Lenovo 2010 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2010 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2009/10 Annual Report Lenovo Group Limited

38

CORPORATE GOVERNANCE

The Company reserves the right, at its discretion, to pay any awards under the LTI Program in cash or ordinary

shares. The Company has created and funded a trust to pay shares to eligible recipients. In the case of SARs,

awards are due after exercise by the recipient. In the case of RSUs, awards are due after the employee satisfies

any vesting conditions.

The number of units that are awarded under the plan is set and reviewed annually, reflecting competitive

market positioning, market practices, especially those among Lenovo’s competitors, as well as the Company’s

performance and an individual’s actual and expected contribution to the business. In certain circumstances,

awards under the LTI Program may be made to support the attraction of new hires. Award levels and mix may

vary.

During the year, CEO, senior management and selected employees received an annual award comprised of SARs

and RSUs.

Awards outstanding for executive and non-executive directors as of March 31, 2010 under the LTI Program are

presented below.

Share Option Scheme

The Company operates two share option schemes, the “New Option Scheme” and the “Old Option Scheme”.

Details of the programs are set out in the Directors’ Report on pages 51 to 54. Options outstanding for executive

and non-executive directors as of March 31, 2010 under these schemes are presented in the Directors’ Report on

page 53.

No options were granted under these schemes during the year.

Retirement Bene ts

The Company operates a number of retirement schemes for its employees, including executive directors and senior

management. These schemes are reviewed regularly and intended to deliver benefit levels that are consistent with

local market practices. Details of the programs are set out in the Directors’ Report on pages 63 to 65.

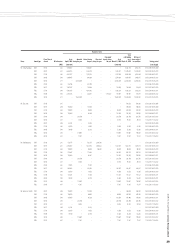

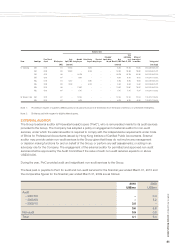

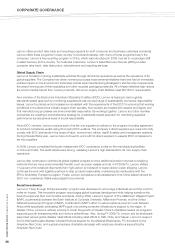

Long-Term Incentive Awards

The total number of awards of the members of the Board, including the Chairman of the Board and CEO, under

the LTI Program as disclosed pursuant to Securities and Futures Ordinance is set out below:

Number of units

Name Award type

Fiscal Year of

Award Effective price

As at

April 1, 2009

Awarded

during the year

Vested during

the year

Exercised

during the year

Cancelled/

lapsed during

the year

As at

March 31, 2010

Total

outstanding

as at

March 31, 2010

Max no. of

shares subject

to conditions Vesting period

(HK$) (unvested) (unvested) (mm.dd.yyyy)

Mr. Liu Chuanzhi SAR 05/06 3.15 – – – – – – 564,000 564,000 05.01.2006-05.01.2008

SAR 06/07 2.99 130,000 – 130,000 – – – 390,000 390,000 06.01.2007-06.01.2009

SAR 07/08 3.94 198,000 – 99,000 – – 99,000 297,000 297,000 06.01.2008-06.01.2010

SAR 08/09 5.88 195,980 – 65,326 – – 130,654 195,980 195,980 06.01.2009-06.01.2011

SAR 09/10 3.17 – 18,500,000 – – – 18,500,000 18,500,000 18,500,000 05.25.2010-05.25-2013

RSU 06/07 2.99 43,334 – 43,334 –––––06.01.2007-06.01.2009

RSU 07/08 3.94 66,000 – 33,000 – – 33,000 33,000 33,000 06.01.2008-06.01.2010

RSU 08/09 5.88 78,390 – 26,130 – – 52,260 52,260 52,260 06.01.2009-06.01.2011