Lenovo 2010 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2010 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2009/10 Annual Report Lenovo Group Limited

104

NOTES TO THE FINANCIAL STATEMENTS (continued)

104

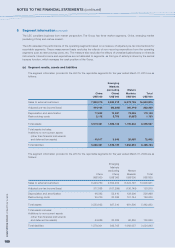

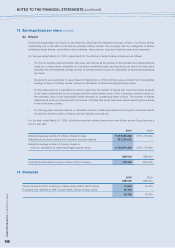

9 Taxation

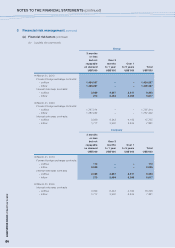

The amount of taxation in the consolidated income statement represents:

2010 2009

US$’000 US$’000

Current taxation

– Hong Kong profits tax 58 149

– Taxation outside Hong Kong 87,716 90,532

Deferred taxation (Note 21) (40,839) (52,237)

46,935 38,444

Hong Kong profits tax has been provided at the rate of 16.5% (2009: 16.5%) on the estimated assessable profit for the

year.

Taxation outside Hong Kong represents income and irrecoverable withholding taxes of subsidiaries operating in the

Chinese Mainland and overseas, calculated at rates applicable in the respective jurisdictions.

The Group has been granted certain tax concessions by tax authorities in the Chinese Mainland and overseas whereby the

subsidiaries operating in the respective jurisdictions are entitled to preferential tax treatment.

The differences between the Group’s expected tax charge, calculated at the domestic rates applicable to the countries

concerned, and the Group’s tax charge for the year were as follows:

2010 2009

US$’000 US$’000

Profit/(loss) before taxation 176,303 (187,945)

Tax calculated at domestic rates applicable in countries concerned 16,875 24,689

Income not subject to taxation (252,688) (248,517)

Expenses not deductible for taxation purposes 262,091 237,954

Utilization of previously unrecognized tax losses (77) (1,699)

Effect on opening deferred tax assets due to change in tax rates 867 (1,993)

Deferred tax assets not recognized 12,131 37,304

Under/(over) provision in prior years 7,736 (9,294)

46,935 38,444

The weighted average applicable tax rate was 10%. No disclosure is made for 2009 as this is not meaningful given the

Group incurred an overall loss before taxation last year.

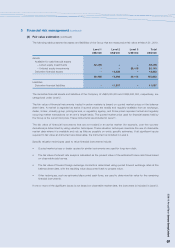

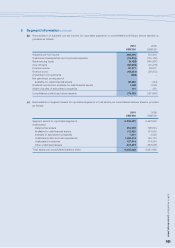

10 Employee benefit costs

2010 2009

US$’000 US$’000

Wages and salaries (including provision for restructuring

costs of US$5,123,000 (2009: US$116,077,000)) 899,970 939,421

Social security costs 95,923 98,250

Long-term incentive awards granted to directors

and employees (Note 29(a)) 51,412 54,114

Pension costs

– defined contribution plans 32,978 25,403

– defined benefit plans 11,088 11,032

Others 90,648 109,030

1,182,019 1,237,250