Lenovo 2010 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2010 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2009/10 Annual Report Lenovo Group Limited

120

NOTES TO THE FINANCIAL STATEMENTS (continued)

120

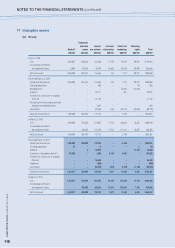

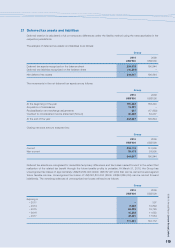

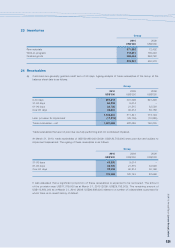

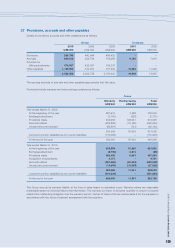

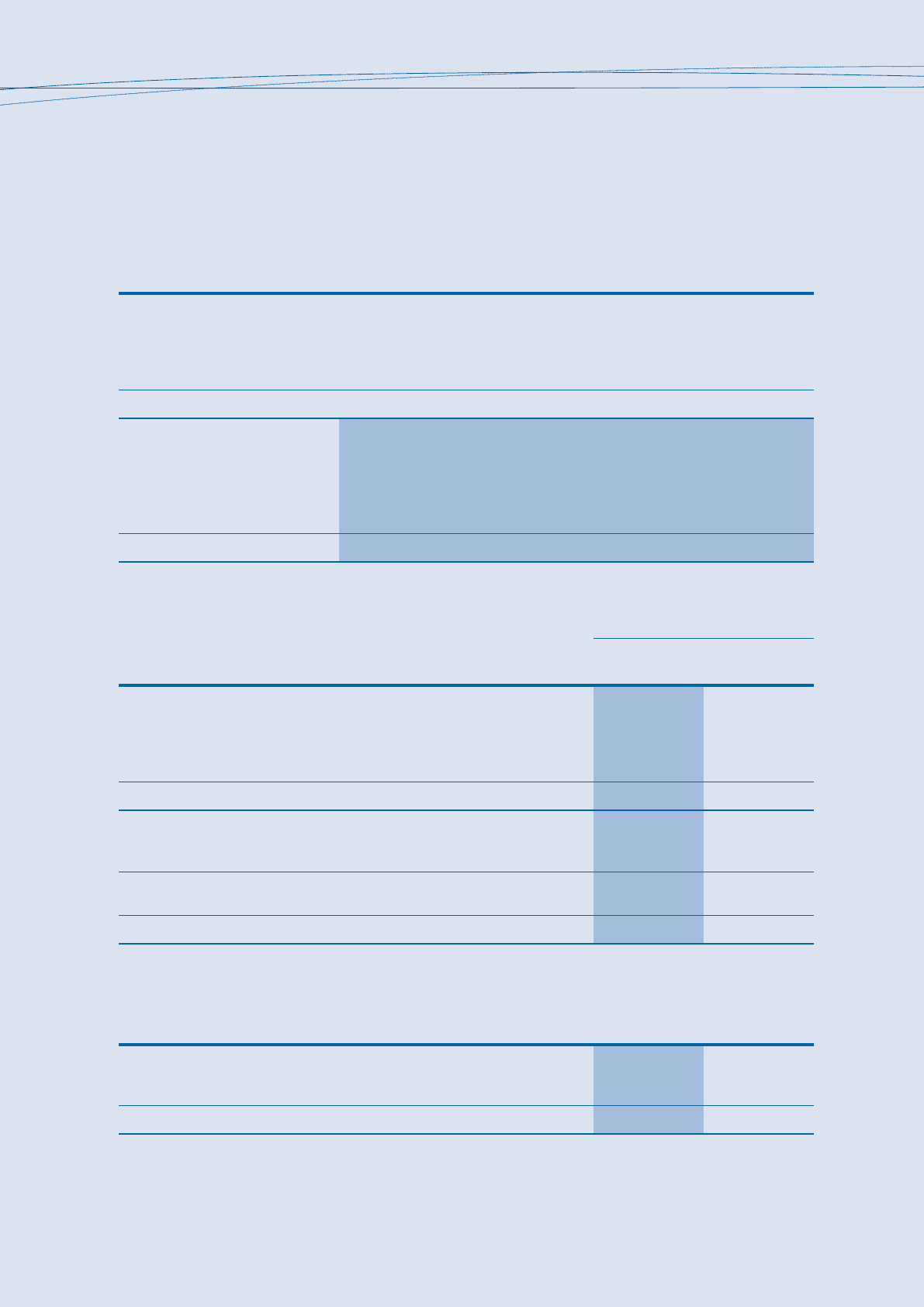

21 Deferred tax assets and liabilities (continued)

The movements in net deferred tax assets, analyzed by major component, during the year are as follows:

Tax

Tax depreciation Deferred

Provisions losses allowances revenue Others Total

US$’000 US$’000 US$’000 US$’000 US$’000 US$’000

Year ended March 31, 2009

At the beginning of the year 99,322 7,658 5,975 29,634 13,851 156,440

Reclassification and exchange adjustments (1,540) (5,695) (2,216) (1,881) (6,501) (17,833)

(Debited)/credited to consolidated

income statement (Note 9) (9,599) 17,556 64 17,713 26,503 52,237

At the end of the year 88,183 19,519 3,823 45,466 33,853 190,844

Year ended March 31, 2010

At the beginning of the year 88,183 19,519 3,823 45,466 33,853 190,844

Acquisition of subsidiaries 6,000 6,327 – – – 12,327

Reclassification and exchange adjustments (1,568) 9,079 1,419 1,763 (10,056) 637

Credited/(debited) to consolidated

income statement (Note 9) 11,482 (11,025) 4,191 36,409 (218) 40,839

At the end of the year 104,097 23,900 9,433 83,638 23,579 244,647

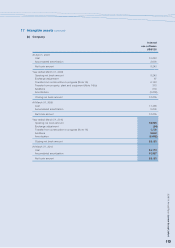

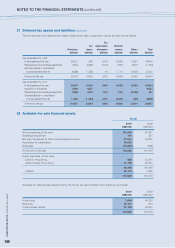

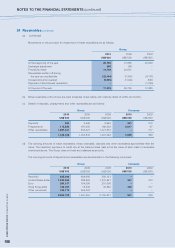

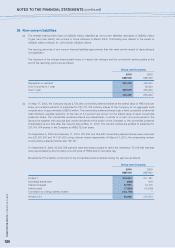

22 Available-for-sale financial assets

Group

2010 2009

US$’000 US$’000

At the beginning of the year 101,916 67,697

Exchange adjustment 191 247

Net gain transferred to other comprehensive income 67,674 34,830

Acquisition of subsidiaries 18,020 –

Disposals (75,281) (858)

At the end of the year 112,520 101,916

Equity securities, at fair value

Listed in Hong Kong 636 33,215

Listed outside Hong Kong 91,769 66,821

92,405 100,036

Unlisted 20,115 1,880

112,520 101,916

Available-for-sale financial assets held by the Group are denominated in the following currencies:

2010 2009

US$’000 US$’000

Hong Kong 1,640 34,220

Renminbi 19,111 875

United States dollars 91,769 66,821

112,520 101,916