IBM 2007 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2007 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

97

Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies

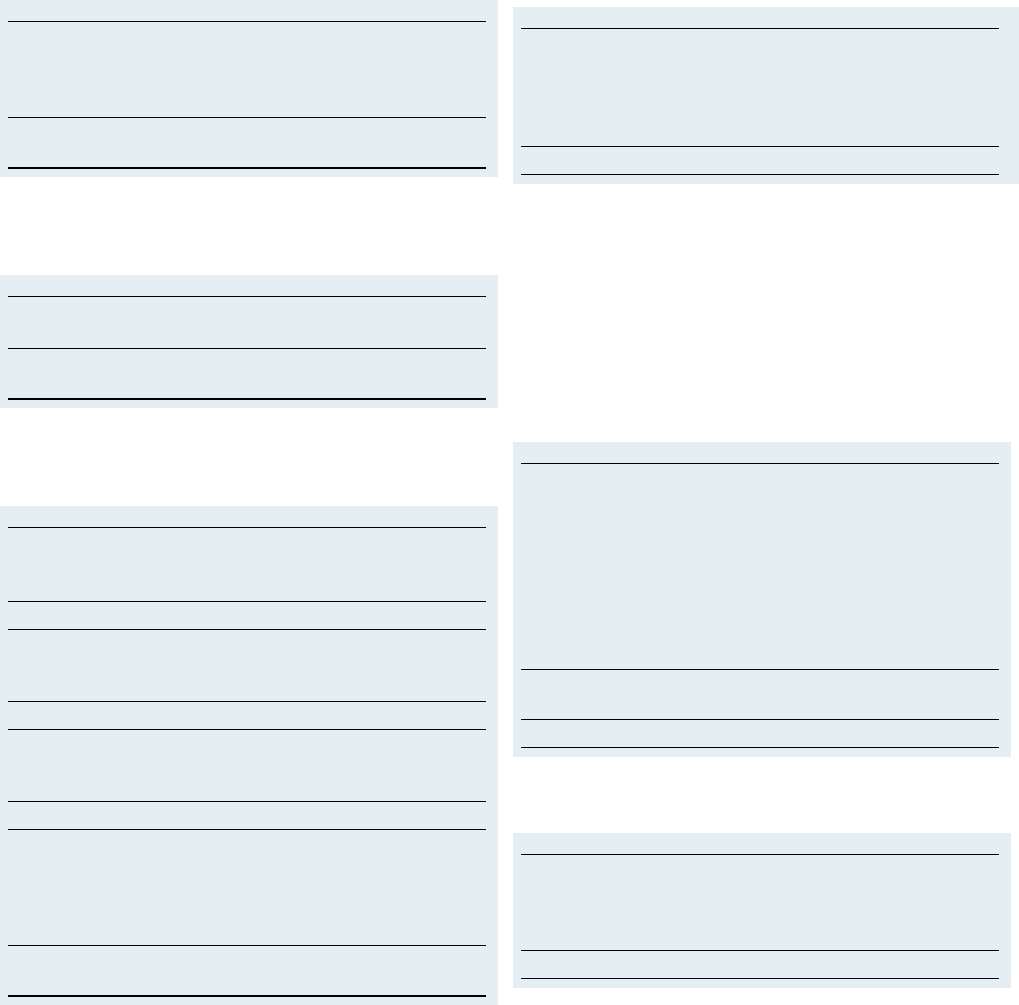

Note O. Taxes

($ in millions)

FOR THE YEAR ENDED DECEMBER 31: 2007 2006 2005

Income from continuing operations

before income taxes:

U.S. operations $ 7,667 $ 7,277 $ 7,450

Non-U.S. operations 6,822 6,040 4,776

Total income from continuing

operations before income taxes $14,489 $13,317 $12,226

The continuing operations provision for income taxes by geographic

operations is as follows:

($ in millions)

FOR THE YEAR ENDED DECEMBER 31: 2007 2006 2005

U.S. operations $2,280 $2,413 $2,988

Non-U.S. operations 1,791 1,488 1,244

Total continuing operations

provision for income taxes $4,071 $3,901 $4,232

The components of the continuing operations provision for income

taxes by taxing jurisdiction are as follows:

($ in millions)

FOR THE YEAR ENDED DECEMBER 31: 2007 2006 2005

U.S. federal:

Current $1,085 $ 602 $ 521

Deferred 683 1,326 1,811

1,768 1,928 2,332

U.S. state and local:

Current 141 11 80

Deferred (19) 198 183

122 209 263

Non-U.S:

Current 2,105 1,564 1,446

Deferred 76 200 191

2,181 1,764 1,637

Total continuing operations

provision for income taxes 4,071 3,901 4,232

Provision for social security,

real estate, personal property

and other taxes 3,832 3,461 3,501

Total taxes included in income

from continuing operations $7,903 $7,362 $7,733

A reconciliation of the statutory U.S. federal tax rate to the company’s

continuing operations effective tax rate is as follows:

FOR THE YEAR ENDED DECEMBER 31: 2007 2006 2005

Statutory rate 35% 35% 35%

Foreign tax differential (6) (5) (5)

State and local 1 1 1

“Act” repatriation* — — 4

Other (2) (2) —

Effective rate 28% 29% 35%

* American Jobs Creation Act of 2004, which permitted the repatriation of non-U.S.

earnings at a reduced tax rate.

The effect of tax law changes on deferred tax assets and liabilities did

not have a material impact on the company’s effective tax rate.

The significant components of deferred tax assets and liabilities

that are recorded in the Consolidated Statement of Financial Position

were as follows:

Deferred Tax Assets

($ in millions)

AT DECEMBER 31: 2007 2006

Stock-based and other compensation $ 2,920 $ 3,147

Retirement-related benefits 2,505 3,002

Capitalized research and development 1,050 1,355

Federal/state tax loss/state credit carryforwards 772 299

Bad debt, inventory and warranty reserves 647 724

Deferred income 645 506

Foreign tax loss/credit carryforwards 498 390

Capital loss carryforwards 9 131

Other 1,962 1,802

Gross deferred tax assets 11,008 11,356

Less: valuation allowance 772 510

Net deferred tax assets $10,236 $10,846

Deferred Tax Liabilities

($ in millions)

AT DECEMBER 31: 2007 2006

Retirement-related benefits $4,964 $2,906

Leases 1,635 1,385

Software development costs 462 505

Other 1,334 1,340

Gross deferred tax liabilities $8,395 $6,136