Lenovo 2010 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2010 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2009/10 Annual Report Lenovo Group Limited

93

2009/10 Annual Report Lenovo Group Limited

93

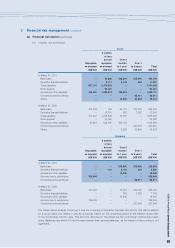

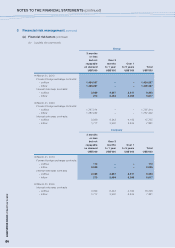

3 Financial risk management (continued)

(a) Financial risk factors (continued)

(iv) Liquidity risk (continued)

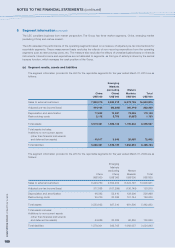

Group

3 months

or less

but not Over 3

Repayable repayable months Over 1

on demand on demand to 1 year to 5 years Total

US$’000 US$’000 US$’000 US$’000 US$’000

At March 31, 2010

Bank loans – 30,888 263,818 200,000 494,706

Derivative financial liabilities – 8,117 3,142 248 11,507

Trade payables 667,781 2,473,645 – – 3,141,426

Notes payable – 94,427 – – 94,427

Accrual and other payables 360,020 1,293,273 196,824 – 1,850,117

Convertible preferred shares – – – 98,611 98,611

Others – – 10,550 24,863 35,413

At March 31, 2009

Bank loans 400,000 159 55,134 230,000 685,293

Derivative financial liabilities – 23,291 383 7,382 31,056

Trade payables 371,607 1,228,596 35,087 – 1,635,290

Notes payable – 34,180 – – 34,180

Accrual and other payables 46,891 623,690 465,102 – 1,135,683

Convertible preferred shares – – – 227,564 227,564

Others – – 2,359 33,864 36,223

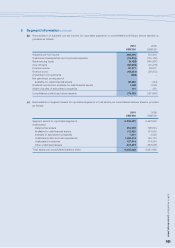

Company

3 months

or less

but not Over 3

Repayable repayable months Over 1

on demand on demand to 1 year to 5 years Total

US$’000 US$’000 US$’000 US$’000 US$’000

At March 31, 2010

Bank loans – – 230,000 200,000 430,000

Derivative financial liabilities – 110 3,142 248 3,500

Accrual and other payables – – 19,848 – 19,848

Amounts due to subsidiaries 526,686 – – – 526,686

Convertible preferred shares – – – 98,611 98,611

At March 31, 2009

Bank loans 400,000 – 35,000 230,000 665,000

Derivative financial liabilities – – 383 7,382 7,765

Accrual and other payables – – 18,945 – 18,945

Amounts due to subsidiaries 329,039 – – – 329,039

Convertible preferred shares – – – 227,564 227,564

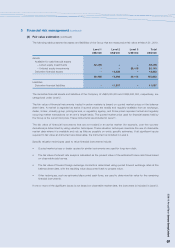

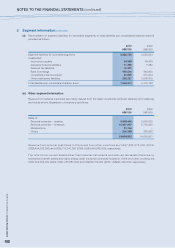

The tables below analyze the Group’s and the Company’s derivative financial instruments that will be settled

on a gross basis into relevant maturity groupings based on the remaining period at the balance sheet date

to the contractual maturity date. The amounts disclosed in the tables are the contractual undiscounted cash

flows. Balances due within 12 months approximate their carrying balances, as the impact of discounting is not

significant.