Lenovo 2010 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2010 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152

|

|

2009/10 Annual Report Lenovo Group Limited

2

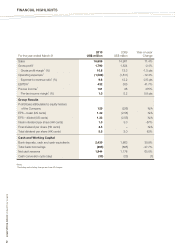

For the year ended March 31

2010

US$ million

2009

US$ million

Year-on-year

Change

Sales 16,605 14,901 11.4%

Gross pro t11,790 1,834 -2.4%

Gross pro t margin1 (%) 10.8 12.3 -1.5 pts

Operating expenses1(1,586) (1,811) -12.4%

Expense-to-revenue ratio1 (%) 9.6 12.2 -2.6 pts

EBITDA1 432 305 41.7%

Pre-tax income1161 28 475%

Pre-tax income margin1 (%) 1.0 0.2 0.8 pts

Group Results

Pro t/(loss) attributable to equity holders

of the Company 129 (226) N/A

EPS – basic (US cents) 1.42 (2.56) N/A

EPS – diluted (US cents) 1.33 (2.56) N/A

Interim dividend per share (HK cents) 1.0 3.0 -67%

Final dividend per share (HK cents) 4.5 – N/A

Total dividend per share (HK cents) 5.5 3.0 83%

Cash and Working Capital

Bank deposits, cash and cash equivalents 2,439 1,863 30.9%

Total bank borrowings (495) (685) -27.7%

Net cash reserves 1,944 1,178 65.0%

Cash conversion cycle (day) (30) (23) (7)

Notes:

1 Excluding restructuring charges and one-off charges.

FINANCIAL HIGHLIGHTS