Lenovo 2010 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2010 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2009/10 Annual Report Lenovo Group Limited

105105

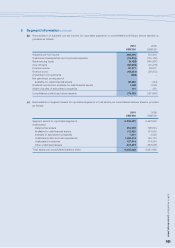

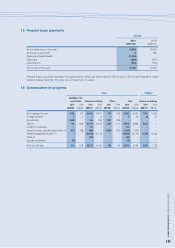

10 Employee benefit costs (continued)

The Group contributes to respective local municipal government retirement schemes which are available to all qualified

employees in the Chinese Mainland. Contributions to these schemes are calculated with reference to the monthly average

salaries as set out by the local municipal government.

The Group participates in various defined contribution schemes, either voluntary or mandatory, for all qualified employees.

The assets of those defined contribution schemes are held separately from those of the Group in independently

administered funds.

The Group also contributes to certain defined benefit pension schemes, details of which are set out in Note 36.

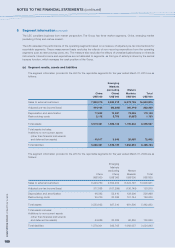

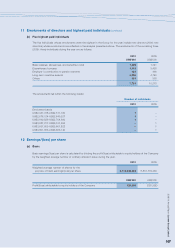

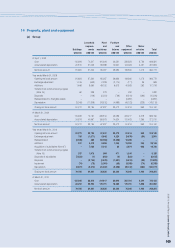

11 Emoluments of directors and highest paid individuals

(a) Directors’ and senior management’s emoluments

Directors’ emoluments comprise payments by the Group to directors of the Company in connection with the

management of the affairs of the Company and its subsidiaries. The remuneration of each director for the years

ended March 31, 2009 and 2010 is set out below:

2010

Retirement

payments

and

Long-term employer’s

Discretionary incentives contribution Other

bonuses awards to pension benefits-

Name of Director Fees Salary (note i) (note ii) schemes in-kind Total

US$’000 US$’000 US$’000 US$’000 US$’000 US$’000 US$’000

Executive director

Mr. Yang Yuanqing – 850 246 6,045 85 91 7,317

Non-executive directors

Mr. Liu Chuanzhi – 452 – 1,828 – – 2,280

Mr. Zhu Linan 68 – – 124 – – 192

Ms. Ma Xuezheng 68 – – 305 – – 373

Mr. James G. Coulter 68 – – 122 – – 190

Mr. William O. Grabe 79 – – 201 – – 280

Dr. Wu Yibing 68 – – 51 – – 119

Independent non-

executive directors

Professor Woo Chia-Wei 68 – – 189 – – 257

Mr. Ting Lee Sen 68 – – 176 – – 244

Mr. John W. Barter III 90 – – 158 – – 248

Dr. Tian Suning 68 – – 110 – – 178

Mr. Nicholas C Allen 22 – – 12 – – 34

667 1,302 246 9,321 85 91 11,712