Lenovo 2010 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2010 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2009/10 Annual Report Lenovo Group Limited

66

DIRECTORS’ REPORT (continued)

66

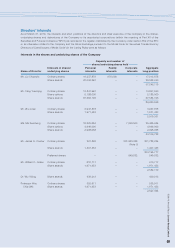

Facility agreement with covenant on controlling shareholder

The Company entered into a facility agreement with a syndicate of banks on March 13, 2006 and an amendment agreement on

May 21, 2009 (collectively the “Facility Agreement”) for a term loan facility of up to US$400 million (the “Facility”). The Facility is

repayable on the 42nd, 48th, 54th and 60th months after March 13, 2006. The Facility Agreement includes, inter alia, terms to

the effect that it will be an event of default if Legend Holdings Limited, the controlling shareholder of the Company: (i) is not or

ceases to be the direct or indirect beneficial owner of 35% or more of the issued share capital of the Company; (ii) does not or

ceases to control the Company; or (iii) is not or ceases to be the single largest shareholder of the Company. As at March 31,

2010, the outstanding balance of the Facility is US$200 million.

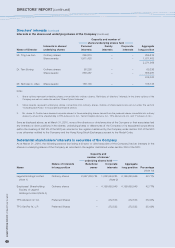

Connected transactions

During the year, the following transactions constitute connected transactions of the Company and require disclosure in the

annual report pursuant to rule 14A.45 of the Listing Rules.

1. On September 5, 2008, the Company entered into three master agreements (the “Master Agreements”) with 聯想移動通

信科技有限公司(Lenovo Mobile Communication Technology Ltd.) (“Lenovo Mobile”), APLL-Zhiqin Technology Logistics

Limited (“APLL”) and 北京聯想調頻科技有限公司(Beijing Legend Tiaopin Technology Limited) (“Legend Tiaopin”),

respectively for a term commencing from September 5, 2008 and expiring on March 31, 2010. Lenovo Mobile, APLL

and Legend Tiaopin are regarded as associates of 聯想控股有限公司(Legend Holdings Limited) (collectively the “Legend

Group”), the controlling shareholder of the Company, and thus are connected persons of the Company within the meaning

of the Listing Rules. Details of the Master Agreements are set out in the Company’s announcement dated September 9,

2008.

Products/Services provided under the Master Agreements:

Master Agreement with Lenovo Mobile

(i) Sale of mobile handsets, IT products and services, R&D services for computing devices (the “Legend Products and

Services”) from the Legend Group to the Group; and

(ii) Sale of personal computers, servers, peripherals and the related services (the “Computing Products and Services”)

from the Group to the Legend Group.

Master Agreement with APLL

(i) Provision of logistic services from the Legend Group to the Group; and

(ii) Sale of the Computing Products and Services from the Group to the Legend Group.

Master Agreement with Legend Tiaopin

(i) Provision of IT products and services (“IT Products and Services”) from the Legend Group to the Group; and

(ii) Sale of Computing Products and Services from the Group to the Legend Group.

Annual Cap Amount of the transactions:

(i) The aggregate amount payable by the Group to the Legend Group for sale of Legend Products and Services and the

IT Products and Services will not exceed US$39,000,000 and US$50,000,000 for the financial years ended March

31, 2009 and 2010 respectively;

(ii) The aggregate amount payable by the Group to the Legend Group for the provision of logistics services will not

exceed US$5,000,000 and US$6,000,000 for the financial years ended March 31, 2009 and 2010 respectively; and

(iii) The aggregate amount payable by the Legend Group to the Group for the sale of Computing Products and

Services will not exceed US$5,000,000 and US$6,000,000 for the financial years ended March 31, 2009 and 2010

respectively.