Lenovo 2010 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2010 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2009/10 Annual Report Lenovo Group Limited

114

NOTES TO THE FINANCIAL STATEMENTS (continued)

114

17 Intangible assets (continued)

Impairment tests for goodwill and intangible assets with indefinite useful lives

As explained in Note 5, the Group underwent an organizational structure change under which these intangible assets

have been allocated to the Group’s cash-generating units (“CGU”) affected using a relative value approach in accordance

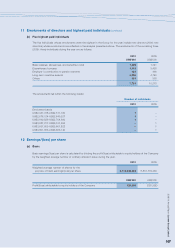

with HKAS 36, “Impairment of Assets”. The carrying amounts of goodwill and trademarks and trade names with indefinite

useful lives are presented below:

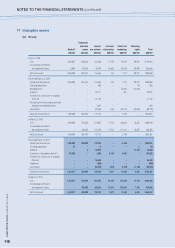

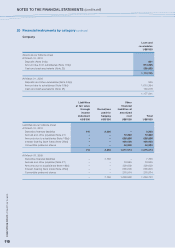

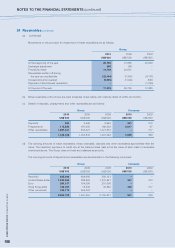

At March 31, 2010

Japan,

Australia, Amounts

Latin North West New pending

China HARIE * America America Europe Zealand allocation Total

US$ million US$ million US$ million US$ million US$ million US$ million US$ million US$ million

Goodwill 850 143 24 151 92 37 177 1,474

Trademarks and trade names 209 55 9 58 35 14 – 380

* Includes Africa, Asia Pacific, Central/Eastern Europe, Hong Kong, India, Korea, Middle East, Pakistan, Russia, Taiwan and Turkey

At March 31, 2009

Asia Pacific

Europe, (excluding

Middle East Greater Greater

Americas and Africa China) China Total

US$ million US$ million US$ million US$ million US$ million

Goodwill 364 102 152 679 1,297

Trademarks and trade names 107 30 45 198 380

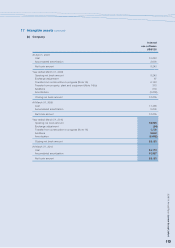

The reallocation of goodwill and trademarks and trade names with indefinite useful lives does not have any impact on or

change in the basis of assessment of their recoverable amounts.

Goodwill pending allocation represents the amount attributable to the acquisition of Lenovo Mobile Communication

Technology Ltd, details of which are set out in Note 37. The goodwill is primarily attributable to the significant synergies

expected to arise in connection with the development of the mobile of the internet device business of the Group.

Management is in the process of determining the allocation of goodwill to the appropriate CGU of the Group.

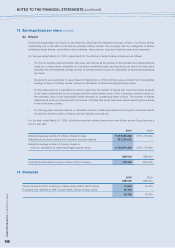

The Group completed its annual impairment test for goodwill allocated to the Group’s various CGU by comparing their

recoverable amounts to their carrying amounts as at the reporting date. The recoverable amount of a CGU is determined

based on value in use. These assessments use pre-tax cash flow projections based on financial budgets approved by

management covering a 5-year period with a terminal value related to the future cash flows of the CGU beyond the five-

year period are extrapolated using the estimated growth rates stated below. The estimated growth rates adopted do not

exceed the long-term average growth rates for the businesses in which the CGU operates.