Lenovo 2010 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2010 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2009/10 Annual Report Lenovo Group Limited

122

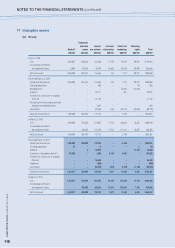

NOTES TO THE FINANCIAL STATEMENTS (continued)

122

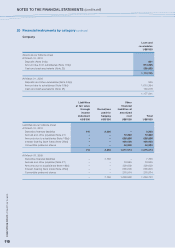

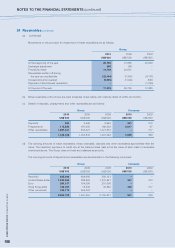

24 Receivables (continued)

(a) (continued)

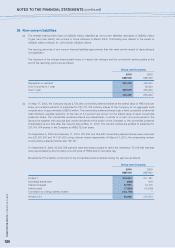

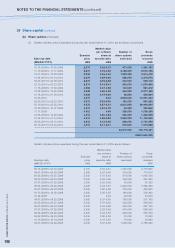

Movements on the provision for impairment of trade receivables are as follows:

Group

2010 2009 2008

US$’000 US$’000 US$’000

At the beginning of the year 29,755 13,885 23,939

Exchange adjustment 296 168 –

Provisions made 14,702 24,631 –

Receivables written off during

the year as uncollectible (22,434) (7,400) (8,167)

Unused amounts reversed (5,000) (1,529) (597)

Disposal of discontinued operations – – (1,290)

At the end of the year 17,319 29,755 13,885

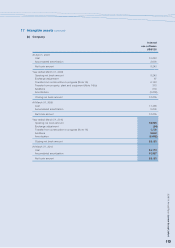

(b) Notes receivable of the Group are bank accepted notes mainly with maturity dates of within six months.

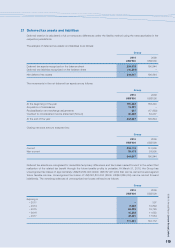

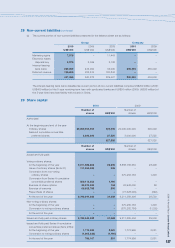

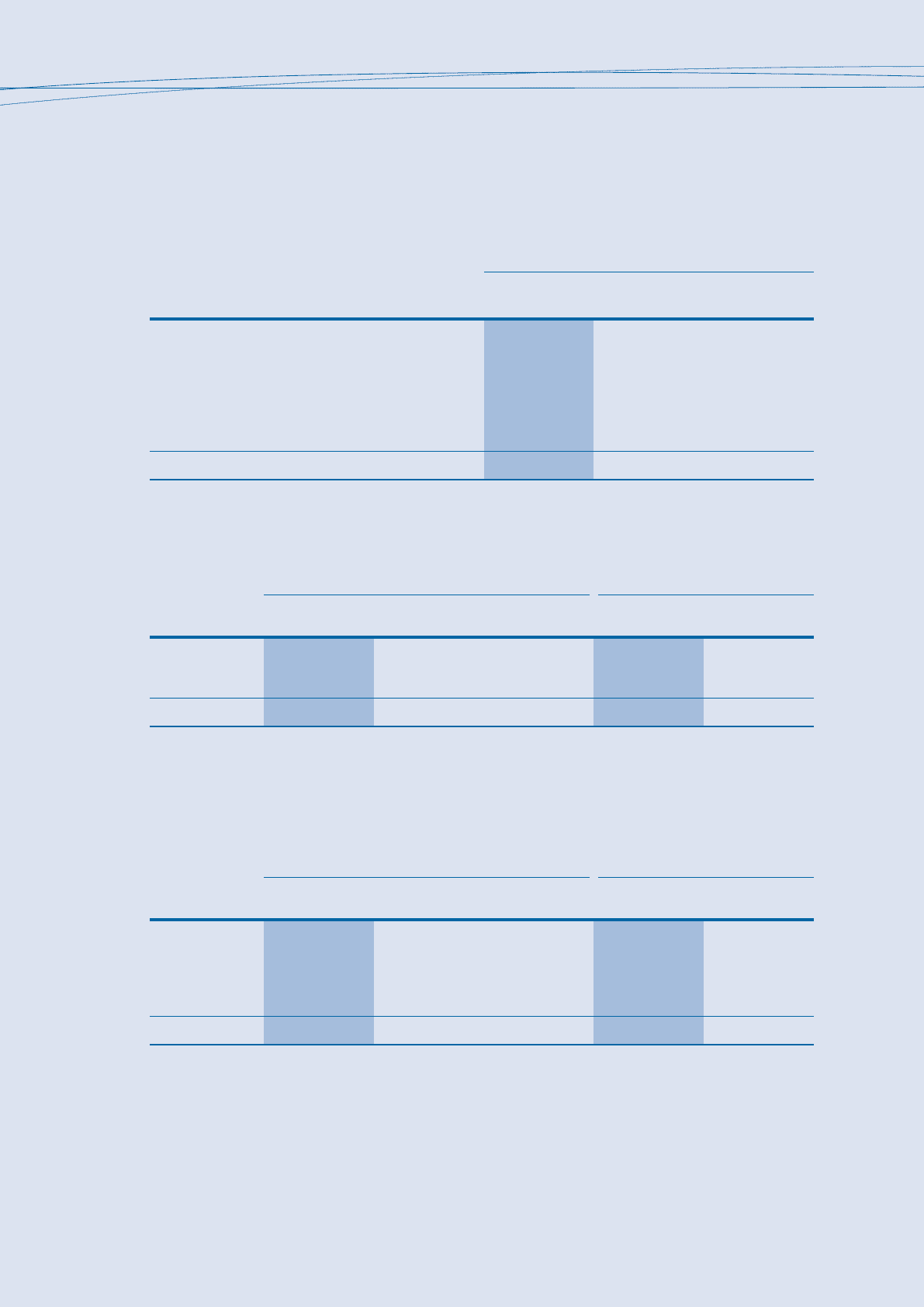

(c) Details of deposits, prepayments and other receivables are as follows:

Group Company

2010 2009 2008 2010 2009

US$’000 US$’000 US$’000 US$’000 US$’000

Deposits 553 3,466 2,640 881 212

Prepayments 175,528 197,050 182,534 5,017 67

Other receivables 1,287,341 834,327 1,021,872 – 317

1,463,422 1,034,843 1,207,046 5,898 596

(d) The carrying amounts of trade receivables, notes receivable, deposits and other receivables approximate their fair

value. The maximum exposure to credit risk at the balance sheet date is the fair value of each class of receivable

mentioned above. The Group does not hold any collateral as security.

The carrying amounts of deposits and receivables are denominated in the following currencies:

Group Company

2010 2009 2008 2010 2009

US$’000 US$’000 US$’000 US$’000 US$’000

Renminbi 625,006 488,692 593,121 – –

United States dollar 1,532,052 288,806 1,275,841 531 312

Euro 250,017 194,396 251,095 – –

Hong Kong dollar 105,457 15,236 35,820 350 217

Other currencies 183,170 554,324 – – –

2,695,702 1,541,454 2,155,877 881 529