Lenovo 2010 Annual Report Download - page 143

Download and view the complete annual report

Please find page 143 of the 2010 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2009/10 Annual Report Lenovo Group Limited

141

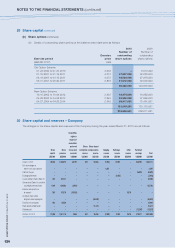

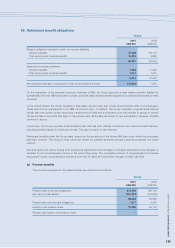

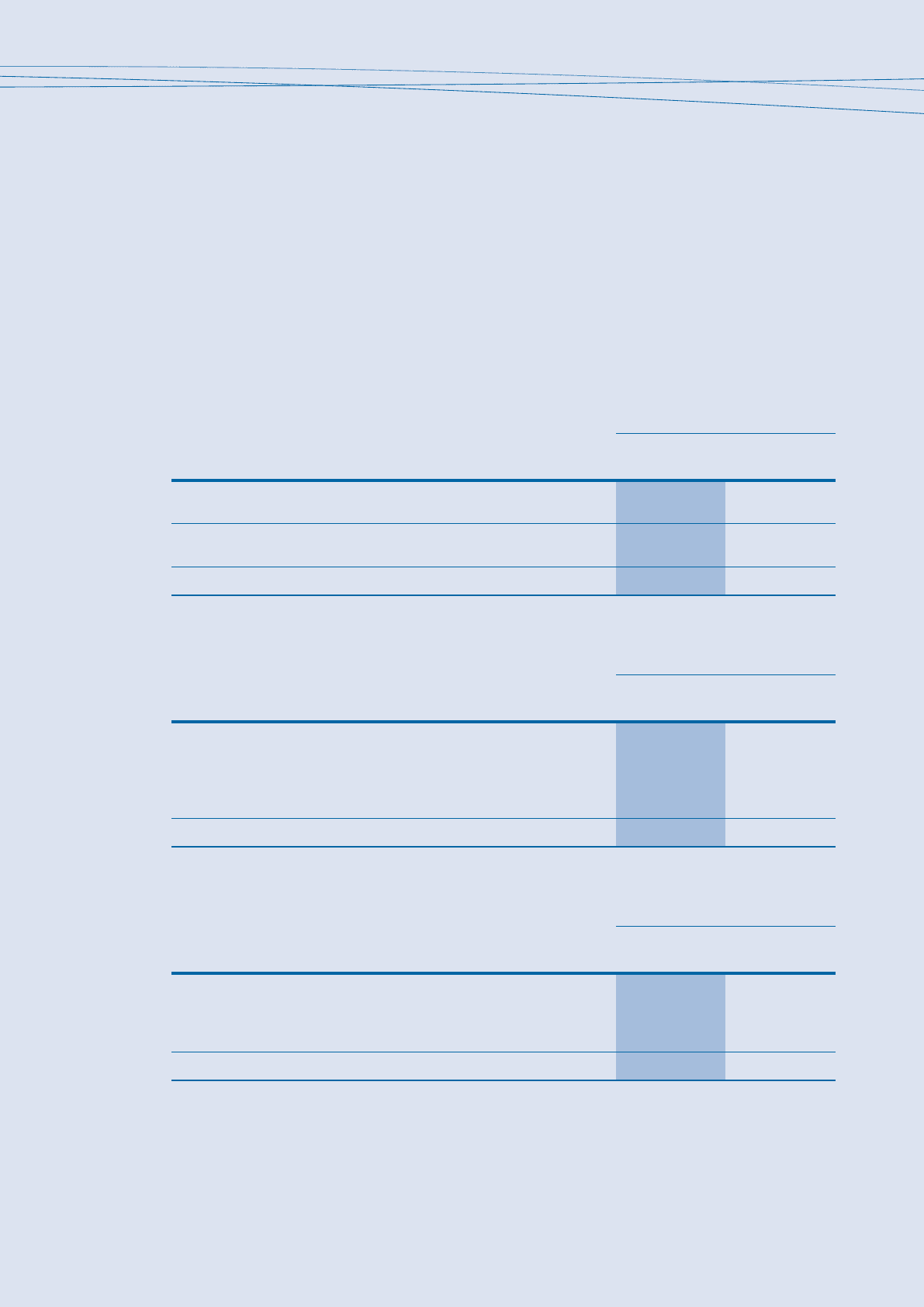

36 Retirement benefit obligations (continued)

(b) Post-employment medical benefits

The Group operates a number of post-employment medical benefit schemes, principally in the US. The method

of accounting, assumptions and the frequency of valuations are similar to those used for defined benefit pension

schemes.

The US plan (Lenovo Future Health Account and Retiree Life Insurance Program) is currently funded by a trust that

qualifies for tax exemption under US tax law, out of which benefits to eligible retirees and dependents will be made.

The liabilities for post-employment medical benefits are not sensitive to changes in future medical cost trend rates.

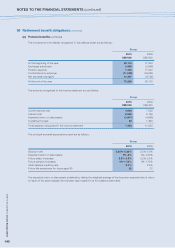

The amounts recognized in the balance sheet are determined as follows:

Group

2010 2009

US$’000 US$’000

Present value of funded obligations 18,053 16,491

Fair value of plan assets (7,618) (7,761)

10,435 8,730

Present value of unfunded obligations 197 155

Liability in the balance sheet 10,632 8,885

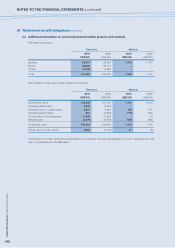

Movements in the liability recognized in the balance sheet are as follows:

Group

2010 2009

US$’000 US$’000

At the beginning of the year 8,885 8,226

Exchange adjustment 373 (116)

Contributions by employer – (13)

Post-retirement expense 1,841 1,021

Net actuarial gains (467) (233)

At the end of the year 10,632 8,885

The amounts recognized in the income statement are as follows:

Group

2010 2009

US$’000 US$’000

Current service cost 1,221 1,650

Interest cost 816 739

Expected return on plan assets (196) (217)

Curtailment gain – (1,151)

Total expense recognized in the income statement 1,841 1,021