Lenovo 2010 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2010 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2009/10 Annual Report Lenovo Group Limited

125125

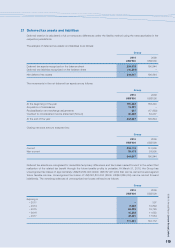

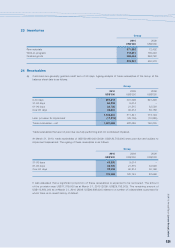

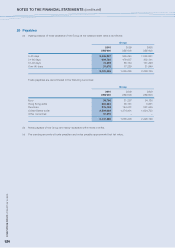

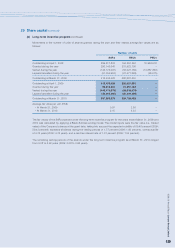

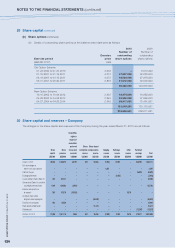

27 Provisions, accruals and other payables

Details of provisions, accruals and other payables are as follows:

Group Company

2010 2009 2008 2010 2009

US$’000 US$’000 US$’000 US$’000 US$’000

Provisions 260,796 460,994 496,432 – –

Accruals 659,212 524,746 742,269 9,765 7,916

Provision for

billing adjustments 474,937 426,081 159,276 – –

Other payables 1,190,905 610,937 761,445 10,083 11,029

2,585,850 2,022,758 2,159,422 19,848 18,945

The carrying amounts of accruals and other payables approximate their fair value.

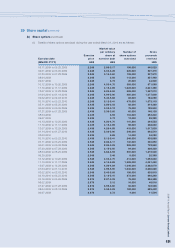

Provisions include warranty and restructuring provisions as follows:

Group

Warranty Restructuring Total

US$’000 US$’000 US$’000

Year ended March 31, 2009

At the beginning of the year 697,915 7,588 705,503

Exchange adjustment (2,191) (520) (2,711)

Provisions made 404,564 108,041 512,605

Amounts utilized (483,898) (16,755) (500,653)

Unused amounts reversed (82,991) (751) (83,742)

533,399 97,603 631,002

Long-term portion classified as non-current liabilities (170,008) – (170,008)

At the end of the year 363,391 97,603 460,994

Year ended March 31, 2010

At the beginning of the year 533,399 97,603 631,002

Exchange adjustment (2,739) 2,673 (66)

Provisions made 480,402 6,631 487,033

Acquisition of subsidiaries 4,701 – 4,701

Amounts utilized (451,065) (81,943) (533,008)

Unused amounts reversed (14,009) (13,623) (27,632)

550,689 11,341 562,030

Long-term portion classified as non-current liabilities (301,234) – (301,234)

At the end of the year 249,455 11,341 260,796

The Group records its warranty liability at the time of sales based on estimated costs. Warranty claims are reasonably

predictable based on historical failure rate information. The warranty provision is reviewed quarterly to ensure it properly

reflects the outstanding obligation over the warranty period. Certain of these costs are reimbursable from the suppliers in

accordance with the terms of relevant arrangement with the suppliers.