Lenovo 2010 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2010 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2009/10 Annual Report Lenovo Group Limited

77

NOTES TO THE FINANCIAL STATEMENTS

1 Basis of preparation

The financial statements have been prepared in accordance with Hong Kong Financial Reporting Standards (“HKFRS”).

The financial statements have been prepared under the historical cost convention except that certain financial assets and

financial liabilities are stated at fair values, as explained in the significant accounting policies set out below.

The preparation of financial statements in conformity with HKFRS requires the use of certain critical accounting estimates.

It also requires management to exercise its judgment in the process of applying the Group’s accounting policies. The

areas involving a higher degree of judgment or complexity, or areas where assumptions and estimates are significant to

the financial statements are disclosed in Note 4.

The Group has adopted those revised standards, new interpretations, and amendments to standards and interpretations

that are mandatory for the year ended March 31, 2010.

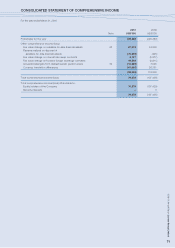

The adoption of HKAS 1 (Revised) requires “non-owner changes in equity” to be presented separately from “owner

changes in equity”. Management has decided to present two statements, a consolidated income statement and a

consolidated statement of comprehensive income.

The other adoptions do not result in substantial changes to the Group’s accounting policies or financial results.

At the date of approval of these financial statements, the following new and revised standards, new interpretations, and

amendments to standards and interpretations have been issued but are not effective for the year ended March 31, 2010

and have not been early adopted:

– HKFRS 1 (Revised), “First-time adoption of Hong Kong Financial Reporting Standards”, effective for annual periods

beginning on or after July 1, 2009; and for amendments to HKFRS 1 (Revised) published in May 2010, effective for

annual periods beginning on or after January 1, 2011

– HKFRS 2 (Amendment), “Share-based payment”, effective for annual periods beginning on or after July 1, 2009

– HKFRS 3 (Revised), “Business combinations”, effective for annual periods beginning on or after July 1, 2009; and for

amendments to HKFRS 3 (Revised) published in May 2010, effective for annual periods beginning on or after July 1,

2010

– HKFRS 7 (Amendment), “Financial instruments: Disclosures”, effective for annual periods beginning on or after

January 1, 2011

– HKFRS 8 (Amendment), “Operating segments”, effective for annual periods beginning on or after January 1, 2010

– HKFRS 9, “Financial instruments”, effective for annual periods beginning on or after January 1, 2013

– HKAS 1 (Amendment), “Presentation of financial statements”, effective for annual periods beginning on or after

January 1, 2010; and for amendments to HKAS 1 (Revised) published in May 2010, effective for annual periods

beginning on or after January 1, 2011

– HKAS 7 (Amendment), “Cash flow statements”, effective for annual periods beginning on or after January 1, 2010

– HKAS 17 (Amendment), “Leases”, effective for annual periods beginning on or after January 1, 2010

– HKAS 18 (Amendment), “Revenue”, effective for annual periods beginning on or after January 1, 2010

– HKAS 21 (Amendment), “The effect of changes in foreign exchange rates”, effective for annual periods beginning on

or after July 1, 2010

– HKAS 24 (Revised), “Related party disclosures”, effective for annual periods beginning on or after January 1, 2011

– HKAS 27 (Revised), “Consolidated and separate financial statements”, effective for annual periods beginning on or

after July 1, 2009

– HKAS 28 (Amendment), “Investments in associates”, effective for annual periods beginning on or after July 1, 2010