Lenovo 2010 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2010 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2009/10 Annual Report Lenovo Group Limited

92

NOTES TO THE FINANCIAL STATEMENTS (continued)

2009/10 Annual Report Lenovo Group Limited

92

3 Financial risk management (continued)

(a) Financial risk factors (continued)

(iii) Credit risk

Credit risk is managed on a group basis. Credit risk arises from cash and cash equivalents, derivative financial

instruments and deposits with banks and financial institutions, as well as credit exposures to customers,

including outstanding receivables and committed transactions.

For banks and other financial institutions, the Group controls its credit risk through monitoring their credit rating

and setting approved counterparty credit limits that are regularly reviewed.

The Group has no significant concentration of customer credit risk. The Group has a credit policy in place and

exposures to these credit risks are monitored on an ongoing basis.

No credit limits were exceeded during the reporting period, and management does not expect any losses from

non-performance by these counterparties.

(iv) Liquidity risk

Cash flow forecasting of the Group is performed by Group Treasury. It monitors rolling forecasts of the Group’s

liquidity requirements to ensure it has sufficient cash to meet operational needs while maintaining sufficient

headroom on its undrawn committed borrowing facilities (Note 32) at all times so that the Group does not

breach borrowing limits or covenants (where applicable) on any of its borrowing facilities. Such forecasting

takes into consideration the Group’s debt financing plans, covenant compliance, compliance with internal

balance sheet ratio targets and, if applicable external regulatory or legal requirements, for example, currency

restrictions.

Surplus cash held by the operating entities over and above balance required for working capital management

are transferred to Group Treasury. Group Treasury invests surplus cash in interest bearing current

accounts, time deposits, money market deposits and marketable securities, choosing instruments with

appropriate maturities or sufficient liquidity to provide sufficient headroom as determined by the above-

mentioned forecasts, At the reporting date, the Group held money market funds of US$530,429,000 (2009:

US$354,135,000).

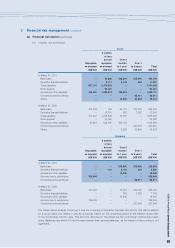

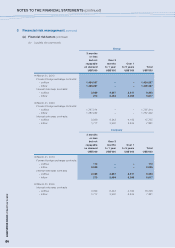

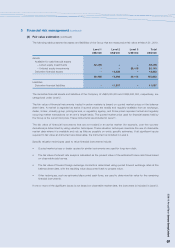

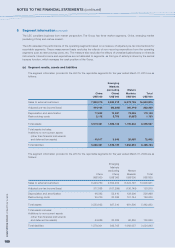

The tables below analyze the Group’s and the Company’s financial liabilities and net-settled derivative financial

liabilities into relevant maturity groupings based on the remaining period at the balance sheet date to the

contractual maturity date. The amounts disclosed in the tables are the contractual undiscounted cash flows.

Balances due within 12 months approximate their carrying balances, as the impact of discounting is not

significant.