Lenovo 2010 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2010 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2009/10 Annual Report Lenovo Group Limited

41

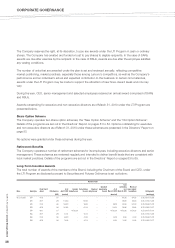

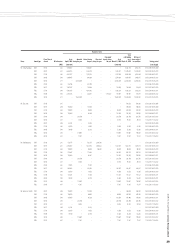

Number of units

Name Award type

Fiscal Year of

Award Effective price

As at

April 1, 2009

Awarded

during the year

Vested during

the year

Exercised

during the year

Cancelled/

lapsed during

the year

As at

March 31, 2010

Total

outstanding

as at

March 31, 2010

Max no. of

shares subject

to conditions Vesting period

(HK$) (unvested) (unvested) (mm.dd.yyyy)

Dr. Tian Suning SAR 07/08 5.14 101,300 – 50,650 – – 50,650 151,950 151,950 09.01.2008-09.01.2010

SAR 08/09 5.88 195,980 – 65,326 – – 130,654 195,980 195,980 06.01.2009-06.01.2011

SAR 09/10 3.88 – 263,796 – – – 263,796 263,796 263,796 08.07.2010-08.07.2012

SAR 09/10 4.47 – 38,163 – – – 38,163 38,163 38,163 11.30.2010-11.30.2012

RSU 07/08 5.14 33,767 – 16,883 – – 16,884 16,884 16,884 09.01.2008-09.01.2010

RSU 08/09 5.88 78,390 – 26,130 – – 52,260 52,260 52,260 06.01.2009-06.01.2011

RSU 09/10 3.88 – 119,907 – – – 119,907 119,907 119,907 08.07.2010-08.07.2012

RSU 09/10 4.47 – 17,347 – – – 17,347 17,347 17,347 11.30.2010-11.30.2012

Mr. Nicholas C. Allen SAR 09/10 4.47 – 107,343 – – – 107,343 107,343 107,343 11.30.2010–11.30.2012

RSU 09/10 4.47 – 48,792 – – – 48,792 48,792 48,792 11.30.2010–11.30.2012

Note 1: Proceeds in respect of quarterly deferral grants to be paid only at point of termination from the board of directors or unforeseen emergency.

Note 2: Dividends paid with respect to eligible deferral grants.

EXTERNAL AUDITOR

The Group’s external auditor is PricewaterhouseCoopers (“PwC”), who is remunerated mainly for its audit services

provided to the Group. The Company has adopted a policy on engagement of external auditor for non-audit

services, under which the external auditor is required to comply with the independence requirements under Code

of Ethics for Professional Accountants issued by Hong Kong Institute of Certified Public Accountants. External

auditor may provide certain non-audit services to the Group given that these do not involve any management

or decision making functions for and on behalf of the Group; or perform any self assessments; or acting in an

advocacy role for the Company. The engagement of the external auditor for permitted and approved non-audit

services shall be approved by the Audit Committee if the value of such non-audit services equals to or above

US$320,000.

During the year, PwC provided audit and insignificant non-audit services to the Group.

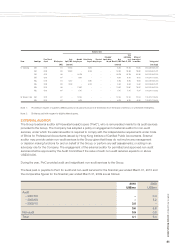

The fees paid or payable to PwC for audit and non-audit services for the financial year ended March 31, 2010 and

the comparative figures for the financial year ended March 31, 2009 are as follows:

2010 2009

US$mn US$mn

Audit

– 2007/08 – 0.4

– 2008/09 – 5.2

– 2009/10 3.6 –

3.6 5.6

Non-audit 0.5 0.8

Total 4.1 6.4