Lenovo 2010 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2010 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2009/10 Annual Report Lenovo Group Limited

79

2009/10 Annual Report Lenovo Group Limited

79

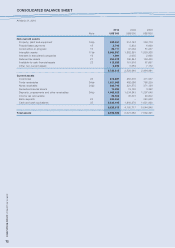

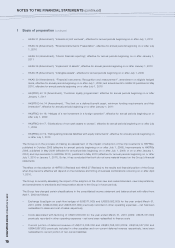

1 Basis of preparation (continued)

– Future billing adjustments of US$374,586,000 at March 31, 2010 (2009: US$313,364,000) previously netted with

trade and notes receivables have been reclassified to other payables

– Amounts receivable from and payable to subcontracting vendors of US$1,043,498,000 and US$959,082,000 (2009:

US$421,017,000 and US$355,996,000) previously included in trade receivables and trade payables have been

reclassified to other receivables and other payables respectively

Management considered the current classifications are more appropriate and consistent with industry practice.

Comparative information has been reclassified to conform to the current period’s presentation.

A consolidated balance sheet as at March 31, 2008 with balances reclassified mentioned above is presented for

reference.

2 Significant accounting policies

The significant accounting policies adopted in the preparation of these financial statements are set out below:

(a) Basis of consolidation

(i) The consolidated financial statements include the financial statements of the Company and all of its subsidiaries

made up to March 31.

Subsidiaries are all entities (including special purpose entities) over which the Group has the power to govern

the financial and operating policies generally accompanying a shareholding of more than one half of the voting

rights. The existence and effect of potential voting rights that are currently exercisable or convertible are

considered when assessing whether the Group controls another entity.

Subsidiaries are fully consolidated from the date on which control is transferred to the Group. They are de-

consolidated from the date that control ceases.

The purchase method of accounting is used to account for the acquisition of subsidiaries by the Group. The

cost of an acquisition is measured as the fair value of the assets given, equity instruments issued and liabilities

incurred or assumed at the date of exchange, plus costs directly attributable to the acquisition. Identifiable

assets acquired and liabilities and contingent liabilities assumed in a business combination are measured

initially at their fair values at the acquisition date, irrespective of the extent of any minority interest. The excess

of the cost of acquisition over the fair value of the Group’s share of the identifiable net assets acquired is

recorded as goodwill (Note 2(f)(i)). If the cost of acquisition is less than the fair value of the net assets of the

subsidiary acquired, the difference is recognized directly in the income statement.

Accounting policies of subsidiaries have been changed where necessary to ensure consistency with the policies

adopted by the Group.

(ii) Inter-company transactions, balances and unrealized gains on transactions between group companies are

eliminated. Unrealized losses are also eliminated unless the transaction provides evidence of an impairment of

the asset transferred.

(iii) In the Company’s balance sheet, the investments in subsidiaries are stated at cost less provision for impairment

losses. The results of subsidiaries are accounted for by the Company on the basis of dividends received and

receivable.

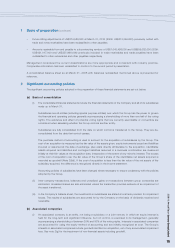

(b) Associated companies

(i) An associated company is an entity, not being a subsidiary or a joint venture, in which an equity interest is

held for the long-term and significant influence, but not control, is exercised in its management, generally

accompanying a shareholding of between 20% and 50% of the voting rights. Interests in associated companies

are accounted for using the equity method of accounting and are initially recognized at cost. The Group’s

interests in associated companies include goodwill identified on acquisition, net of any accumulated impairment

loss. See note 2(g) for the impairment of non-financial assets including goodwill.