IBM 2007 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2007 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

86

Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies

Management Discussion ..................................14

Consolidated Statements ..................................58

Notes ........................................................... 64

A-F ...................................................................64

G-M ............................................................ 84

G. Plant, Rental Machines and

Other Property ...........................................84

H. Investments and Sundry Assets ..................84

I. Intangible Assets Including Goodwill ........84

J. Borrowings ............................................ 85

K. Derivatives and Hedging Transactions ......88

L. Other Liabilities ..........................................91

M. Stockholders’ Equity Activity .....................92

N-S ...................................................................94

T-W ................................................................102

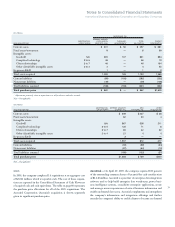

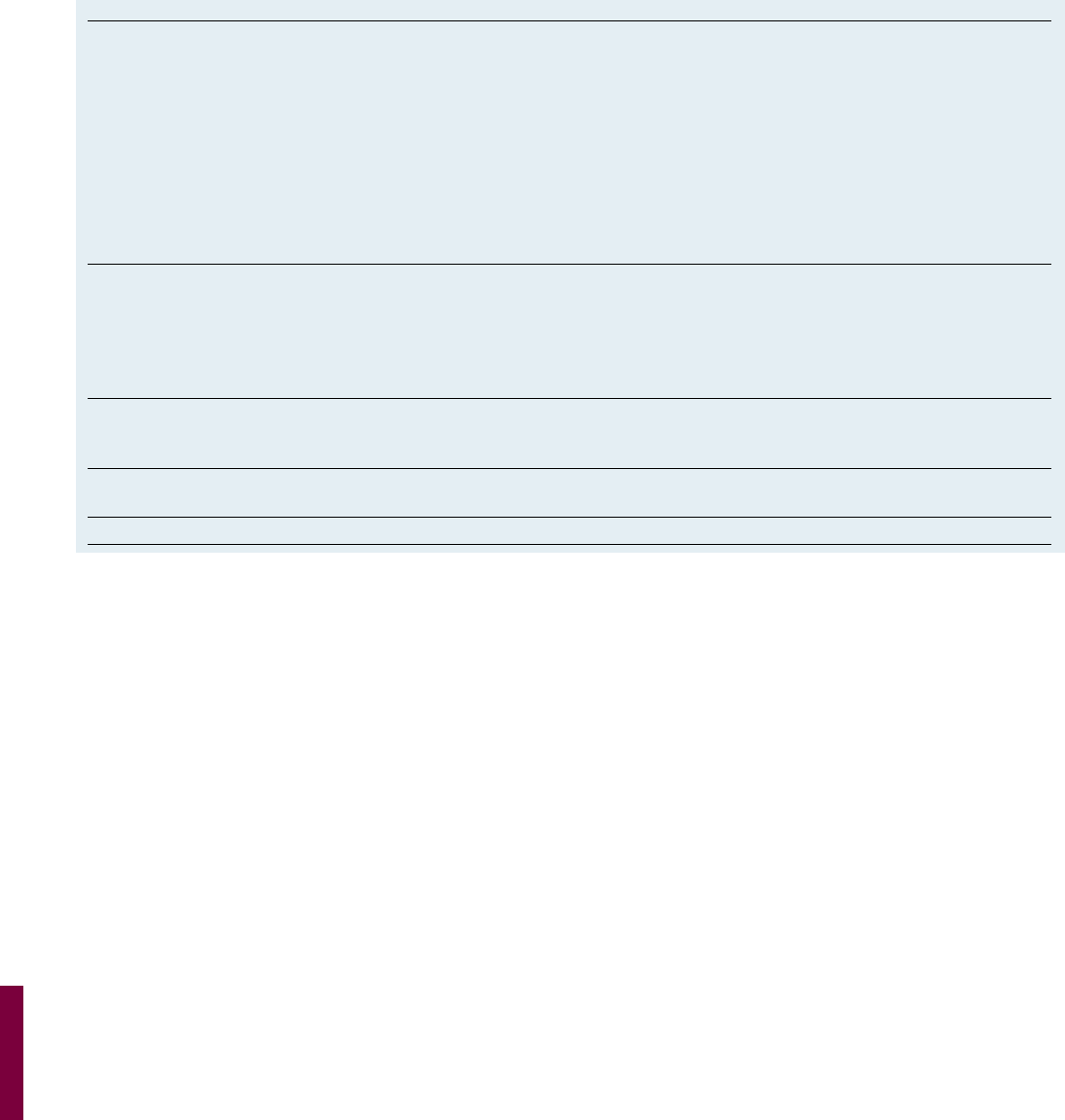

Long-Term Debt

PRE-SWAP BORROWING

($ in millions)

AT DECEMBER 31: MATURITIES 2007 2006*

U.S. Dollar Notes and Debentures (average interest rate at December 31, 2007):**

4.48% 2008 – 2011 $12,295***+ $ 7,137

5.34% 2012 – 2013 3,545+ 2,047

5.69% 2014 – 2018 3,026 26

8.375% 2019 750 750

7.00% 2025 600 600

6.22% 2027 469 469

6.50% 2028 313 313

5.875% 2032 600 600

7.00% 2045 150 150

7.125% 2096 850 850

22,598 12,942

Other Currencies (average interest rate at December 31, 2007, in parentheses):

Euros (3.4%) 2008–2013 2,466 2,234

Japanese yen (2.2%) 2010–2014 767 796

Swiss francs (1.5%) 2008 442 410

Other (2.7%) 2008–2013 89 66

26,362 16,448

Less: Net unamortized discount 65 64

Add: SFAS No. 133 fair value adjustment

++ 432 164

26,729 16,548

Less: Current maturities 3,690 2,768

Total $23,039 $13,780

* Reclassified to conform with 2007 presentation.

** As part of the company’s 2002 acquisition of PricewaterhouseCoopers’ Global Business Consulting and Technology Services Unit, the company issued convertible notes bearing interest

at a stated rate of 3.43 percent with a face value of approximately $328 million to certain of the acquired PricewaterhouseCoopers’ Global Business Consulting and Technology Services

Unit partners. The notes were convertible into 4,764,543 shares of IBM common stock at the option of the holders at any time based on a fixed conversion price of $68.81 per share of the

company’s common stock. As of December 31, 2007, all of the shares have been issued.

*** On January 29, 2008, IBM International Group Capital LLC, which is an indirect, 100 percent-owned finance subsidiary of the company, issued $3.5 billion of 18-month floating

rate notes. These proceeds will be utilized to reduce the 364-day bridge loan associated with the 2007 accelerated share repurchase transaction. (See note M, “Stockholders’ Equity,” on

pages 92 and 93 for additional information.) As such, the 2007 amount includes $3.5 billion of the bridge loan balance which has been reclassified to long-term debt in accordance with

SFAS No. 6, “Classification of Short-Term Obligations Expected to be Refinanced”.

+ $4.1 billion in debt securities issued by IBM International Group Capital LLC, as defined in Rule 3-10(b) of Regulation S-X is included in 2008-2011 ($2.6 billion) and 2012-2013

($1.5 billion). Debt securities issued by IBM International Group Capital LLC are fully and unconditionally guaranteed by the company.

++ In accordance with the requirements of SFAS No. 133, the portion of the company’s fixed rate debt obligations that is hedged is reflected in the Consolidated Statement of Financial

Position as an amount equal to the sum of the debt’s carrying value plus an SFAS No. 133 fair value adjustment representing changes in the fair value of the hedged debt obligations

attributable to movements in benchmark interest rates.