Lenovo 2010 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2010 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152

|

|

2009/10 Annual Report Lenovo Group Limited

121121

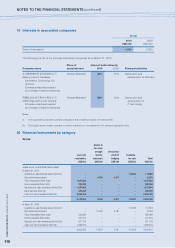

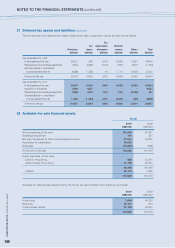

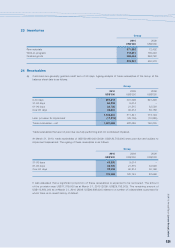

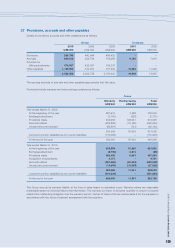

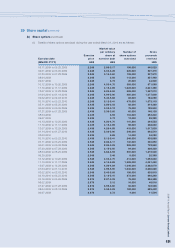

23 Inventories

Group

2010 2009

US$’000 US$’000

Raw materials 371,592 72,402

Work-in-progress 118,851 109,246

Finished goods 388,444 268,722

878,887 450,370

24 Receivables

(a) Customers are generally granted credit term of 30 days. Ageing analysis of trade receivables of the Group at the

balance sheet date is as follows:

Group

2010 2009 2008

US$’000 US$’000 US$’000

0-30 days 907,412 391,098 691,428

31-60 days 65,335 9,014 –

61-90 days 32,730 21,515 32,528

Over 90 days 32,904 90,214 50,168

1,038,381 511,841 774,124

Less: provision for impairment (17,319) (29,755) (13,885)

Trade receivables – net 1,021,062 482,086 760,239

Trade receivables that are not past due are fully performing and not considered impaired.

At March 31, 2010, trade receivables of US$130,969,000 (2009: US$120,743,000) were past due and subject to

impairment assessment. The ageing of these receivables is as follows:

Group

2010 2009 2008

US$’000 US$’000 US$’000

31-60 days 65,335 9,014 –

61-90 days 32,730 21,515 32,528

Over 90 days 32,904 90,214 50,168

130,969 120,743 82,696

It was assessed that a significant proportion of these receivables is expected to be recovered. The amount

of the provision was US$17,319,000 as at March 31, 2010 (2009: US$29,755,000). The remaining amount of

US$113,650,000 as at March 31, 2010 (2009: US$90,988,000) relates to a number of independent customers for

whom there is no recent history of default.