Lenovo 2010 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2010 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2009/10 Annual Report Lenovo Group Limited

100

NOTES TO THE FINANCIAL STATEMENTS (continued)

100

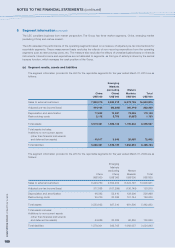

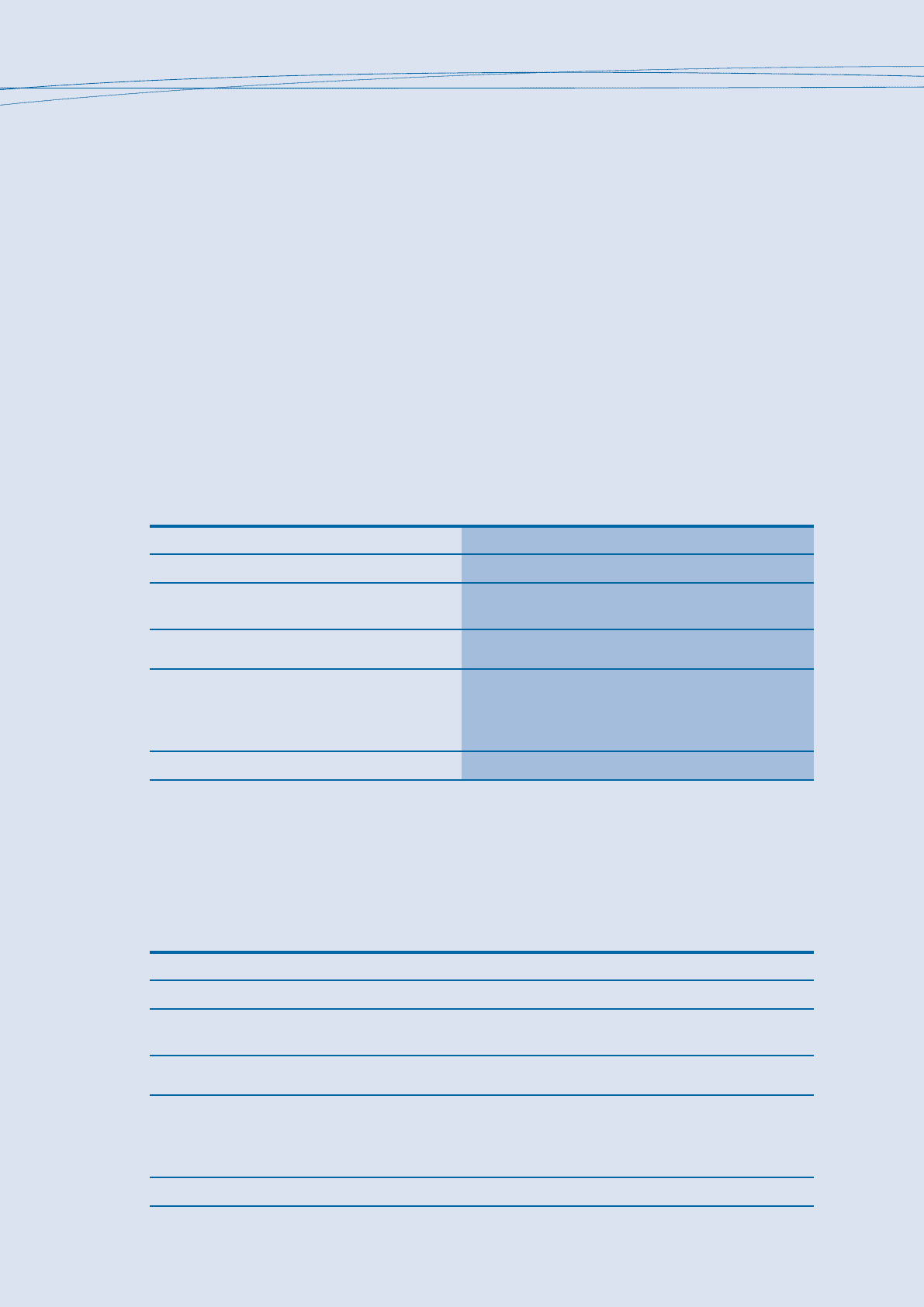

5 Segment information (continued)

The LEC considers business from market perspective. The Group has three market segments, China, emerging market

(excluding China) and mature market.

The LEC assesses the performance of the operating segments based on a measure of adjusted pre-tax income/(loss) for

reportable segments. These measurement basis excludes the effects of non-recurring expenditure from the operating

segments such as restructuring costs, etc. The measure also excludes the effects of unrealized gains/losses on financial

instruments. Interest income and expenditure are not allocated to segments, as this type of activity is driven by the central

treasury function, which manages the cash position of the Group.

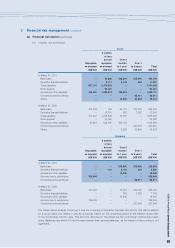

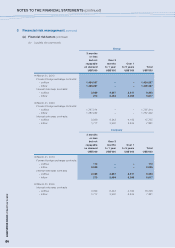

(a) Segment results, assets and liabilities

The segment information provided to the LEC for the reportable segments for the year ended March 31, 2010 are as

follows:

Emerging

Markets

(excluding Mature

China China) Markets Total

US$’000 US$’000 US$’000 US$’000

Sales to external customers 7,892,275 2,639,812 6,072,728 16,604,815

Adjusted pre-tax income/(loss) 444,164 (96,625) (65,119) 282,420

Depreciation and amortization 77,833 19,297 73,039 170,169

Restructuring costs 2,112 5,708 (6,087) 1,733

Total assets 3,519,421 1,586,158 1,199,948 6,305,527

Total assets includes:

Additions to non-current assets

(other than financial instruments

and deferred tax assets) 49,017 3,540 20,085 72,642

Total liabilities 3,238,451 1,929,730 1,258,603 6,426,784

The segment information provided to the LEC for the reportable segments for the year ended March 31, 2009 are as

follows:

Emerging

Markets

(excluding Mature

China China) Markets Total

US$’000 US$’000 US$’000 US$’000

Sales to external customers 6,223,760 2,352,974 6,324,197 14,900,931

Adjusted pre-tax income/(loss) 377,858 (107,299) (136,749) 133,810

Depreciation and amortization 46,382 52,410 128,206 226,998

Restructuring costs 20,700 23,586 101,744 146,030

Total assets 3,533,922 927,510 981,500 5,442,932

Total assets includes:

Additions to non-current assets

(other than financial instruments

and deferred tax assets) 44,686 23,384 62,850 130,920

Total liabilities 1,579,301 382,705 1,062,057 3,024,063