Lenovo 2010 Annual Report Download - page 146

Download and view the complete annual report

Please find page 146 of the 2010 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2009/10 Annual Report Lenovo Group Limited

144

NOTES TO THE FINANCIAL STATEMENTS (continued)

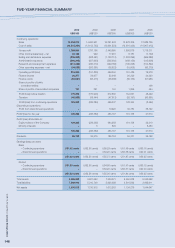

37 Business combinations

On January 31, 2010 the Group completed the acquisition of the entire interests in Lenovo Mobile Communication

Technology Ltd (“Lenovo Mobile”) under a sale and purchase agreement dated November 27, 2009.

The estimated total consideration for acquiring Lenovo Mobile is approximately HK$250 million, including cash, the

Company’s shares as consideration shares and related transaction costs.

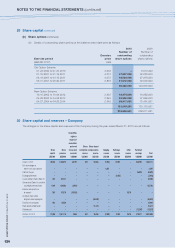

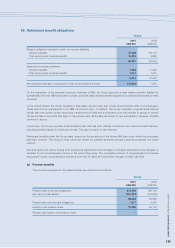

Set forth below is the preliminary calculation of goodwill:

US$’000

Purchase consideration:

– Cash 186,146

– Direct costs relating to the acquisition 990

– Fair value of shares issued (Notes 29 and 30) 63,500

Total purchase consideration 250,636

Less: Fair value of net assets acquired (74,084)

Goodwill (Note 17(a)) 176,552

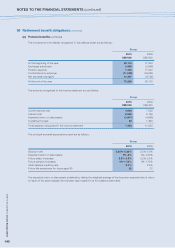

The major components of assets and liabilities arising from the acquisition are as follows:

Fair value Carrying value

US$’000 US$’000

Cash and cash equivalents 80,432 80,432

Secured bank balances 28,330 28,330

Property, plant and equipment (Note 14(a)) 16,720 17,693

Other non-current assets 12,472 12,472

Intangible assets (Note 17(a)) 18,268 1,624

Net working capital except cash and cash equivalents and secured bank balances (76,476) (76,476)

Non-current liabilities (5,662) (5,662)

Net assets acquired 74,084 58,413

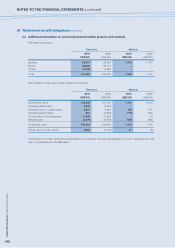

US$’000

Purchase consideration settled in cash 186,146

Direct costs relating to the acquisition 990

Less: Cash and cash equivalents in subsidiaries acquired (80,432)

Acquisition of subsidiaries, net of cash acquired 106,704

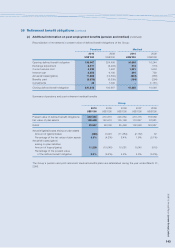

The goodwill is primarily attributable to the significant synergies expected to arise in connection with the development of

the mobile internet device business of the Group.

Intangible assets acquired are expected to be amortized over their useful lives of 3 years.

The acquired tangible assets primarily comprised trade receivables, inventories and plant and equipment. The liabilities

assumed primarily comprised trade payables and other current and non-current liabilities.

The sale and purchase agreement contains provisions that may require miscellaneous adjustments to be agreed between

the Company and seller. Such adjustments have not been finalized, but estimates have been recorded as part of the

purchase price allocation, as indicated above. This process is expected to be finalized in the financial year 2010/11.