IBM 2007 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2007 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management Discussion

International Business Machines Corporation and Subsidiary Companies

54

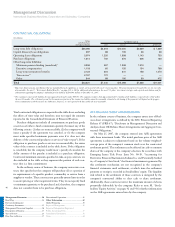

UNGUARANTEED RESIDUAL VALUE

($ in millions)

TOTAL ESTIMATED RUN OUT OF 2007 BALANCE

2011 AND

2006 2007 2008 2009 2010 BEYOND

Sales-type leases $ 854 $ 915 $211 $286 $294 $124

Operating leases 342 421 148 123 117 33

Total unguaranteed residual value $ 1,196 $ 1,336 $359 $409 $411 $157

Related original amount financed $23,225 $24,517

Percentage 5.2% 5.4%

DEBT

AT DECEMBER 31: 2007 2006

Debt-to-equity ratio 7.1x 6.9x

Global Financing funds its operations primarily through borrowings

using a debt-to-equity ratio of approximately 7 to 1. The debt is used

to fund Global Financing assets and is composed of intercompany loans

and external debt. The terms of the intercompany loans are set by the

company to substantially match the term and currency underlying the

receivable and are based on arm’s-length pricing. Both assets and debt

are presented in the Global Financing Balance Sheet on page 52.

The Global Financing business provides funding predominantly for

the company’s external clients but also provides intercompany financ-

ing for the company, as described in the “Description of Business” on

pages 50 and 51. As previously stated, the company measures Global

Financing as if it were a standalone entity and accordingly, interest

expense relating to debt supporting Global Financing’s external cli-

ent and internal business is included in the “Global Financing Results

of Operations” on page 51 and in note V, “Segment Information,” on

pages 116 to 119.

In the company’s Consolidated Statement of Earnings on page

58, however, the interest expense supporting Global Financing’s

internal financing to the company is reclassified from Cost of

Financing to Interest expense.

The following table provides additional information on debt. In

this table, Intercompany activity is comprised of internal loans and

leases at arm’s length pricing in support of Global Services’ long-

term contracts and other internal activity. The company believes

these assets should be appropriately levered in line with the overall

Global Financing business model.

($ in millions)

DECEMBER 31, 2007 DECEMBER 31, 2006

Global Financing Segment $24,532 $22,287

Debt to support external clients $21,072 $18,990

Debt to support internal clients 3,460 3,297

Non-Global Financing Segments 10,743 395

Debt supporting operations 14,203 3,692

Intercompany activity (3,460) (3,297)

Total company debt $35,274 $22,682

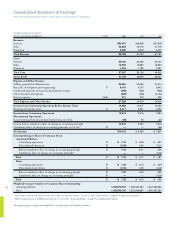

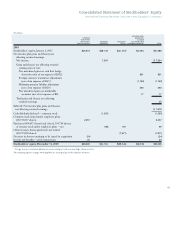

Management Discussion ............................ 14

Road Map .........................................................14

Forward-Looking and

Cautionary Statements .....................................15

Management Discussion Snapshot ..................16

Description of Business ....................................17

Year in Review ..................................................23

Prior Year in Review ........................................37

Discontinued Operations .................................42

Other Information ............................................42

Global Financing ........................................ 50

Report of Management ....................................56

Report of Independent Registered

Public Accounting Firm ...................................57

Consolidated Statements ..................................58

Notes .................................................................64