Lenovo 2010 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2010 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2009/10 Annual Report Lenovo Group Limited

15

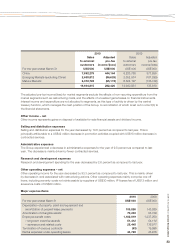

strong expense reductions during the year, totaling

US$224 million, driving the expense-to-revenue ratio

(excluding the restructuring costs and one-off items)

to a historic low of 9.6 percent, continuing the trend

of year-on-year improvement for the last four quarters.

The Group reported an operating profit (excluding the

restructuring and one-off items) of US$204 million

for the year, increase by 750 percent year-to-year.

Including a net gain of US$82 million from the disposal

of some investments and restructuring costs and one-

off items totaling US$68 million, of which including

approximately US$20 million redundancy costs incurred

in fiscal quarter four, Lenovo’s profit attributable to

equity holders amounted to US$129 million for the year,

recovering from the loss of US$226 million in the year

before.

The Group’s strong performance during the last

four quarters was the result of clarifying its strategic

priorities at the beginning of the fiscal year. The

“Protect and Attack” strategy is aimed at protecting

its core businesses in China and global commercial

business, while at the same time, attacking the

hyper-growth areas in global transactional business

in emerging markets. Lenovo also reorganized its

business by merging operations into two geographies,

namely Mature Markets and Emerging Markets. And,

to further ensure faster and stronger end-to-end

management, two product groups were created: the

Think Product Group mainly targets at commercial

customers, and the Idea Product Group mainly targets

at consumer customers.

Lenovo also took major steps to strengthen its

business model, became faster and more efficient,

and put the building blocks in place to extend its

transactional model globally, while simplifying its

relationship business to make it more productive in

focusing on the key accounts.

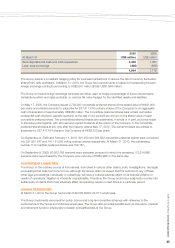

The Group reacquired Lenovo Mobile in November

2009 as part of its strategy to establish a leadership

position in the China mobile internet market during its

early development phase. The purchase of Lenovo

Mobile was approved by shareholders in January 2010,

resulting in the inclusion of two months of Lenovo

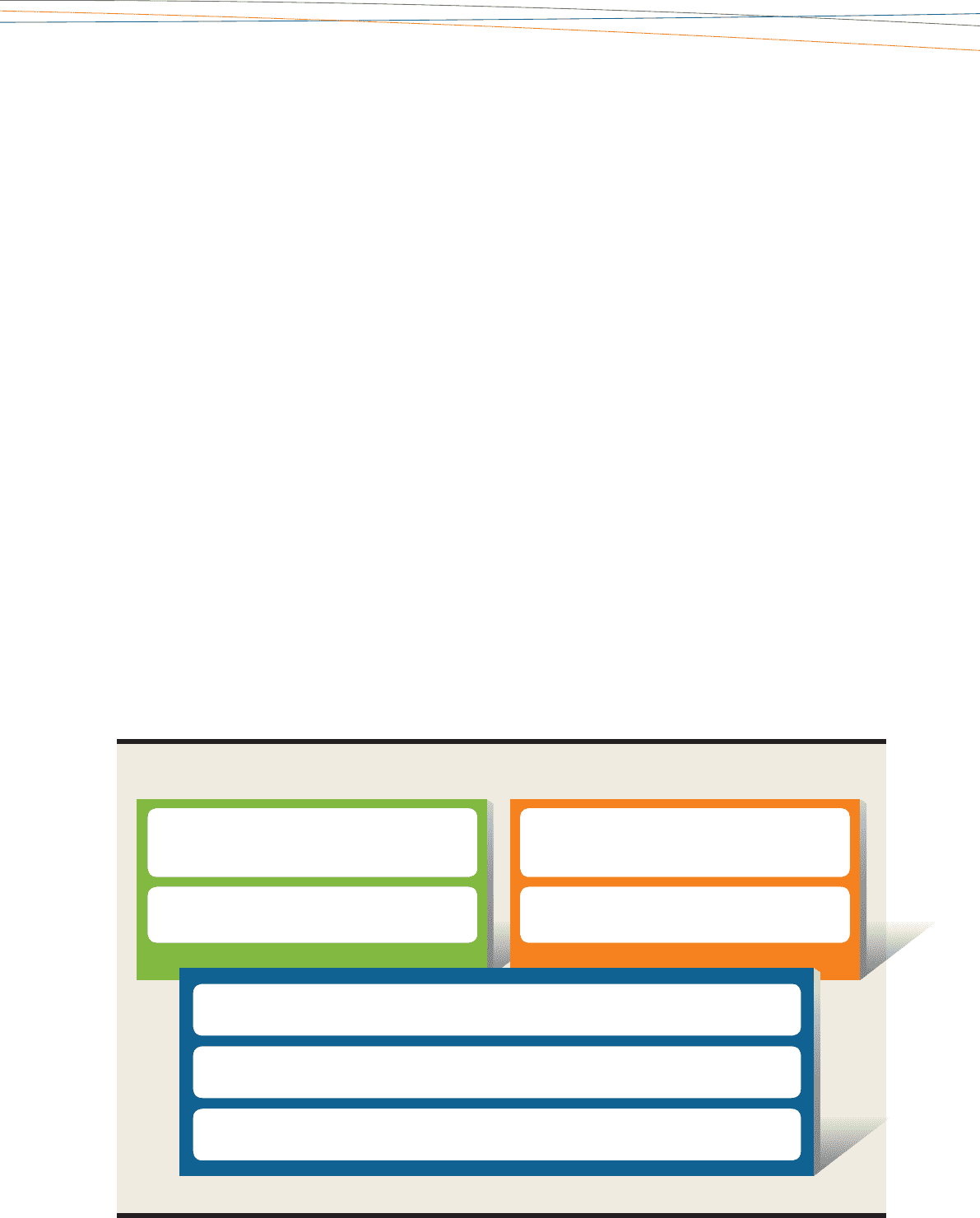

Protect Attack

Think/

Rel

Emerging

Market

• Focus on TM & SMB/consumer

• Primary leverage of idea portfolio

• Return to profitability

• Maintain/Grow share

China • Expand leadership position

• Improve profitability

• Go global & gain share

• Use Idea & Think

• Invest & move to profitability

TM

WW

Effective business model • Drive speed and efficiency

Innovation leadership • Premium Think

• Creative Idea

• New businesses

• Innovation efficiency

Lean cost structure • Leverage China infrastructure in TM & EM

• Meet the par with competition in Rel

“PROTECT and ATTACK” Strategy