – 13,283 – 13,283

92,405 13,283 20,115 125,803

Liabilities

Derivative financial liabilities – 11,507 – 11,507

The derivative financial assets and liabilities of the Company of US$2,025,000 and US$3,500,000, respectively, are

categorized under Level 2.

The fair value of financial instruments traded in active markets is based on quoted market prices at the balance

sheet date. A market is regarded as active if quoted prices are readily and regularly available from an exchange,

dealer, broker, industry group, pricing service, or regulatory agency, and those prices represent actual and regularly

occurring market transactions on an arm’s length basis. The quoted market price used for financial assets held by

the Group is the current bid price. These instruments are included in Level 1.

The fair value of financial instruments that are not traded in an active market (for example, over-the-counter

derivatives) is determined by using valuation techniques. These valuation techniques maximize the use of observable

market data where it is available and rely as little as possible on entity specific estimates. If all significant inputs

required to fair value an instrument are observable, the instrument is included in Level 2.

Specific valuation techniques used to value financial instruments include:

• Quoted market prices or dealer quotes for similar instruments are used for long-term debt.

• The fair value of interest rate swaps is calculated as the present value of the estimated future cash flows based

on observable yield curves.

• The fair value of forward foreign exchange contracts is determined using quoted forward exchange rates at the

balance sheet date, with the resulting value discounted back to present value.

• Other techniques, such as estimated discounted cash flows, are used to determine fair value for the remaining

financial instruments.

If one or more of the significant inputs is not based on observable market data, the instrument is included in Level 3.