Lenovo 2010 Annual Report Download - page 142

Download and view the complete annual report

Please find page 142 of the 2010 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152

|

|

2009/10 Annual Report Lenovo Group Limited

140

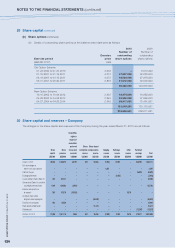

NOTES TO THE FINANCIAL STATEMENTS (continued)

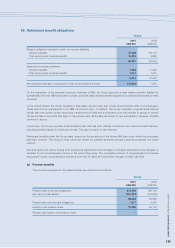

36 Retirement benefit obligations (continued)

(a) Pension benefits (continued)

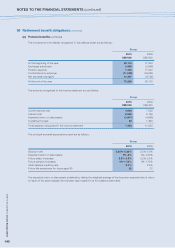

The movements in the liability recognized in the balance sheet are as follows:

Group

2010 2009

US$’000 US$’000

At the beginning of the year 59,115 77,264

Exchange adjustment 3,468 (2,566)

Pension expense 7,433 11,032

Contributions by employer (11,088) (19,823)

Net actuarial loss/(gain) 11,307 (6,792)

At the end of the year 70,235 59,115

The amounts recognized in the income statement are as follows:

Group

2010 2009

US$’000 US$’000

Current service cost 4,833 7,522

Interest cost 6,505 6,186

Expected return on plan assets (3,947) (4,066)

Curtailment losses 42 1,390

Total expense recognized in the income statement 7,433 11,032

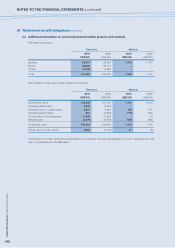

The principal actuarial assumptions used are as follows:

Group

2010 2009

Discount rate 2.25%-5.25% 2.5%-5.5%

Expected return on plan assets 0%-5% 0%-4.25%

Future salary increases 2.2%-3.5% 2.2%-3.5%

Future pension increases 0%-1.75% 0%-1.75%

Cash balance crediting rate 2.5% 2.5%

Future life expectancy for those aged 60 22 22

The expected return on plan assets is derived by taking the weighted average of the long term expected rate of return

on each of the asset classes that the plan was invested in at the balance sheet date.