Lenovo 2010 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2010 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2009/10 Annual Report Lenovo Group Limited

128

NOTES TO THE FINANCIAL STATEMENTS (continued)

128

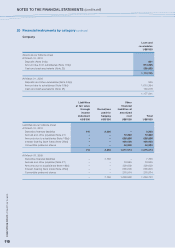

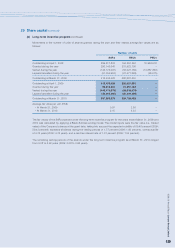

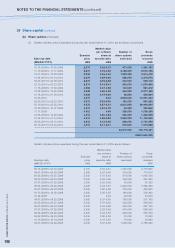

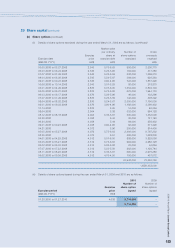

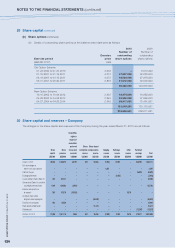

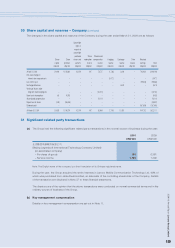

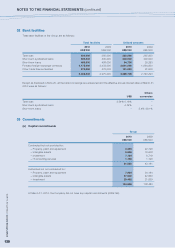

29 Share capital (continued)

(a) Long-term incentive program

A performance-related long-term incentive program was approved on May 26, 2005 for the purpose of rewarding

and motivating directors, executives and top-performing employees of the Company and its subsidiaries (the

“Participants”). The long-term incentive program is designed to enable the Company to attract and retain the best

available personnel, and encourage and motivate Participants to work towards enhancing the value of the Company

and its shares by aligning their interests with those of the shareholders of the Company.

The Company also approved a share-based compensation package for non-executive directors.

Under the long-term incentive program, the Company may grant awards, at its discretion, using any of the three

types of equity-based compensation: (i) share appreciation rights, (ii) restricted share units and (iii) performance

share units, which are described below:

(i) Share Appreciation Rights (“SARs”)

An SAR entitles the holder to receive the appreciation in value of the Company’s share price above a

predetermined level.

(ii) Restricted Share Units (“RSUs”)

An RSU is equal to the value of one ordinary share of the Company. Once vested, an RSU is converted to an

ordinary share.

(iii) Performance Share Units (“PSUs”)

Each PSU is assigned a value equal to a number of the Company’s shares based on the Company’s

performance against specified targets over a three-year period. The equivalent number of shares for each PSU

can range from 0 to 2, depending on the Company’s performance.

The PSU plan was discontinued in 2006; however, the Company continues to honor grants previously awarded.

All outstanding awards vested completely on May 1, 2008.

Under all three types of compensation, the Company reserves the right, at its discretion, to pay the award in cash or

ordinary shares of the Company.