Lenovo 2010 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2010 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2009/10 Annual Report Lenovo Group Limited

6767

Connected transactions (continued)

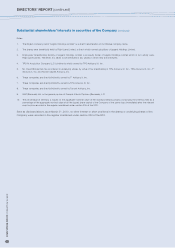

2. On March 31, 2009, the Company entered into a Master Services Agreement with Lenovo Mobile in respect of the sharing

of office spaces, provision of logistic, administrative and information technology services by the Group to the Legend

Group for a term of three years commencing from April 1, 2009 and expiring on March 31, 2012. The annual cap amount

of the transactions for each of the three financial years ending March 31, 2012 are HK$25,000,000. Details of this Master

Services Agreement are set out in the Company’s announcement dated March 31, 2009.

3 On November 27, 2009, Gainnew International Limited (“Gainnew”), Jade Ahead Limited (“Jade Ahead”) and others

(collectively the “Vendors”), entered into a sale and purchase agreement (the “S&P Agreement”) with Lenovo

Manufacturing Limited and Lenovo Beijing Limited (collectively the “Purchasers”), pursuant to which the Vendors agreed

to dispose of and the Purchasers agreed to purchase the entire registered capital of Lenovo Mobile at an aggregate

consideration of US$200 million which would be settled as to US$154 million by cash and as to US$46 million by the issue

of 80,894,033 ordinary shares of par value HK$0.025 each in the share capital of the Company subject to adjustment

with reference to the net cash balance of Lenovo Mobile (the “Acquisition”). Jade Ahead is regarded as an associate

of the controlling shareholder of the Company and Gainnew is regarded as an associate of a director of a subsidiary of

the Company and thus are connected persons of the Company within the meaning of the Listing Rules. Details of the

Acquisition are set out in the Company’s announcement dated November 27, 2009 and the circular dated December

18, 2009. The S&P Agreement and the transactions contemplated thereunder were approved by the independent

shareholders of the Company at an extraordinary general meeting of the Company on January 22, 2010. The Acquisition

was completed on January 31, 2010.

Following the completion of the Acquisition mentioned in paragraph 3 above, Lenovo Mobile has become a wholly-owned

subsidiary of the Company and ceased to be a connected person under the Listing Rules.

In accordance with rule 14A.37 of the Listing Rules, the independent non-executive directors of the Company reviewed the

continuing connected transactions in paragraphs 1 and 2 above and confirmed that the transactions were entered into:

(i) In the ordinary and usual course of business of the Group;

(ii) Either on normal commercial terms or on terms no less favourable to the Group than terms available to or from (as

appropriate) independent third parties; and

(iii) In accordance with the relevant agreement governing them on terms that were fair and reasonable and in the interests of

the shareholders of the Group as a whole.

In accordance with rule 14A.38 of the Listing Rules, the external auditor of the Company performed certain agreed-upon

procedures and reported the findings that the continuing connected transactions in paragraphs 1 and 2 above:–

(i) have received the approval of the Company’s board of directors;

(ii) are in accordance with the pricing policies of the Company, where applicable;

(iii) have been entered in accordance with the relevant agreements governing the transactions; and

(iv) have not exceeded the respective cap amounts as set out in the respective announcements.

Auditor

The financial statements have been audited by PricewaterhouseCoopers who retire and, being eligible, offer themselves for re-

appointment.