Lenovo 2010 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2010 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2009/10 Annual Report Lenovo Group Limited

78

NOTES TO THE FINANCIAL STATEMENTS (continued)

2009/10 Annual Report Lenovo Group Limited

78

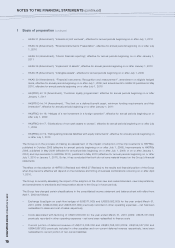

1 Basis of preparation (continued)

– HKAS 31 (Amendment), “Interests in joint ventures”, effective for annual periods beginning on or after July 1, 2010

– HKAS 32 (Amendment), “Financial instruments: Presentation”, effective for annual periods beginning on or after July

1, 2010

– HKAS 34 (Amendment), “Interim financial reporting”, effective for annual periods beginning on or after January 1,

2011

– HKAS 36 (Amendment), “Impairment of assets”, effective for annual periods beginning on or after January 1, 2010

– HKAS 38 (Amendment), “Intangible assets”, effective for annual periods beginning on or after July 1, 2009

– HKAS 39 (Amendment), “Financial instruments: Recognition and measurement”, amendment on eligible hedged

items, effective for annual periods beginning on or after July 1, 2009; and amendments to HKAS 39 published in May

2010, effective for annual periods beginning on or after July 1, 2010

– HK(IFRIC)-Int 13 (Amendment), “Customer loyalty programmes”, effective for annual periods beginning on or after

January 1, 2011

– HK(IFRIC)-Int 14 (Amendment), “The limit on a defined benefit asset, minimum funding requirements and their

interaction”, effective for annual periods beginning on or after January 1, 2011

– HK(IFRIC)-Int 16, “Hedges of a net investment in a foreign operation”, effective for annual periods beginning on or

after July 1, 2009

– HK(IFRIC)-Int 17, “Distributions of non-cash assets to owners”, effective for annual periods beginning on or after July

1, 2009

– HK(IFRIC)-Int 19, “Extinguishing financial liabilities with equity instruments”, effective for annual periods beginning on

or after July 1, 2010

The Group is in the process of making an assessment of the impact of adoption of the Improvements to HKFRSs,

published in October 2008 (effective for annual periods beginning on or after July 1, 2009), Improvements to HKFRSs

2009, published in May 2009 (effective for annual periods beginning on or after July 1, 2009, or on or after January 1,

2010) and improvements to HKFRSs 2010, published in May 2010 (effective for annual periods beginning on or after

July 1, 2010 or January 1, 2011). So far, it has concluded that both do not have material impact on the Group’s financial

statements.

The effect on the adoption of HKFRS 3 (Revised) and HKAS 27 (Revised) to the results and financial position of the Group

when they become effective will depend on the incidence and timing of business combinations occurring on or after April

1, 2010.

The Group is currently assessing the impact of the adoption of the other new and revised standard, new interpretations,

and amendments to standards and interpretation above to the Group in future periods.

The Group has changed certain classifications in the consolidated income statement and balance sheet with effect from

April 1, 2009 as follows:

– Exchange (loss)/gain on cash flow hedges of (US$371,000) and (US$59,592,000) for the year ended March 31,

2010 (2009: (US$420,000) and US$56,007,000) previously recorded in other operating expenses – net has been

reclassified to sales and cost of sales respectively

– Costs associated with factoring of US$10,600,000 for the year ended March 31, 2010 (2009: US$18,331,000)

previously recorded in other operating expenses – net have been reclassified to finance costs

– Current portion of deferred revenue of US$113,038,000 and US$83,768,000 (2009: US$156,527,000 and

US$46,987,000) previously included in other payables and non-current deferred revenue respectively, have been

reclassified to current portion of non-current liabilities