Lenovo 2010 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2010 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2009/10 Annual Report Lenovo Group Limited

127127

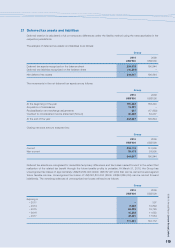

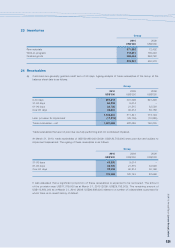

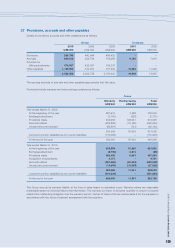

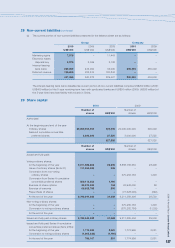

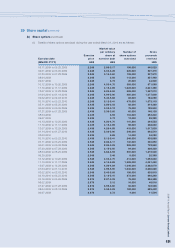

28 Non-current liabilities (continued)

(c) The current portion of non-current liabilities presented in the balance sheet are as follows:

Group Company

2010 2009 2008 2010 2009

US$’000 US$’000 US$’000 US$’000 US$’000

Marketing rights 7,575 – 11,443 – –

Electronic waste

disposal levy 2,975 2,359 2,138 – –

Interest-bearing

bank loans 230,000 435,000 35,000 230,000 435,000

Deferred revenue 196,806 203,514 180,846 – –

437,356 640,873 229,427 230,000 435,000

The interest-bearing bank loans classified as current portion of non-current liabilities comprise US$200 million (2009:

US$400 million) of the 5-year revolving term loan with syndicated banks and US$30 million (2009: US$35 million) of

the 5-year fixed rate loan facility with a bank in China.

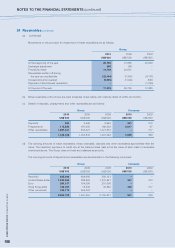

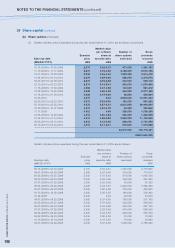

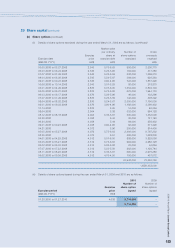

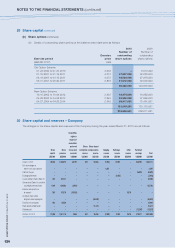

29 Share capital

2010

2009

Number of Number of

shares HK$’000 shares HK$’000

Authorized:

At the beginning and end of the year

Ordinary shares 20,000,000,000 500,000 20,000,000,000 500,000

Series A cumulative convertible

preferred shares 3,000,000 27,525 3,000,000 27,525

527,525 527,525

Number of Number of

shares US$’000 shares US$’000

Issued and fully paid:

Voting ordinary shares:

At the beginning of the year 9,211,389,406 29,530 8,888,786,650 28,496

Issue of ordinary shares (Note 37) 111,668,936 359 – –

Conversion from non-voting

ordinary shares – – 375,282,756 1,203

Conversion from Series A cumulative

convertible preferred shares 369,112,652 1,190 – –

Exercise of share options 32,370,500 104 24,948,000 80

Exercise of warrants 63,502,788 205 – –

Repurchase of shares – – (77,628,000) (249)

At the end of the year 9,788,044,282 31,388 9,211,389,406 29,530

Non-voting ordinary shares:

At the beginning of the year – – 375,282,756 1,203

Conversion to voting ordinary shares – – (375,282,756) (1,203)

At the end of the year – – – –

Issued and fully paid ordinary shares 9,788,044,282 31,388 9,211,389,406 29,530

Issued and fully paid Series A cumulative

convertible preferred shares (Note 28(b)):

At the beginning of the year 1,774,999 2,081 1,774,999 2,081

Conversion to voting ordinary shares (1,005,832) (1,190) – –

At the end of the year 769,167 891 1,774,999 2,081